- India

- /

- Diversified Financial

- /

- NSEI:INFIBEAM

Infibeam Avenues Limited's (NSE:INFIBEAM) 32% Share Price Surge Not Quite Adding Up

Despite an already strong run, Infibeam Avenues Limited (NSE:INFIBEAM) shares have been powering on, with a gain of 32% in the last thirty days. The annual gain comes to 124% following the latest surge, making investors sit up and take notice.

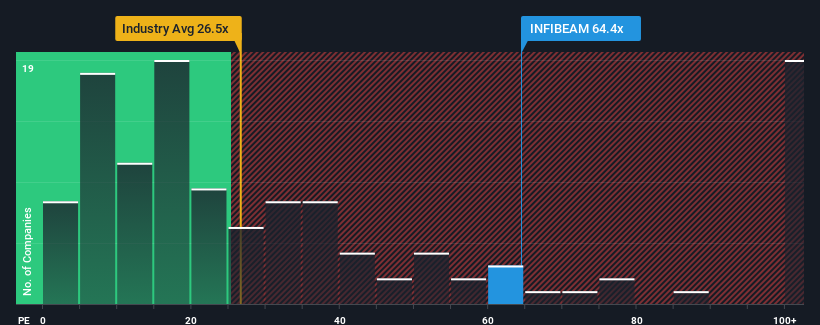

Following the firm bounce in price, Infibeam Avenues' price-to-earnings (or "P/E") ratio of 64.4x might make it look like a strong sell right now compared to the market in India, where around half of the companies have P/E ratios below 31x and even P/E's below 17x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Recent times haven't been advantageous for Infibeam Avenues as its earnings have been rising slower than most other companies. It might be that many expect the uninspiring earnings performance to recover significantly, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Infibeam Avenues

Does Growth Match The High P/E?

In order to justify its P/E ratio, Infibeam Avenues would need to produce outstanding growth well in excess of the market.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 10% last year. Pleasingly, EPS has also lifted 106% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 26% as estimated by the two analysts watching the company. With the market predicted to deliver 25% growth , the company is positioned for a comparable earnings result.

In light of this, it's curious that Infibeam Avenues' P/E sits above the majority of other companies. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of earnings growth is likely to weigh down the share price eventually.

What We Can Learn From Infibeam Avenues' P/E?

Infibeam Avenues' P/E is flying high just like its stock has during the last month. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Infibeam Avenues currently trades on a higher than expected P/E since its forecast growth is only in line with the wider market. When we see an average earnings outlook with market-like growth, we suspect the share price is at risk of declining, sending the high P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Infibeam Avenues, and understanding them should be part of your investment process.

If these risks are making you reconsider your opinion on Infibeam Avenues, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade Infibeam Avenues, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:INFIBEAM

Infibeam Avenues

Operates as a digital payment and e-commerce technology company that engages in the provision of digital payment solutions, data center infrastructure, and software platforms for businesses and governments to execute e-commerce transactions.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives