- India

- /

- Electronic Equipment and Components

- /

- NSEI:OSELDEVICE

Osel Devices Limited (NSE:OSELDEVICE) CEO Rajendra Ravi Mishra, the company's largest shareholder sees 17% reduction in holdings value

Key Insights

- Insiders appear to have a vested interest in Osel Devices' growth, as seen by their sizeable ownership

- 72% of the company is held by a single shareholder (Rajendra Ravi Mishra)

- Using data from company's past performance alongside ownership research, one can better assess the future performance of a company

Every investor in Osel Devices Limited (NSE:OSELDEVICE) should be aware of the most powerful shareholder groups. And the group that holds the biggest piece of the pie are individual insiders with 72% ownership. Put another way, the group faces the maximum upside potential (or downside risk).

And following last week's 17% decline in share price, insiders suffered the most losses.

In the chart below, we zoom in on the different ownership groups of Osel Devices.

See our latest analysis for Osel Devices

What Does The Lack Of Institutional Ownership Tell Us About Osel Devices?

Institutional investors often avoid companies that are too small, too illiquid or too risky for their tastes. But it's unusual to see larger companies without any institutional investors.

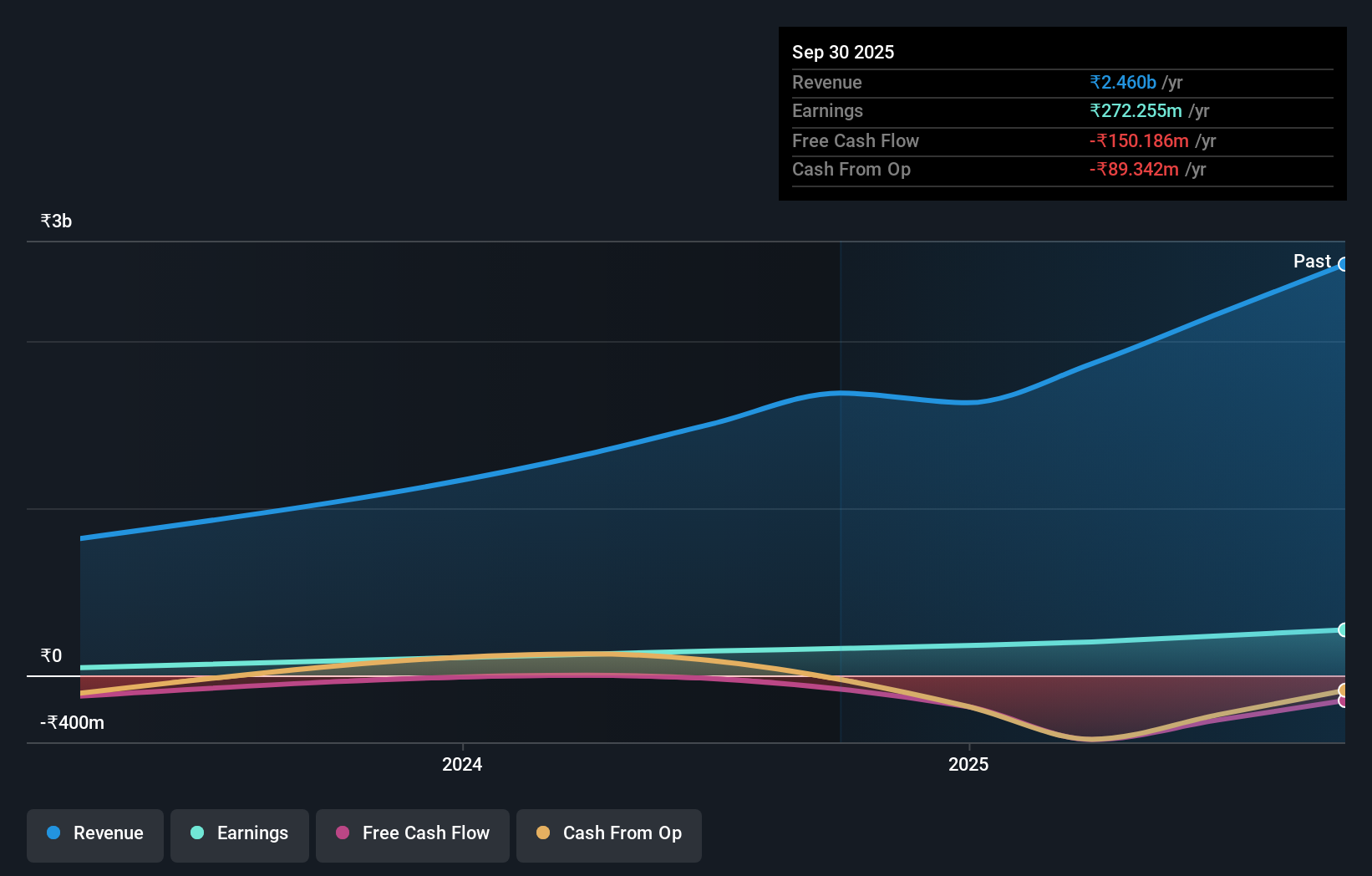

There are many reasons why a company might not have any institutions on the share registry. It may be hard for institutions to buy large amounts of shares, if liquidity (the amount of shares traded each day) is low. If the company has not needed to raise capital, institutions might lack the opportunity to build a position. On the other hand, it's always possible that professional investors are avoiding a company because they don't think it's the best place for their money. Osel Devices' earnings and revenue track record (below) may not be compelling to institutional investors -- or they simply might not have looked at the business closely.

We note that hedge funds don't have a meaningful investment in Osel Devices. With a 72% stake, CEO Rajendra Ravi Mishra is the largest shareholder. With such a huge stake, we infer that they have significant control of the future of the company. It's usually considered a good sign when insiders own a significant number of shares in the company, and in this case, we're glad to see a company insider with such skin in the game. The second and third largest shareholders are Jyotsna Jawahar and Ritesh Kumar, with an equal amount of shares to their name at 0.0004%. Interestingly, the second-largest shareholder, Jyotsna Jawahar is also Chief Financial Officer, again, pointing towards strong insider ownership amongst the company's top shareholders.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. We're not picking up on any analyst coverage of the stock at the moment, so the company is unlikely to be widely held.

Insider Ownership Of Osel Devices

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

It seems that insiders own more than half the Osel Devices Limited stock. This gives them a lot of power. That means they own ₹7.0b worth of shares in the ₹9.7b company. That's quite meaningful. It is good to see this level of investment. You can check here to see if those insiders have been buying recently.

General Public Ownership

The general public-- including retail investors -- own 28% stake in the company, and hence can't easily be ignored. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand Osel Devices better, we need to consider many other factors. For instance, we've identified 2 warning signs for Osel Devices (1 is concerning) that you should be aware of.

If you would prefer check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, backed by strong financial data.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:OSELDEVICE

Osel Devices

Designs, manufactures, and assembles a range of LED display systems to customers across various industries and applications in India.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026