- India

- /

- Consumer Finance

- /

- NSEI:UJJIVAN

We Ran A Stock Scan For Earnings Growth And Ujjivan Financial Services (NSE:UJJIVAN) Passed With Ease

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Ujjivan Financial Services (NSE:UJJIVAN). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Ujjivan Financial Services with the means to add long-term value to shareholders.

Check out our latest analysis for Ujjivan Financial Services

How Quickly Is Ujjivan Financial Services Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Ujjivan Financial Services' shareholders have have plenty to be happy about as their annual EPS growth for the last 3 years was 48%. While that sort of growth rate isn't sustainable for long, it certainly catches the eye of prospective investors.

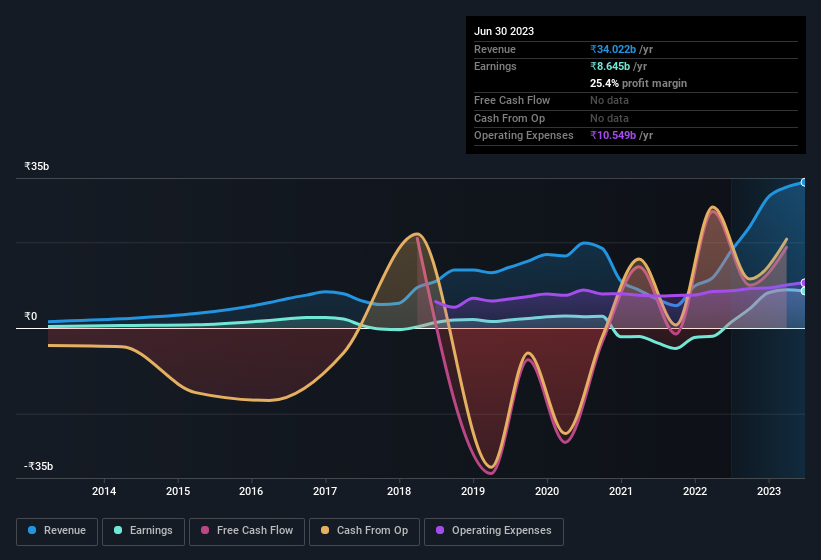

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. It's noted that Ujjivan Financial Services' revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. EBIT margins for Ujjivan Financial Services remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 89% to ₹34b. That's encouraging news for the company!

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Ujjivan Financial Services' future EPS 100% free.

Are Ujjivan Financial Services Insiders Aligned With All Shareholders?

As a general rule, it's worth considering how much the CEO is paid, since unreasonably high rates could be considered against the interests of shareholders. Our analysis has discovered that the median total compensation for the CEOs of companies like Ujjivan Financial Services with market caps between ₹33b and ₹133b is about ₹32m.

The Ujjivan Financial Services CEO received total compensation of only ₹3.4m in the year to March 2023. This could be considered a token amount, and indicates that the company does not need to use payment to motivate the CEO - that is often a good sign. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Does Ujjivan Financial Services Deserve A Spot On Your Watchlist?

Ujjivan Financial Services' earnings per share growth have been climbing higher at an appreciable rate. This appreciable increase in earnings could be a sign of an upward trajectory for the company. Meanwhile, the very reasonable CEO pay is a great reassurance, since it points to an absence of wasteful spending habits. So Ujjivan Financial Services looks like it could be a good quality growth stock, at first glance. That's worth watching. What about risks? Every company has them, and we've spotted 2 warning signs for Ujjivan Financial Services you should know about.

Although Ujjivan Financial Services certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade Ujjivan Financial Services, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:UJJIVAN

Ujjivan Financial Services

Ujjivan Financial Services Limited provides financial services to economically weaker section in India.

Average dividend payer with moderate growth potential.

Market Insights

Community Narratives