- India

- /

- Professional Services

- /

- NSEI:LATENTVIEW

Robust Earnings May Not Tell The Whole Story For Latent View Analytics (NSE:LATENTVIEW)

Despite posting some strong earnings, the market for Latent View Analytics Limited's (NSE:LATENTVIEW) stock hasn't moved much. Our analysis suggests that shareholders have noticed something concerning in the numbers.

Check out our latest analysis for Latent View Analytics

Zooming In On Latent View Analytics' Earnings

As finance nerds would already know, the accrual ratio from cashflow is a key measure for assessing how well a company's free cash flow (FCF) matches its profit. In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. This ratio tells us how much of a company's profit is not backed by free cashflow.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

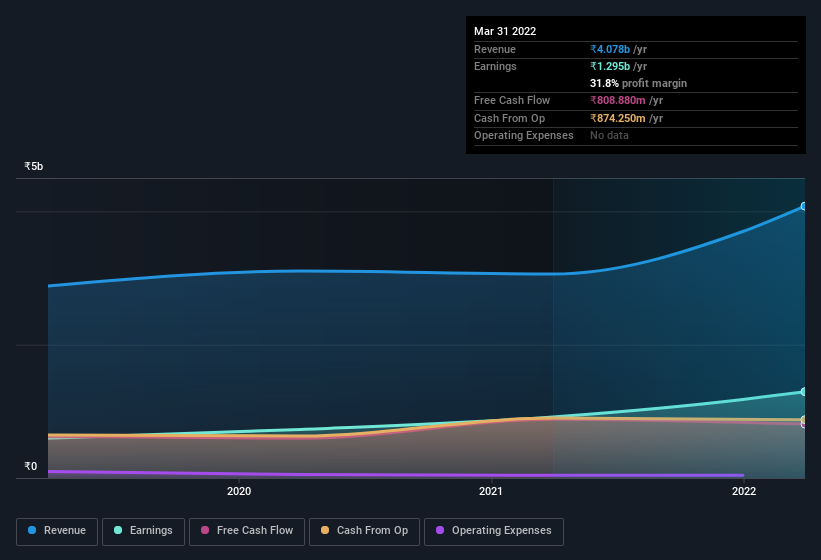

Over the twelve months to March 2022, Latent View Analytics recorded an accrual ratio of 0.25. Unfortunately, that means its free cash flow fell significantly short of its reported profits. In fact, it had free cash flow of ₹809m in the last year, which was a lot less than its statutory profit of ₹1.30b. Latent View Analytics shareholders will no doubt be hoping that its free cash flow bounces back next year, since it was down over the last twelve months. However, that's not all there is to consider. The accrual ratio is reflecting the impact of unusual items on statutory profit, at least in part.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Latent View Analytics.

The Impact Of Unusual Items On Profit

Given the accrual ratio, it's not overly surprising that Latent View Analytics' profit was boosted by unusual items worth ₹226m in the last twelve months. While it's always nice to have higher profit, a large contribution from unusual items sometimes dampens our enthusiasm. We ran the numbers on most publicly listed companies worldwide, and it's very common for unusual items to be once-off in nature. And that's as you'd expect, given these boosts are described as 'unusual'. Assuming those unusual items don't show up again in the current year, we'd thus expect profit to be weaker next year (in the absence of business growth, that is).

Our Take On Latent View Analytics' Profit Performance

Latent View Analytics had a weak accrual ratio, but its profit did receive a boost from unusual items. For the reasons mentioned above, we think that a perfunctory glance at Latent View Analytics' statutory profits might make it look better than it really is on an underlying level. If you want to do dive deeper into Latent View Analytics, you'd also look into what risks it is currently facing. Be aware that Latent View Analytics is showing 2 warning signs in our investment analysis and 1 of those is a bit unpleasant...

Our examination of Latent View Analytics has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:LATENTVIEW

Latent View Analytics

Provides business analytics, consulting services, data engineering, generative AI, and digital solutions in India, the United States, Singapore, the United Kingdom, and the Netherlands.

Flawless balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026