Here's Why We Think HDFC Life Insurance (NSE:HDFCLIFE) Might Deserve Your Attention Today

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in HDFC Life Insurance (NSE:HDFCLIFE). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

How Fast Is HDFC Life Insurance Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. HDFC Life Insurance managed to grow EPS by 9.0% per year, over three years. That's a good rate of growth, if it can be sustained.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Our analysis has highlighted that HDFC Life Insurance's revenue from operations did not account for all of their revenue in the previous 12 months, so our analysis of its margins might not accurately reflect the underlying business. Despite consistency in EBIT margins year on year, HDFC Life Insurance has actually recorded a dip in revenue. This does not bode too well for short term growth prospects and so understanding the reasons for these results is of great importance.

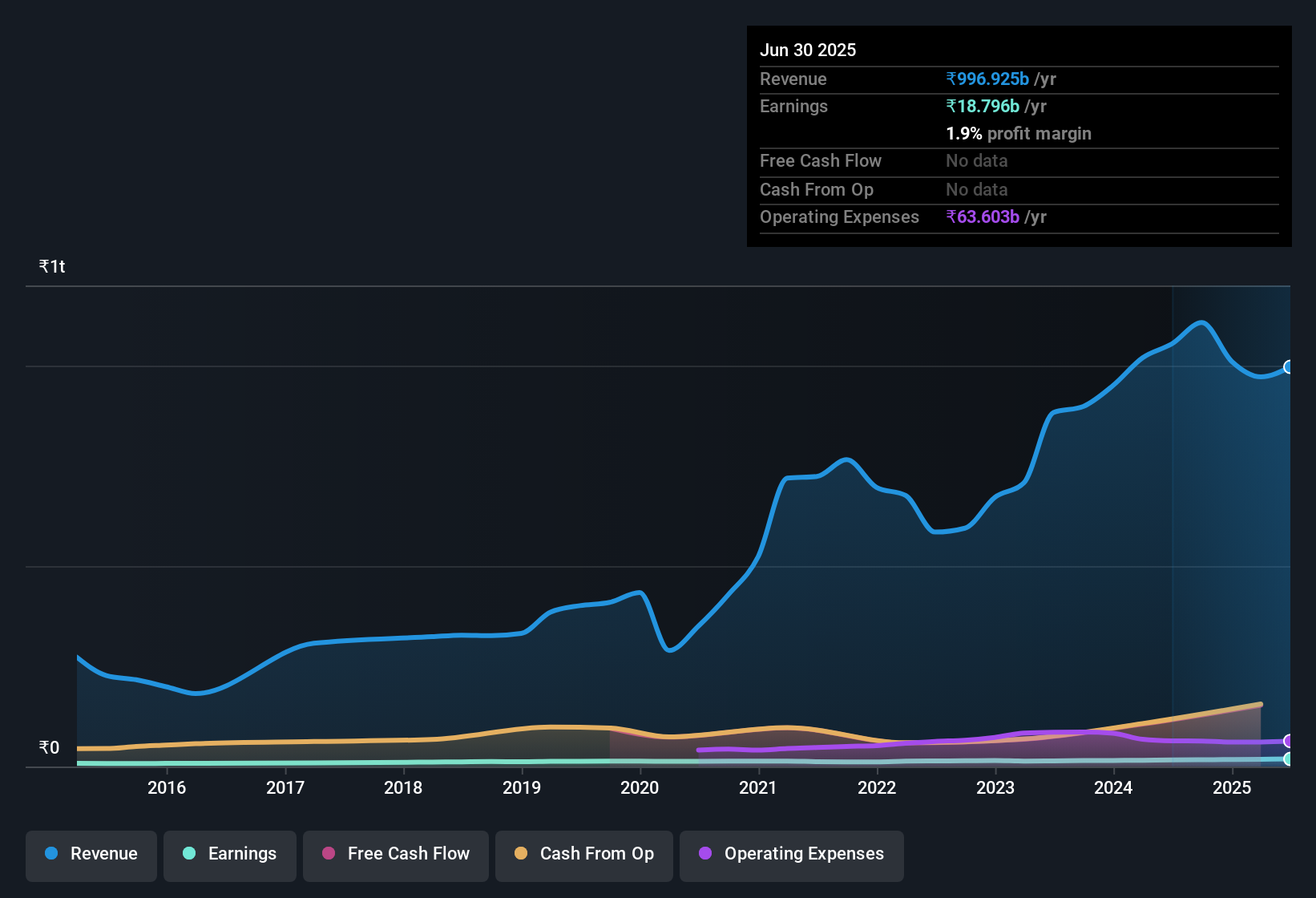

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

See our latest analysis for HDFC Life Insurance

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for HDFC Life Insurance's future EPS 100% free.

Are HDFC Life Insurance Insiders Aligned With All Shareholders?

Owing to the size of HDFC Life Insurance, we wouldn't expect insiders to hold a significant proportion of the company. But we are reassured by the fact they have invested in the company. Indeed, they hold ₹2.6b worth of its stock. That's a lot of money, and no small incentive to work hard. While their ownership only accounts for 0.2%, this is still a considerable amount at stake to encourage the business to maintain a strategy that will deliver value to shareholders.

Does HDFC Life Insurance Deserve A Spot On Your Watchlist?

As previously touched on, HDFC Life Insurance is a growing business, which is encouraging. For those who are looking for a little more than this, the high level of insider ownership enhances our enthusiasm for this growth. The combination definitely favoured by investors so consider keeping the company on a watchlist. Still, you should learn about the 1 warning sign we've spotted with HDFC Life Insurance.

Although HDFC Life Insurance certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of Indian companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if HDFC Life Insurance might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:HDFCLIFE

HDFC Life Insurance

Provides individual and group insurance solutions in India.

Solid track record with adequate balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)