Here's Why We Think Som Distilleries & Breweries (NSE:SDBL) Is Well Worth Watching

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like Som Distilleries & Breweries (NSE:SDBL), which has not only revenues, but also profits. While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for Som Distilleries & Breweries

Som Distilleries & Breweries' Improving Profits

In the last three years Som Distilleries & Breweries' earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. So it would be better to isolate the growth rate over the last year for our analysis. It's good to see that Som Distilleries & Breweries' EPS has grown from ₹4.02 to ₹4.72 over twelve months. This amounts to a 17% gain; a figure that shareholders will be pleased to see.

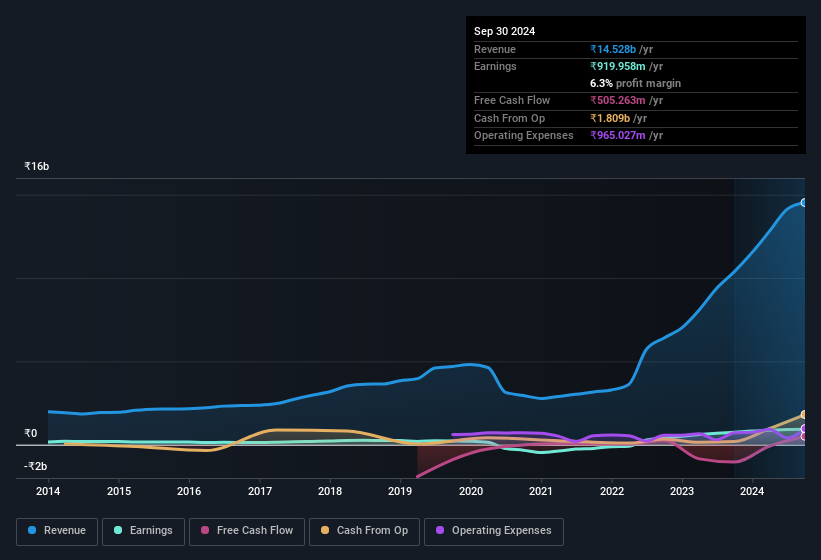

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Som Distilleries & Breweries maintained stable EBIT margins over the last year, all while growing revenue 40% to ₹15b. That's encouraging news for the company!

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

Since Som Distilleries & Breweries is no giant, with a market capitalisation of ₹23b, you should definitely check its cash and debt before getting too excited about its prospects.

Are Som Distilleries & Breweries Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

While Som Distilleries & Breweries insiders did net ₹14m selling stock over the last year, they invested ₹44m, a much higher figure. An optimistic sign for those with Som Distilleries & Breweries in their watchlist. It is also worth noting that it was Chairman & MD Jagdish Arora who made the biggest single purchase, worth ₹11m, paying ₹115 per share.

And the insider buying isn't the only sign of alignment between shareholders and the board, since Som Distilleries & Breweries insiders own more than a third of the company. Owning 47% of the company, insiders have plenty riding on the performance of the the share price. Those who are comforted by solid insider ownership like this should be happy, as it implies that those running the business are genuinely motivated to create shareholder value. To give you an idea, the value of insiders' holdings in the business are valued at ₹11b at the current share price. That should be more than enough to keep them focussed on creating shareholder value!

Is Som Distilleries & Breweries Worth Keeping An Eye On?

As previously touched on, Som Distilleries & Breweries is a growing business, which is encouraging. On top of that, we've seen insiders buying shares even though they already own plenty. That makes the company a prime candidate for your watchlist - and arguably a research priority. Now, you could try to make up your mind on Som Distilleries & Breweries by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

The good news is that Som Distilleries & Breweries is not the only stock with insider buying. Here's a list of small cap, undervalued companies in IN with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SDBL

Som Distilleries & Breweries

Engages in the manufacture and sale of beer and Indian made foreign liquor in India.

Flawless balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives