Lakshmi Machine Works (NSE:LAXMIMACH) Is Paying Out Less In Dividends Than Last Year

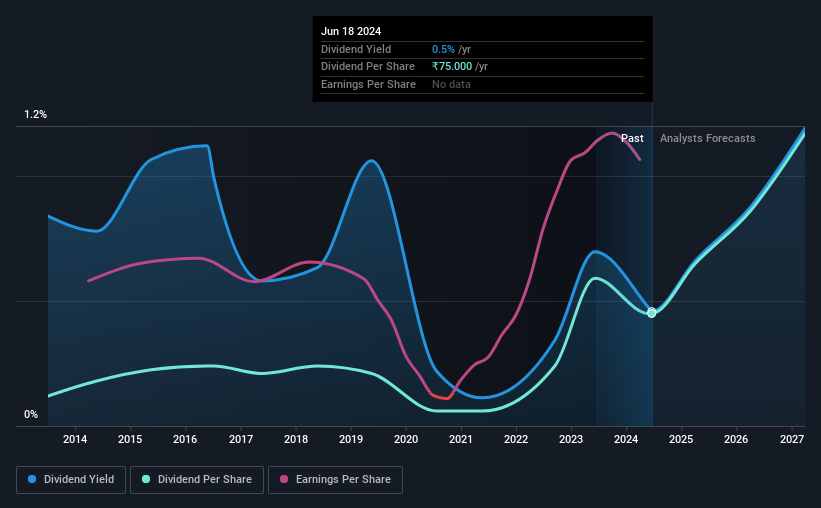

Lakshmi Machine Works Limited's (NSE:LAXMIMACH) dividend is being reduced from last year's payment covering the same period to ₹75.00 on the 30th of August. Based on this payment, the dividend yield will be 0.5%, which is lower than the average for the industry.

View our latest analysis for Lakshmi Machine Works

Lakshmi Machine Works' Payment Has Solid Earnings Coverage

If it is predictable over a long period, even low dividend yields can be attractive. Based on the last payment, Lakshmi Machine Works was earning enough to cover the dividend, but free cash flows weren't positive. With the company not bringing in any cash, paying out to shareholders is bound to become difficult at some point.

Looking forward, earnings per share is forecast to rise by 48.7% over the next year. If the dividend continues along recent trends, we estimate the payout ratio will be 16%, which is in the range that makes us comfortable with the sustainability of the dividend.

Dividend Volatility

The company has a long dividend track record, but it doesn't look great with cuts in the past. The dividend has gone from an annual total of ₹20.00 in 2014 to the most recent total annual payment of ₹75.00. This works out to be a compound annual growth rate (CAGR) of approximately 14% a year over that time. Lakshmi Machine Works has grown distributions at a rapid rate despite cutting the dividend at least once in the past. Companies that cut once often cut again, so we would be cautious about buying this stock solely for the dividend income.

The Dividend Looks Likely To Grow

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. It's encouraging to see that Lakshmi Machine Works has been growing its earnings per share at 15% a year over the past five years. Lakshmi Machine Works definitely has the potential to grow its dividend in the future with earnings on an uptrend and a low payout ratio.

In Summary

Overall, it's not great to see that the dividend has been cut, but this might be explained by the payments being a bit high previously. While Lakshmi Machine Works is earning enough to cover the payments, the cash flows are lacking. Overall, we don't think this company has the makings of a good income stock.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. However, there are other things to consider for investors when analysing stock performance. Just as an example, we've come across 2 warning signs for Lakshmi Machine Works you should be aware of, and 1 of them shouldn't be ignored. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:LMW

LMW

Manufactures and sells textile spinning machinery in India and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion