Monte dei Paschi (BIT:BMPS): Index Inclusion Sparks Fresh Look at Valuation and Growth Potential

Reviewed by Kshitija Bhandaru

Banca Monte dei Paschi di Siena (BIT:BMPS) has just been added to several major S&P indices, including the S&P Global 1200 and S&P EUROPE 350. Index inclusion often draws more interest from institutional investors and index-tracking funds.

See our latest analysis for Banca Monte dei Paschi di Siena.

Momentum in Banca Monte dei Paschi di Siena has been building, with its addition to major S&P indices drawing fresh investor interest. While the share price has pulled back around 7% over the last month, the one-year total shareholder return stands at an impressive 57%, highlighting a robust recovery compared to its longer-term history.

If you are looking to uncover more opportunities in the banking and finance space, now is a great time to expand your search and discover fast growing stocks with high insider ownership.

But with the stock still trading at a discount to analyst targets and showing strong returns, the key question now is whether Monte dei Paschi remains undervalued or if the market has already accounted for future growth.

Most Popular Narrative: 21.6% Undervalued

With the most-followed narrative estimating a fair value of €9.28 for Banca Monte dei Paschi di Siena, the current price of €7.28 appears to leave significant upside. But what exactly supports such a gap between market price and projected value?

Reliance on merger synergies and digital transformation is crucial. However, scale disadvantages and rising costs may constrain long-term earnings improvement. Improved asset quality, capital strength, and expansion initiatives position the bank for enhanced profitability, strategic growth, and stronger shareholder returns as sector consolidation continues.

Want to know what bold projections are driving this narrative? Unpack the hidden story: it blends assumptions on future margins, bank consolidation, and ambitious growth. The calculation behind the headline number might just surprise you.

Result: Fair Value of €9.28 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if asset quality continues to improve or merger synergies are successfully executed, profitability could exceed current expectations.

Find out about the key risks to this Banca Monte dei Paschi di Siena narrative.

Another View: Paying More Than Peers?

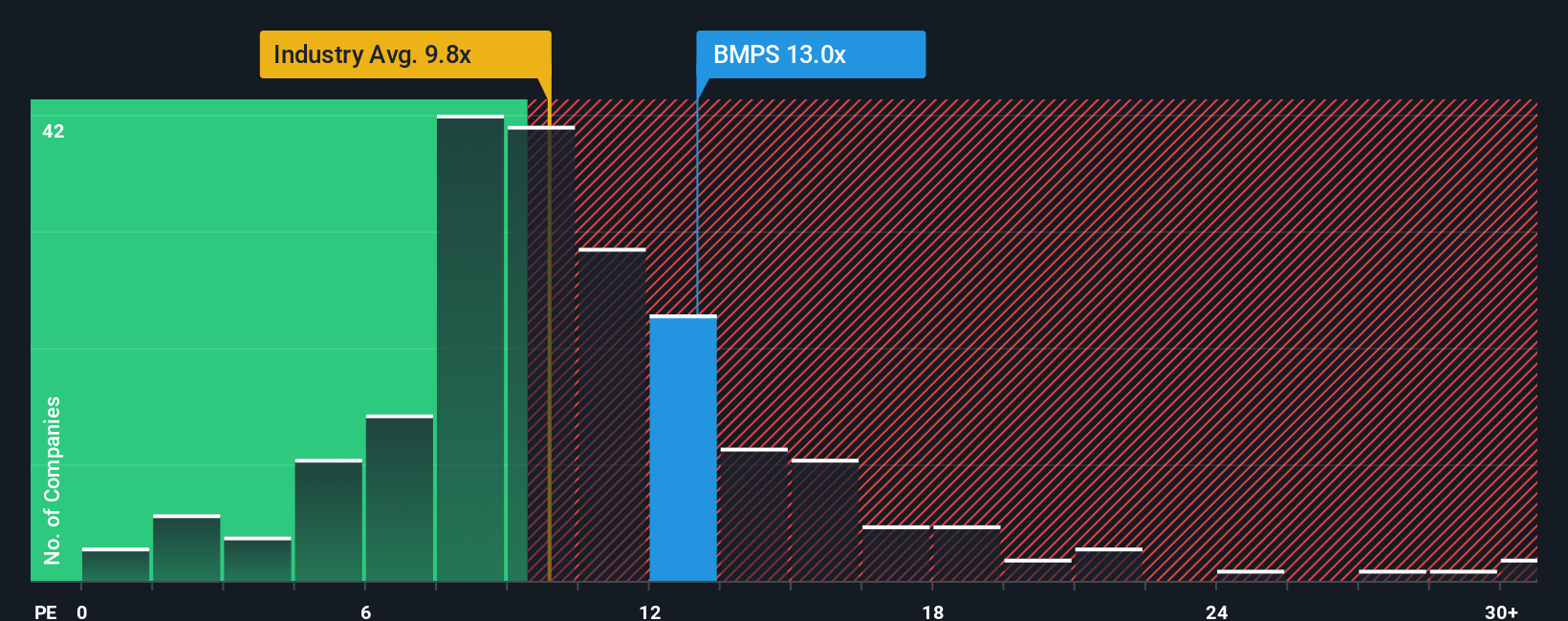

Looking at the price-to-earnings ratio, Banca Monte dei Paschi di Siena currently trades at 13.1x, which is higher than both the peer average of 12x and the broader European banks average of 9.9x. The fair ratio estimate is 10.5x. This gap means the stock is priced at a premium compared to similar banks and its own fair value. This could pose valuation risk if expectations are not met. Could the market be too optimistic, or is there something others are missing?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Banca Monte dei Paschi di Siena Narrative

If you see things differently or are eager to dig into your own figures, you can craft a personalized view of the stock in just a few minutes. So why not Do it your way?

A great starting point for your Banca Monte dei Paschi di Siena research is our analysis highlighting 3 key rewards and 5 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors know the next big opportunity is often just a click away. Why settle for limits when Simply Wall Street gives you the tools to uncover your edge?

- Spot income opportunities early by reviewing these 18 dividend stocks with yields > 3% with attractive yields and steady payout records.

- Find under-the-radar growth stories when you size up these 25 AI penny stocks as they revolutionize tomorrow’s industries through artificial intelligence.

- Catch potential market discounts before the crowd by acting on these 892 undervalued stocks based on cash flows, which trade well below their intrinsic value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Banca Monte dei Paschi di Siena might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:BMPS

Banca Monte dei Paschi di Siena

Provides retail and commercial banking services in Italy.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion