- India

- /

- Electronic Equipment and Components

- /

- NSEI:CONTROLPR

Here's Why We Think Control Print (NSE:CONTROLPR) Might Deserve Your Attention Today

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Control Print (NSE:CONTROLPR). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for Control Print

How Quickly Is Control Print Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. Over the last three years, Control Print has grown EPS by 14% per year. That growth rate is fairly good, assuming the company can keep it up.

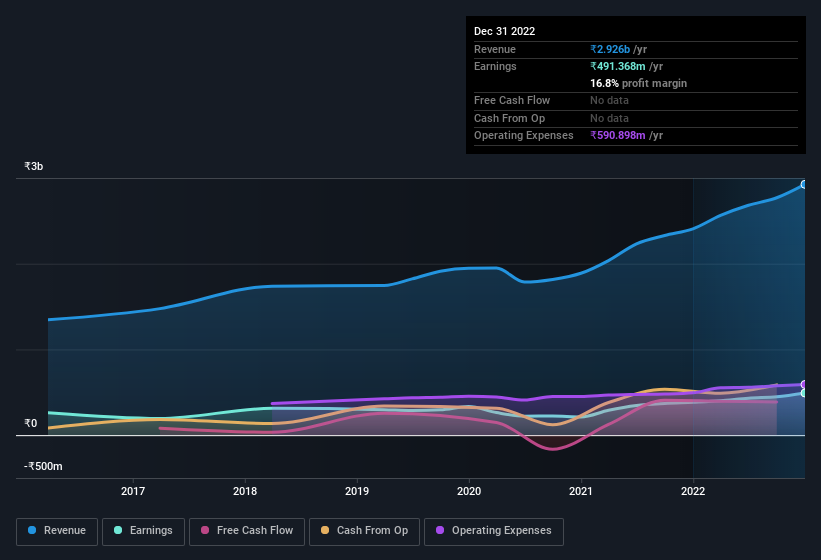

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. While we note Control Print achieved similar EBIT margins to last year, revenue grew by a solid 22% to ₹2.9b. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Control Print isn't a huge company, given its market capitalisation of ₹8.6b. That makes it extra important to check on its balance sheet strength.

Are Control Print Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

In the last twelve months Control Print insiders spent ₹529k on stock; good news for shareholders. This might not be a huge sum, but it's well worth noting anyway, given the complete lack of selling.

On top of the insider buying, it's good to see that Control Print insiders have a valuable investment in the business. To be specific, they have ₹2.7b worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. Those holdings account for over 31% of the company; visible skin in the game.

Should You Add Control Print To Your Watchlist?

As previously touched on, Control Print is a growing business, which is encouraging. In addition, insiders have been busy adding to their sizeable holdings in the company. These factors alone make the company an interesting prospect for your watchlist, as well as continuing research. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if Control Print is trading on a high P/E or a low P/E, relative to its industry.

Keen growth investors love to see insider buying. Thankfully, Control Print isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:CONTROLPR

Control Print

Engages in the manufacture and sale of coding and marking machines and consumables in India and internationally.

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)