- India

- /

- Capital Markets

- /

- NSEI:INVENTURE

Here's Why I Think Inventure Growth & Securities (NSE:INVENTURE) Is An Interesting Stock

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

So if you're like me, you might be more interested in profitable, growing companies, like Inventure Growth & Securities (NSE:INVENTURE). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

See our latest analysis for Inventure Growth & Securities

Inventure Growth & Securities's Earnings Per Share Are Growing.

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). That makes EPS growth an attractive quality for any company. Who among us would not applaud Inventure Growth & Securities's stratospheric annual EPS growth of 40%, compound, over the last three years? While that sort of growth rate isn't sustainable for long, it certainly catches my attention; like a crow with a sparkly stone.

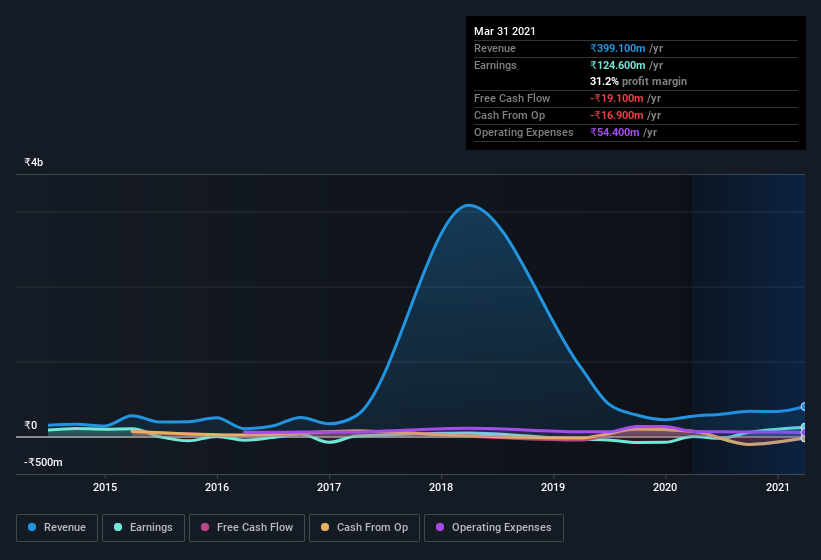

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). I note that Inventure Growth & Securities's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. While we note Inventure Growth & Securities's EBIT margins were flat over the last year, revenue grew by a solid 48% to ₹399m. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Since Inventure Growth & Securities is no giant, with a market capitalization of ₹3.2b, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Inventure Growth & Securities Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So as you can imagine, the fact that Inventure Growth & Securities insiders own a significant number of shares certainly appeals to me. In fact, they own 54% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This makes me think they will be incentivised to plan for the long term - something I like to see. With that sort of holding, insiders have about ₹1.7b riding on the stock, at current prices. That should be more than enough to keep them focussed on creating shareholder value!

Does Inventure Growth & Securities Deserve A Spot On Your Watchlist?

Inventure Growth & Securities's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. That EPS growth certainly has my attention, and the large insider ownership only serves to further stoke my interest. At times fast EPS growth is a sign the business has reached an inflection point; and I do like those. So yes, on this short analysis I do think it's worth considering Inventure Growth & Securities for a spot on your watchlist. It's still necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Inventure Growth & Securities , and understanding them should be part of your investment process.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you decide to trade Inventure Growth & Securities, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:INVENTURE

Adequate balance sheet with low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)