- Italy

- /

- Auto Components

- /

- BIT:CFL

Why We're Not Concerned Yet About Cofle S.p.A.'s (BIT:CFL) 26% Share Price Plunge

To the annoyance of some shareholders, Cofle S.p.A. (BIT:CFL) shares are down a considerable 26% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 58% share price decline.

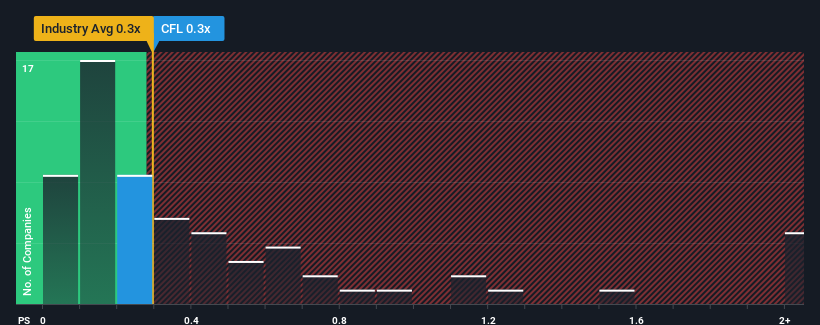

Even after such a large drop in price, you could still be forgiven for feeling indifferent about Cofle's P/S ratio of 0.3x, since the median price-to-sales (or "P/S") ratio for the Auto Components industry in Italy is about the same. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Cofle

What Does Cofle's P/S Mean For Shareholders?

There hasn't been much to differentiate Cofle's and the industry's retreating revenue lately. Perhaps the market is expecting future revenue performance to continue matching the industry, which has kept the P/S in line with expectations. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. In saying that, existing shareholders probably aren't too pessimistic about the share price if the company's revenue continues tracking the industry.

Want the full picture on analyst estimates for the company? Then our free report on Cofle will help you uncover what's on the horizon.How Is Cofle's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Cofle's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 2.7%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 13% in total. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 5.4% per year over the next three years. That's shaping up to be similar to the 3.8% per year growth forecast for the broader industry.

With this information, we can see why Cofle is trading at a fairly similar P/S to the industry. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

What Does Cofle's P/S Mean For Investors?

With its share price dropping off a cliff, the P/S for Cofle looks to be in line with the rest of the Auto Components industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've seen that Cofle maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Cofle (of which 2 can't be ignored!) you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:CFL

Cofle

Engages in the design, production, sale, and marketing of control cables and control systems worldwide.

Good value with slight risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)