Here's Why General Insurance Corporation of India's (NSE:GICRE) CEO May Deserve A Raise

Key Insights

- General Insurance Corporation of India will host its Annual General Meeting on 23rd of September

- CEO Ramaswamy Narayanan's total compensation includes salary of ₹4.15m

- Total compensation is 91% below industry average

- General Insurance Corporation of India's total shareholder return over the past three years was 222% while its EPS grew by 27% over the past three years

The impressive results at General Insurance Corporation of India (NSE:GICRE) recently will be great news for shareholders. At the upcoming AGM on 23rd of September, they would be interested to hear about the company strategy going forward and get a chance to cast their votes on resolutions such as executive remuneration and other company matters. Let's take a look at why we think the CEO has done a good job and we'll present the case for a bump in pay.

See our latest analysis for General Insurance Corporation of India

How Does Total Compensation For Ramaswamy Narayanan Compare With Other Companies In The Industry?

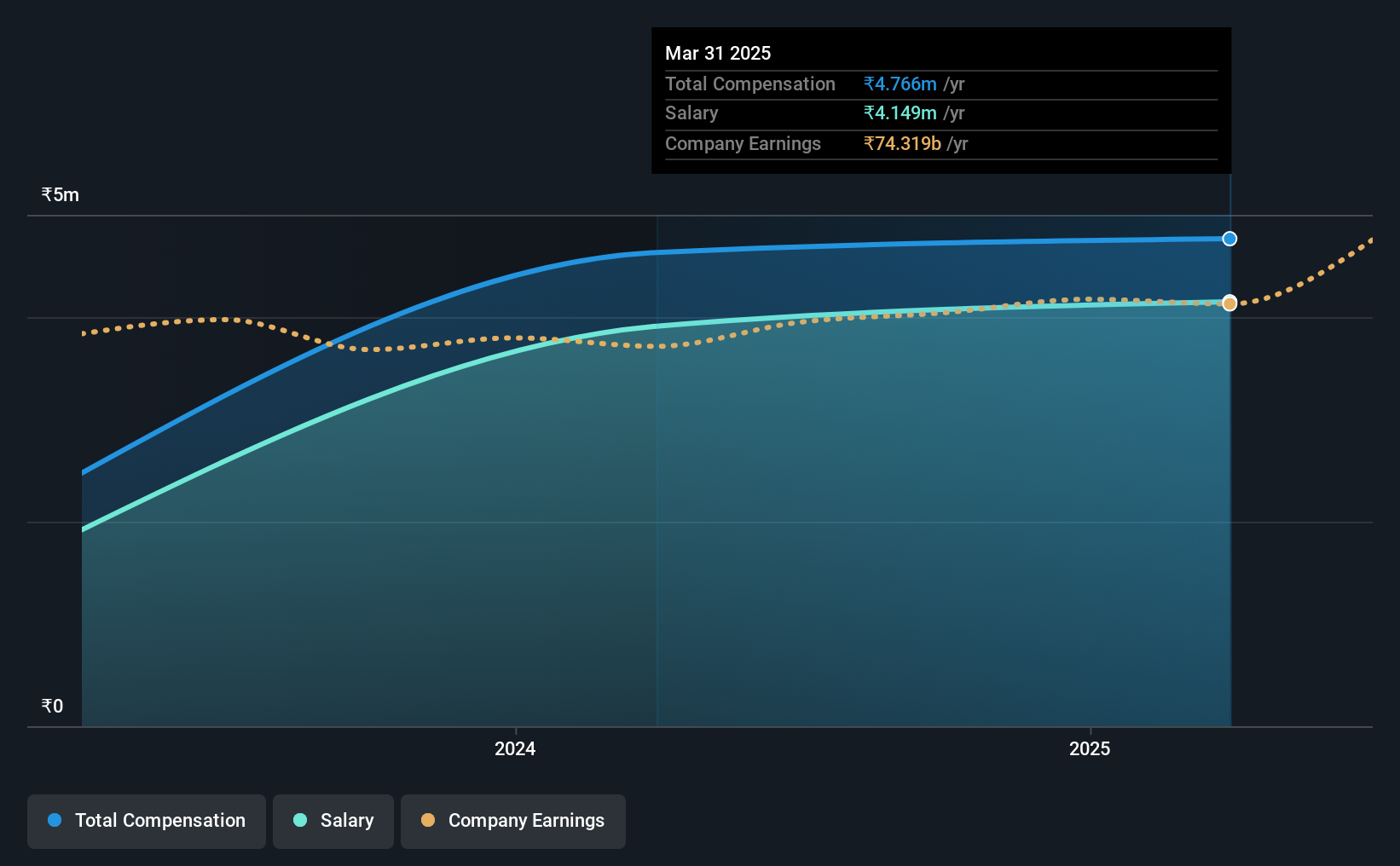

According to our data, General Insurance Corporation of India has a market capitalization of ₹649b, and paid its CEO total annual compensation worth ₹4.8m over the year to March 2025. This means that the compensation hasn't changed much from last year. Notably, the salary which is ₹4.15m, represents most of the total compensation being paid.

On examining similar-sized companies in the Indian Insurance industry with market capitalizations between ₹352b and ₹1.1t, we discovered that the median CEO total compensation of that group was ₹55m. This suggests that Ramaswamy Narayanan is paid below the industry median. Moreover, Ramaswamy Narayanan also holds ₹426k worth of General Insurance Corporation of India stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2025 | 2024 | Proportion (2025) |

| Salary | ₹4.1m | ₹3.9m | 87% |

| Other | ₹617k | ₹722k | 13% |

| Total Compensation | ₹4.8m | ₹4.6m | 100% |

On an industry level, roughly 65% of total compensation represents salary and 35% is other remuneration. General Insurance Corporation of India is paying a higher share of its remuneration through a salary in comparison to the overall industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at General Insurance Corporation of India's Growth Numbers

Over the past three years, General Insurance Corporation of India has seen its earnings per share (EPS) grow by 27% per year. In the last year, its revenue is up 9.6%.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's good to see a bit of revenue growth, as this suggests the business is able to grow sustainably. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has General Insurance Corporation of India Been A Good Investment?

We think that the total shareholder return of 222%, over three years, would leave most General Insurance Corporation of India shareholders smiling. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

To Conclude...

Given the company's decent performance, the CEO remuneration policy might not be shareholders' central point of focus in the AGM. However, investors will get the chance to engage on key strategic initiatives and future growth opportunities for the company and set their longer-term expectations.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. In our study, we found 2 warning signs for General Insurance Corporation of India you should be aware of, and 1 of them can't be ignored.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:GICRE

General Insurance Corporation of India

Provides reinsurance services in India and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)