Does Jammu and Kashmir Bank (NSE:J&KBANK) Deserve A Spot On Your Watchlist?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like Jammu and Kashmir Bank (NSE:J&KBANK), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for Jammu and Kashmir Bank

How Fast Is Jammu and Kashmir Bank Growing Its Earnings Per Share?

Over the last three years, Jammu and Kashmir Bank has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. So it would be better to isolate the growth rate over the last year for our analysis. Impressively, Jammu and Kashmir Bank's EPS catapulted from ₹6.22 to ₹13.10, over the last year. Year on year growth of 110% is certainly a sight to behold. The best case scenario? That the business has hit a true inflection point.

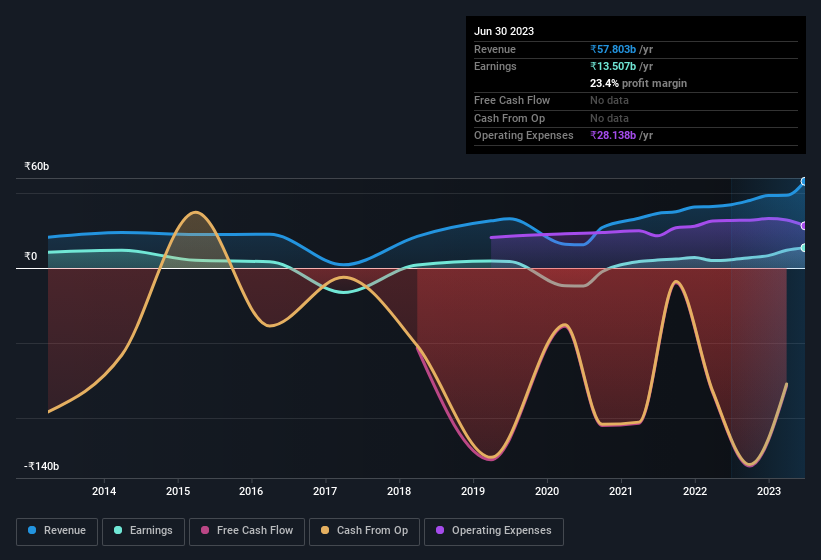

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Our analysis has highlighted that Jammu and Kashmir Bank's revenue from operations did not account for all of their revenue in the previous 12 months, so our analysis of its margins might not accurately reflect the underlying business. EBIT margins for Jammu and Kashmir Bank remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 37% to ₹58b. That's a real positive.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Jammu and Kashmir Bank's balance sheet strength, before getting too excited.

Are Jammu and Kashmir Bank Insiders Aligned With All Shareholders?

It's a necessity that company leaders act in the best interest of shareholders and so insider investment always comes as a reassurance to the market. Jammu and Kashmir Bank followers will find comfort in knowing that insiders have a significant amount of capital that aligns their best interests with the wider shareholder group. Indeed, they hold ₹1.6b worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. While their ownership only accounts for 1.3%, this is still a considerable amount at stake to encourage the business to maintain a strategy that will deliver value to shareholders.

While it's always good to see some strong conviction in the company from insiders through heavy investment, it's also important for shareholders to ask if management compensation policies are reasonable. Well, based on the CEO pay, you'd argue that they are indeed. For companies with market capitalisations between ₹83b and ₹266b, like Jammu and Kashmir Bank, the median CEO pay is around ₹40m.

The Jammu and Kashmir Bank CEO received total compensation of just ₹10m in the year to March 2023. That looks like a modest pay packet, and may hint at a certain respect for the interests of shareholders. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Should You Add Jammu and Kashmir Bank To Your Watchlist?

Jammu and Kashmir Bank's earnings have taken off in quite an impressive fashion. An added bonus for those interested is that management hold a heap of stock and the CEO pay is quite reasonable, illustrating good cash management. The drastic earnings growth indicates the business is going from strength to strength. Hopefully a trend that continues well into the future. Big growth can make big winners, so the writing on the wall tells us that Jammu and Kashmir Bank is worth considering carefully. We don't want to rain on the parade too much, but we did also find 3 warning signs for Jammu and Kashmir Bank that you need to be mindful of.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:J&KBANK

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives