- India

- /

- Tech Hardware

- /

- NSEI:TVSELECT

It's Unlikely That TVS Electronics Limited's (NSE:TVSELECT) CEO Will See A Huge Pay Rise This Year

Key Insights

- TVS Electronics to hold its Annual General Meeting on 13th of August

- CEO Srilalitha Gopal's total compensation includes salary of ₹11.1m

- The total compensation is 187% higher than the average for the industry

- TVS Electronics' total shareholder return over the past three years was 83% while its EPS was down 109% over the past three years

Under the guidance of CEO Srilalitha Gopal, TVS Electronics Limited (NSE:TVSELECT) has performed reasonably well recently. As shareholders go into the upcoming AGM on 13th of August, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. However, some shareholders may still be hesitant of being overly generous with CEO compensation.

See our latest analysis for TVS Electronics

Comparing TVS Electronics Limited's CEO Compensation With The Industry

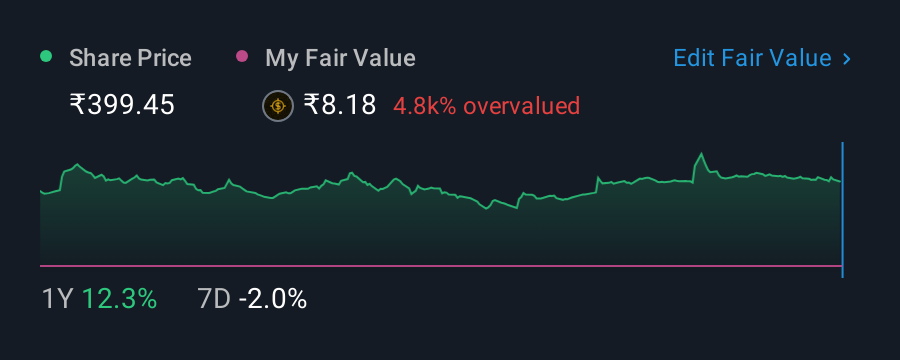

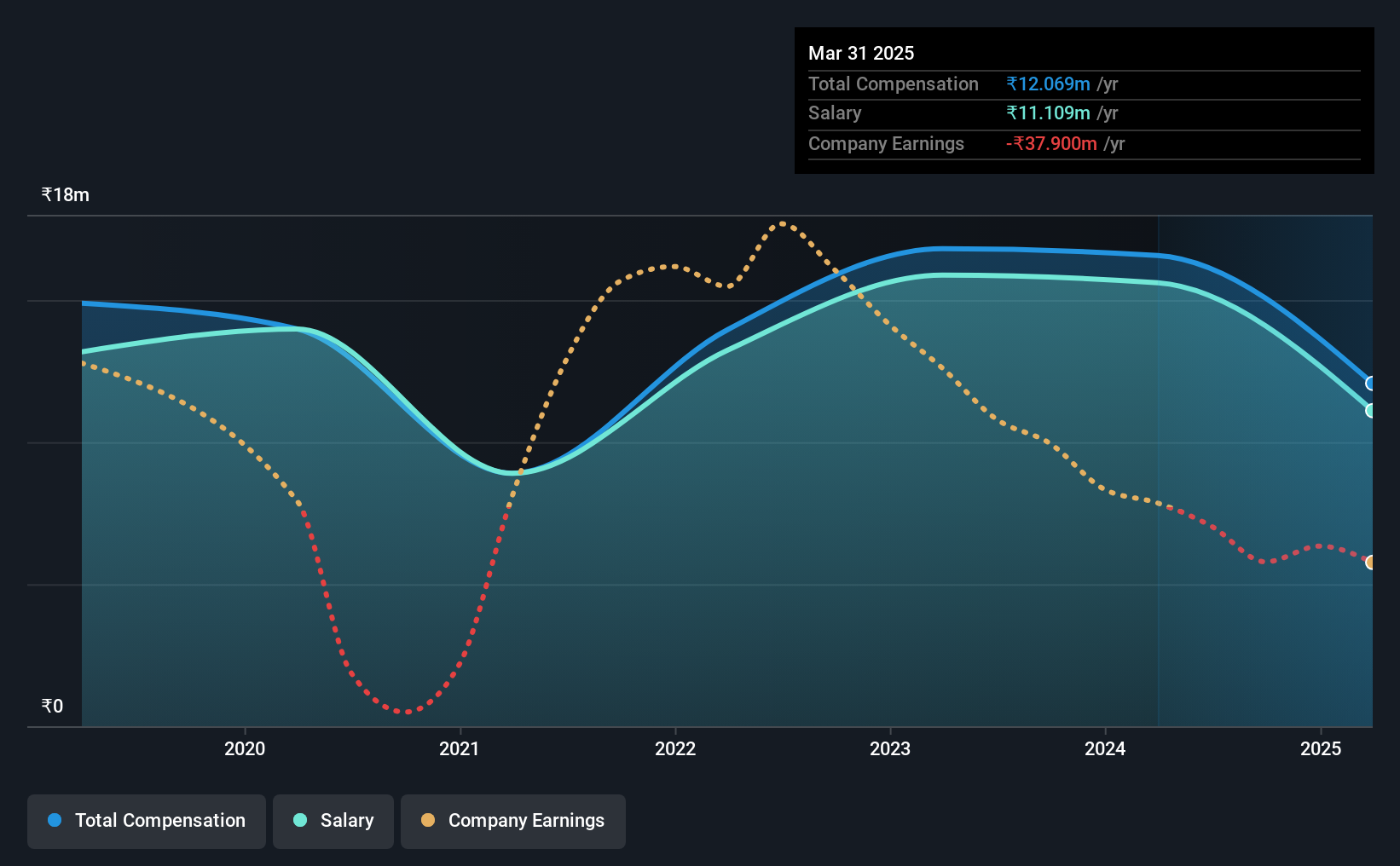

At the time of writing, our data shows that TVS Electronics Limited has a market capitalization of ₹7.5b, and reported total annual CEO compensation of ₹12m for the year to March 2025. Notably, that's a decrease of 27% over the year before. Notably, the salary which is ₹11.1m, represents most of the total compensation being paid.

For comparison, other companies in the India Tech industry with market capitalizations below ₹18b, reported a median total CEO compensation of ₹4.2m. Accordingly, our analysis reveals that TVS Electronics Limited pays Srilalitha Gopal north of the industry median.

| Component | 2025 | 2024 | Proportion (2025) |

| Salary | ₹11m | ₹16m | 92% |

| Other | ₹960k | ₹960k | 8% |

| Total Compensation | ₹12m | ₹17m | 100% |

Speaking on an industry level, nearly 78% of total compensation represents salary, while the remainder of 22% is other remuneration. According to our research, TVS Electronics has allocated a higher percentage of pay to salary in comparison to the wider industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

TVS Electronics Limited's Growth

TVS Electronics Limited has reduced its earnings per share by 109% a year over the last three years. In the last year, its revenue is up 18%.

The reduction in EPS, over three years, is arguably concerning. On the other hand, the strong revenue growth suggests the business is growing. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has TVS Electronics Limited Been A Good Investment?

Boasting a total shareholder return of 83% over three years, TVS Electronics Limited has done well by shareholders. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

To Conclude...

Although the company has performed relatively well, we still think there are some areas that could be improved. We still think that some shareholders will be hesitant of increasing CEO pay until EPS growth improves, since they are already paid higher than the industry.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. That's why we did some digging and identified 2 warning signs for TVS Electronics that you should be aware of before investing.

Switching gears from TVS Electronics, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

Valuation is complex, but we're here to simplify it.

Discover if TVS Electronics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:TVSELECT

TVS Electronics

Through its subsidiaries, designs, manufactures, assembles, markets, sells, and services various products in India.

Slight risk with imperfect balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026