- India

- /

- Hospitality

- /

- NSEI:WESTLIFE

Investors more bullish on Westlife Foodworld (NSE:WESTLIFE) this week as stock lifts 4.0%, despite earnings trending downwards over past five years

When you buy shares in a company, it's worth keeping in mind the possibility that it could fail, and you could lose your money. But on the bright side, if you buy shares in a high quality company at the right price, you can gain well over 100%. One great example is Westlife Foodworld Limited (NSE:WESTLIFE) which saw its share price drive 116% higher over five years. Better yet, the share price has risen 4.0% in the last week.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

Check out our latest analysis for Westlife Foodworld

We don't think that Westlife Foodworld's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

In the last 5 years Westlife Foodworld saw its revenue grow at 16% per year. That's well above most pre-profit companies. So it's not entirely surprising that the share price reflected this performance by increasing at a rate of 17% per year, in that time. This suggests the market has well and truly recognized the progress the business has made. To our minds that makes Westlife Foodworld worth investigating - it may have its best days ahead.

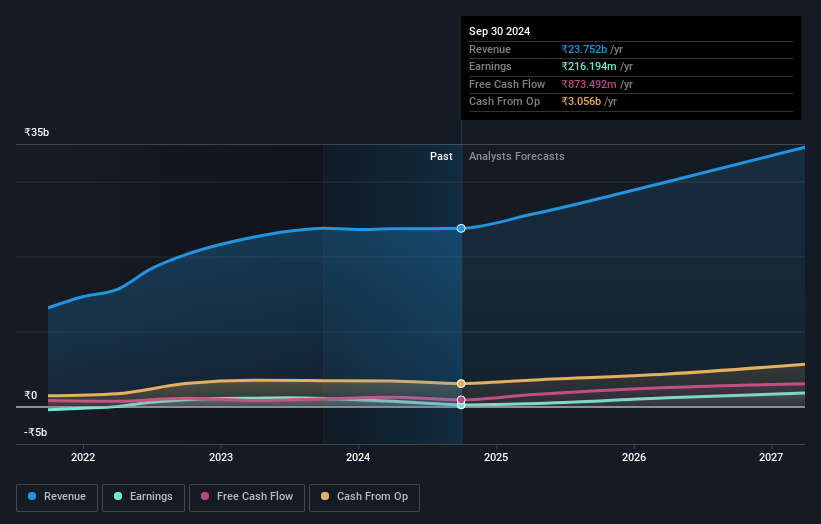

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. This free report showing analyst forecasts should help you form a view on Westlife Foodworld

A Different Perspective

Westlife Foodworld shareholders are up 0.8% for the year (even including dividends). But that was short of the market average. On the bright side, the longer term returns (running at about 17% a year, over half a decade) look better. It may well be that this is a business worth popping on the watching, given the continuing positive reception, over time, from the market. It's always interesting to track share price performance over the longer term. But to understand Westlife Foodworld better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for Westlife Foodworld (of which 1 is a bit unpleasant!) you should know about.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Westlife Foodworld might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:WESTLIFE

Westlife Foodworld

Through its subsidiary, Hardcastle Restaurants Private Limited, owns and operates a chain of McDonald's restaurants in Western and Southern India.

Reasonable growth potential with questionable track record.

Similar Companies

Market Insights

Community Narratives