Onward Technologies (NSE:ONWARDTEC) Is Due To Pay A Dividend Of ₹3.00

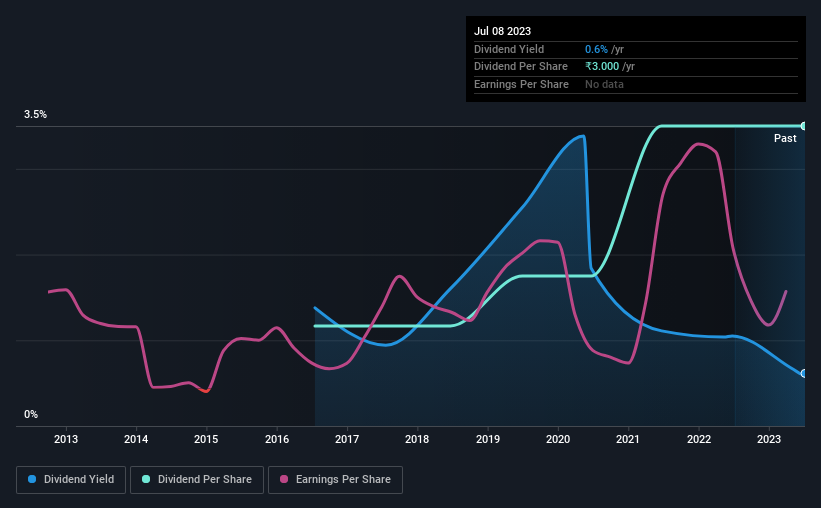

The board of Onward Technologies Limited (NSE:ONWARDTEC) has announced that it will pay a dividend of ₹3.00 per share on the 16th of August. Including this payment, the dividend yield on the stock will be 0.6%, which is a modest boost for shareholders' returns.

While the dividend yield is important for income investors, it is also important to consider any large share price moves, as this will generally outweigh any gains from distributions. Investors will be pleased to see that Onward Technologies' stock price has increased by 60% in the last 3 months, which is good for shareholders and can also explain a decrease in the dividend yield.

Check out our latest analysis for Onward Technologies

Onward Technologies' Payment Has Solid Earnings Coverage

The dividend yield is a little bit low, but sustainability of the payments is also an important part of evaluating an income stock. Before making this announcement, Onward Technologies was earning enough to cover the dividend, but it wasn't generating any free cash flows. In general, we consider cash flow to be more important than earnings, so we would be cautious about relying on the sustainability of this dividend.

Over the next year, EPS could expand by 3.3% if recent trends continue. Assuming the dividend continues along recent trends, we think the payout ratio could be 69% by next year, which is in a pretty sustainable range.

Onward Technologies Doesn't Have A Long Payment History

Onward Technologies' dividend has been pretty stable for a little while now, but we will continue to be cautious until it has been demonstrated for a few more years. The dividend has gone from an annual total of ₹1.00 in 2016 to the most recent total annual payment of ₹3.00. This means that it has been growing its distributions at 17% per annum over that time. Onward Technologies has been growing its dividend quite rapidly, which is exciting. However, the short payment history makes us question whether this performance will persist across a full market cycle.

The Dividend's Growth Prospects Are Limited

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. Earnings have grown at around 3.3% a year for the past five years, which isn't massive but still better than seeing them shrink. Growth of 3.3% may indicate that the company has limited investment opportunity so it is returning its earnings to shareholders instead. This isn't necessarily bad, but we wouldn't expect rapid dividend growth in the future.

Our Thoughts On Onward Technologies' Dividend

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. With cash flows lacking, it is difficult to see how the company can sustain a dividend payment. This company is not in the top tier of income providing stocks.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. However, there are other things to consider for investors when analysing stock performance. Just as an example, we've come across 4 warning signs for Onward Technologies you should be aware of, and 1 of them makes us a bit uncomfortable. Is Onward Technologies not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ONWARDTEC

Onward Technologies

Operates as a software and technology services outsourcing company.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Cheap if able to sustain revenue, and a potential bargain if able to turn store openings into revenue growth

Butler National (Buks) outperforms.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)