- India

- /

- Diversified Financial

- /

- NSEI:INFIBEAM

With Infibeam Avenues Limited (NSE:INFIBEAM) It Looks Like You'll Get What You Pay For

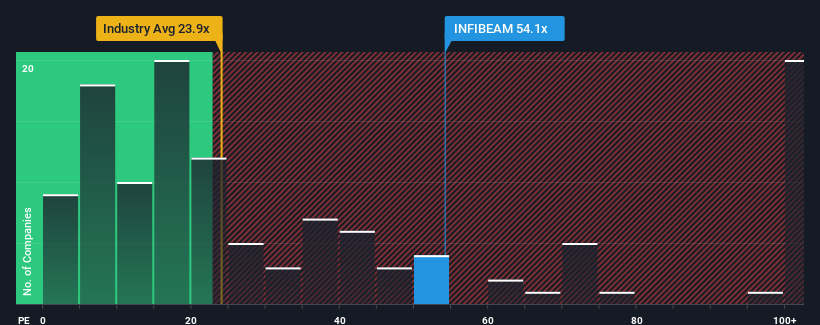

With a price-to-earnings (or "P/E") ratio of 54.1x Infibeam Avenues Limited (NSE:INFIBEAM) may be sending very bearish signals at the moment, given that almost half of all companies in India have P/E ratios under 31x and even P/E's lower than 17x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Recent times haven't been advantageous for Infibeam Avenues as its earnings have been rising slower than most other companies. It might be that many expect the uninspiring earnings performance to recover significantly, which has kept the P/E from collapsing. If not, then existing shareholders may be very nervous about the viability of the share price.

See our latest analysis for Infibeam Avenues

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, Infibeam Avenues would need to produce outstanding growth well in excess of the market.

If we review the last year of earnings growth, the company posted a worthy increase of 9.3%. The latest three year period has also seen an excellent 109% overall rise in EPS, aided somewhat by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Shifting to the future, estimates from the two analysts covering the company suggest earnings should grow by 32% over the next year. That's shaping up to be materially higher than the 25% growth forecast for the broader market.

In light of this, it's understandable that Infibeam Avenues' P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Infibeam Avenues maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

You should always think about risks. Case in point, we've spotted 1 warning sign for Infibeam Avenues you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

If you're looking to trade Infibeam Avenues, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:INFIBEAM

Infibeam Avenues

Operates as a digital payment and e-commerce technology company that engages in the provision of digital payment solutions, data center infrastructure, and software platforms for businesses and governments to execute e-commerce transactions.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives