OnMobile Global (NSE:ONMOBILE) Has Affirmed Its Dividend Of ₹1.50

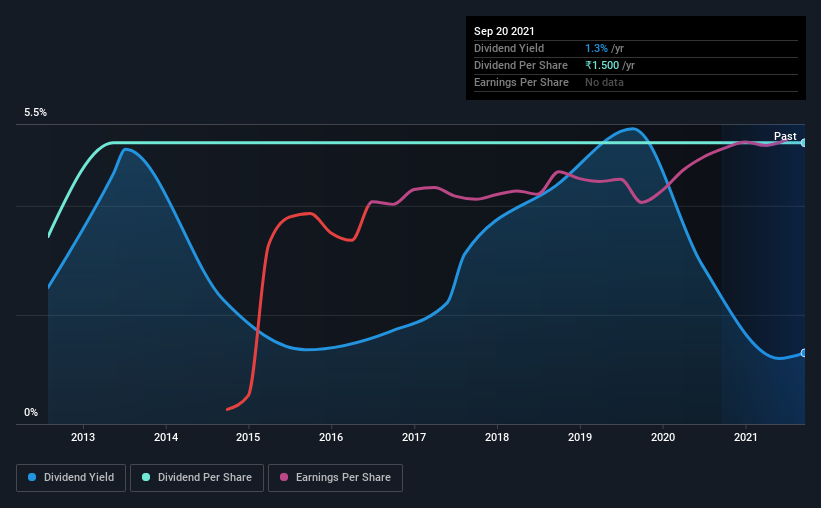

OnMobile Global Limited (NSE:ONMOBILE) has announced that it will pay a dividend of ₹1.50 per share on the 29th of October. This means the dividend yield will be fairly typical at 1.3%.

See our latest analysis for OnMobile Global

OnMobile Global's Payment Has Solid Earnings Coverage

We like to see a healthy dividend yield, but that is only helpful to us if the payment can continue. Before making this announcement, OnMobile Global was paying a whopping 116% as a dividend, but this only made up 31% of its overall earnings. The business might be trying to strike a balance between returning cash to shareholders and reinvesting back into the business, but this high of a payout ratio could definitely force the dividend to be cut if the company runs into a bit of a tough spot.

Looking forward, earnings per share could rise by 74.3% over the next year if the trend from the last few years continues. If the dividend continues along recent trends, we estimate the payout ratio will be 18%, which is in the range that makes us comfortable with the sustainability of the dividend.

OnMobile Global Is Still Building Its Track Record

It is great to see that OnMobile Global has been paying a stable dividend for a number of years now, however we want to be a bit cautious about whether this will remain true through a full economic cycle. The dividend has gone from ₹1.00 in 2012 to the most recent annual payment of ₹1.50. This implies that the company grew its distributions at a yearly rate of about 4.6% over that duration. Modest dividend growth is good to see, especially with the payments being relatively stable. However, the payment history is relatively short and we wouldn't want to rely on this dividend too much.

The Dividend Looks Likely To Grow

Investors could be attracted to the stock based on the quality of its payment history. OnMobile Global has seen EPS rising for the last five years, at 74% per annum. Earnings have been growing rapidly, and with a low payout ratio we think that the company could turn out to be a great dividend stock.

In Summary

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. While the low payout ratio is redeeming feature, this is offset by the minimal cash to cover the payments. Overall, we don't think this company has the makings of a good income stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Taking the debate a bit further, we've identified 4 warning signs for OnMobile Global that investors need to be conscious of moving forward. Looking for more high-yielding dividend ideas? Try our curated list of strong dividend payers.

If you decide to trade OnMobile Global, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:ONMOBILE

OnMobile Global

Provides telecom value added services in India, Europe, Africa, Latin America, the United States, and internationally.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)