- India

- /

- Construction

- /

- NSEI:USK

There Are Reasons To Feel Uneasy About Udayshivakumar Infra's (NSE:USK) Returns On Capital

There are a few key trends to look for if we want to identify the next multi-bagger. In a perfect world, we'd like to see a company investing more capital into its business and ideally the returns earned from that capital are also increasing. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. Although, when we looked at Udayshivakumar Infra (NSE:USK), it didn't seem to tick all of these boxes.

What Is Return On Capital Employed (ROCE)?

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. The formula for this calculation on Udayshivakumar Infra is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

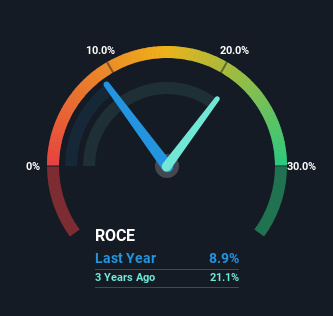

0.089 = ₹207m ÷ (₹3.5b - ₹1.1b) (Based on the trailing twelve months to September 2024).

Therefore, Udayshivakumar Infra has an ROCE of 8.9%. Ultimately, that's a low return and it under-performs the Construction industry average of 15%.

See our latest analysis for Udayshivakumar Infra

Historical performance is a great place to start when researching a stock so above you can see the gauge for Udayshivakumar Infra's ROCE against it's prior returns. If you want to delve into the historical earnings , check out these free graphs detailing revenue and cash flow performance of Udayshivakumar Infra.

How Are Returns Trending?

On the surface, the trend of ROCE at Udayshivakumar Infra doesn't inspire confidence. To be more specific, ROCE has fallen from 22% over the last four years. However it looks like Udayshivakumar Infra might be reinvesting for long term growth because while capital employed has increased, the company's sales haven't changed much in the last 12 months. It's worth keeping an eye on the company's earnings from here on to see if these investments do end up contributing to the bottom line.

On a related note, Udayshivakumar Infra has decreased its current liabilities to 33% of total assets. That could partly explain why the ROCE has dropped. Effectively this means their suppliers or short-term creditors are funding less of the business, which reduces some elements of risk. Some would claim this reduces the business' efficiency at generating ROCE since it is now funding more of the operations with its own money.

The Bottom Line

In summary, Udayshivakumar Infra is reinvesting funds back into the business for growth but unfortunately it looks like sales haven't increased much just yet. Since the stock has gained an impressive 26% over the last year, investors must think there's better things to come. Ultimately, if the underlying trends persist, we wouldn't hold our breath on it being a multi-bagger going forward.

One final note, you should learn about the 2 warning signs we've spotted with Udayshivakumar Infra (including 1 which shouldn't be ignored) .

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:USK

Udayshivakumar Infra

Engages in the execution of infrastructure projects primarily in India.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives