Union Bank of India Second Quarter 2025 Earnings: EPS: ₹6.22 (vs ₹5.14 in 2Q 2024)

Union Bank of India (NSE:UNIONBANK) Second Quarter 2025 Results

Key Financial Results

- Revenue: ₹133.5b (up 14% from 2Q 2024).

- Net income: ₹47.5b (up 33% from 2Q 2024).

- Profit margin: 36% (up from 31% in 2Q 2024). The increase in margin was driven by higher revenue.

- EPS: ₹6.22 (up from ₹5.14 in 2Q 2024).

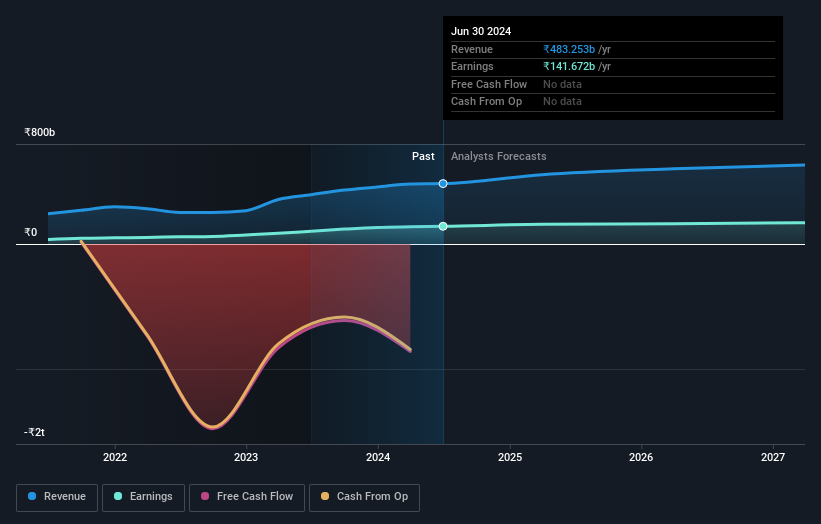

All figures shown in the chart above are for the trailing 12 month (TTM) period

Union Bank of India Earnings Insights

Looking ahead, revenue is forecast to grow 8.8% p.a. on average during the next 3 years, while revenues in the Banks industry in India are expected to remain flat.

Performance of the Indian Banks industry.

The company's shares are down 3.5% from a week ago.

Valuation

It's possible that Union Bank of India could be undervalued with our 6-factor valuation analysis indicating a potential opportunity. Click here to find out what a fair price for the stock might be and where analysts see the share price heading over the next year.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:UNIONBANK

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)