Over the last 7 days, the Indian market has experienced a 2.1% drop, yet it has shown impressive resilience with a 42% rise over the past year and projected earnings growth of 17% per annum in the coming years. In such dynamic conditions, dividend stocks can be an attractive option for investors seeking steady income and potential capital appreciation.

Top 10 Dividend Stocks In India

| Name | Dividend Yield | Dividend Rating |

| Castrol India (BSE:500870) | 3.87% | ★★★★★★ |

| Balmer Lawrie Investments (BSE:532485) | 5.05% | ★★★★★★ |

| D. B (NSEI:DBCORP) | 4.07% | ★★★★★☆ |

| Canara Bank (NSEI:CANBK) | 3.33% | ★★★★★☆ |

| Indian Oil (NSEI:IOC) | 9.01% | ★★★★★☆ |

| VST Industries (BSE:509966) | 3.91% | ★★★★★☆ |

| Redington (NSEI:REDINGTON) | 3.66% | ★★★★★☆ |

| Balmer Lawrie (BSE:523319) | 3.65% | ★★★★★☆ |

| PTC India (NSEI:PTC) | 4.58% | ★★★★★☆ |

| Bank of Baroda (NSEI:BANKBARODA) | 3.25% | ★★★★★☆ |

Click here to see the full list of 19 stocks from our Top Indian Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Canara Bank (NSEI:CANBK)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Canara Bank offers a range of banking products and services both in India and internationally, with a market cap of ₹877.95 billion.

Operations: Canara Bank's revenue is primarily derived from its Wholesale Banking Operations at ₹430.48 billion, Retail Banking Operations - Other Retail Banking at ₹632.28 billion, Treasury Operations at ₹255.75 billion, and Life Insurance Operation at ₹120.19 billion.

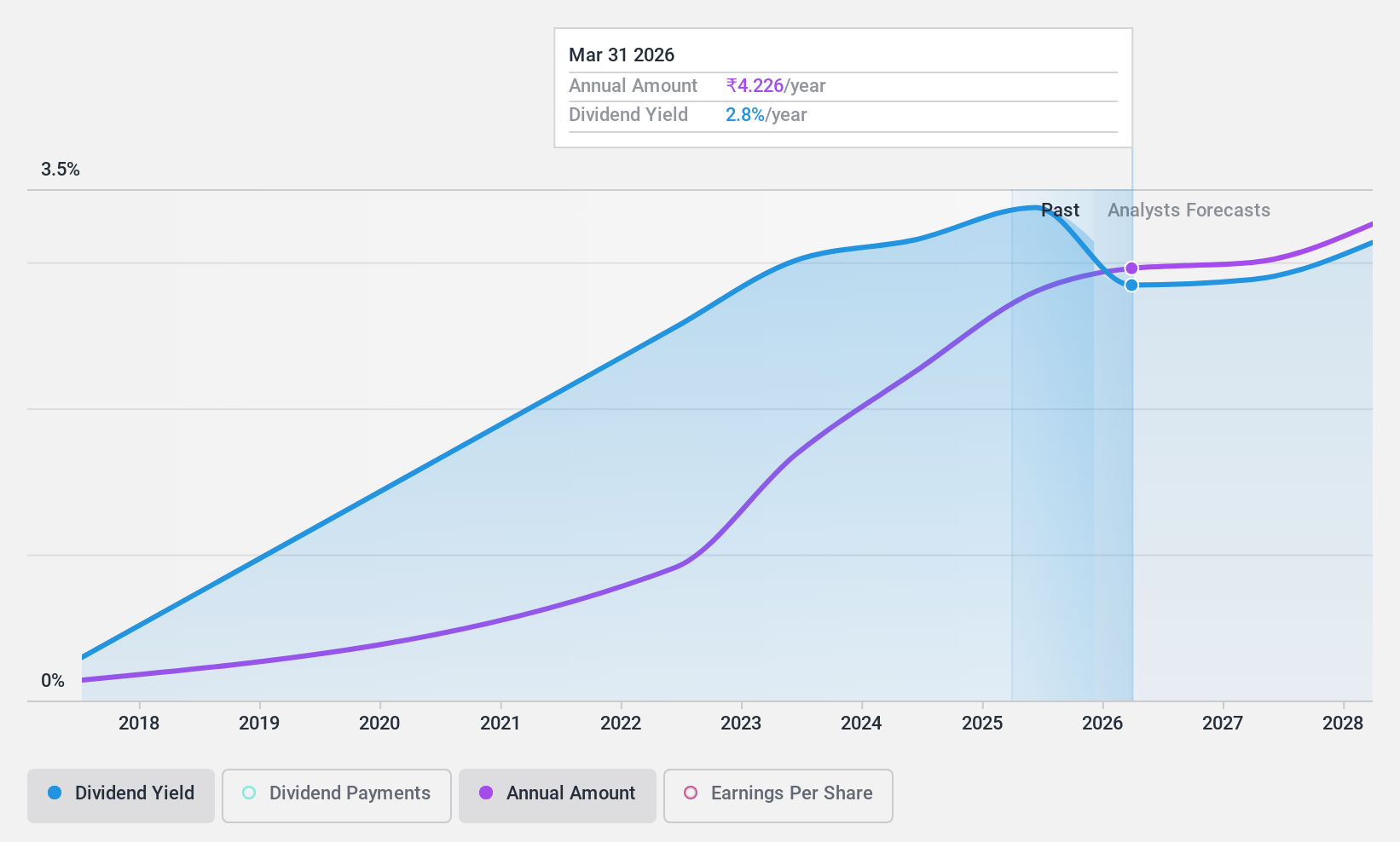

Dividend Yield: 3.3%

Canara Bank's dividend payments have grown over the past decade but remain volatile, with significant annual drops exceeding 20%. Despite this instability, dividends are well covered by earnings due to a low payout ratio of 19.1%, and future coverage is expected to remain strong. The stock trades at a substantial discount to estimated fair value and offers a competitive dividend yield within India's top quartile. However, high non-performing loans at 4.3% present potential risks for investors focused on stability. Recent strategic moves include asset sales in Tanzania and ongoing efforts to manage exposure through auctions of NSL Group assets.

- Click to explore a detailed breakdown of our findings in Canara Bank's dividend report.

- Our expertly prepared valuation report Canara Bank implies its share price may be lower than expected.

D. B (NSEI:DBCORP)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: D. B. Corp Limited operates in newspaper printing and publishing, radio broadcasting, and digital news platforms for news and event management in India and internationally, with a market cap of ₹56.94 billion.

Operations: D. B. Corp Limited's revenue primarily comes from its Printing/Publishing and Allied Business segment, generating ₹22.44 billion, along with its Radio segment contributing ₹1.67 billion.

Dividend Yield: 4.1%

D. B. Corp Limited's dividend yield is among the top 25% in India, supported by a favorable cash payout ratio of 41.3%, indicating strong coverage by cash flows. However, dividends have been volatile over the past decade with periods of significant drops, raising concerns about reliability despite recent increases in payments. The company's earnings cover dividends comfortably at a payout ratio of 79.7%. Recent earnings show mixed results with decreased quarterly net income but improved six-month figures year-over-year.

- Delve into the full analysis dividend report here for a deeper understanding of D. B.

- Our comprehensive valuation report raises the possibility that D. B is priced higher than what may be justified by its financials.

Uniparts India (NSEI:UNIPARTS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Uniparts India Limited, along with its subsidiaries, manufactures and sells engineering systems, solutions, and assemblies for off-highway vehicles across India, the United States, the Asia Pacific, Europe, Japan, and other international markets; it has a market cap of ₹20.02 billion.

Operations: Uniparts India's revenue primarily comes from its Linkage Parts and Components for Off-Highway Vehicles segment, generating ₹11.04 billion.

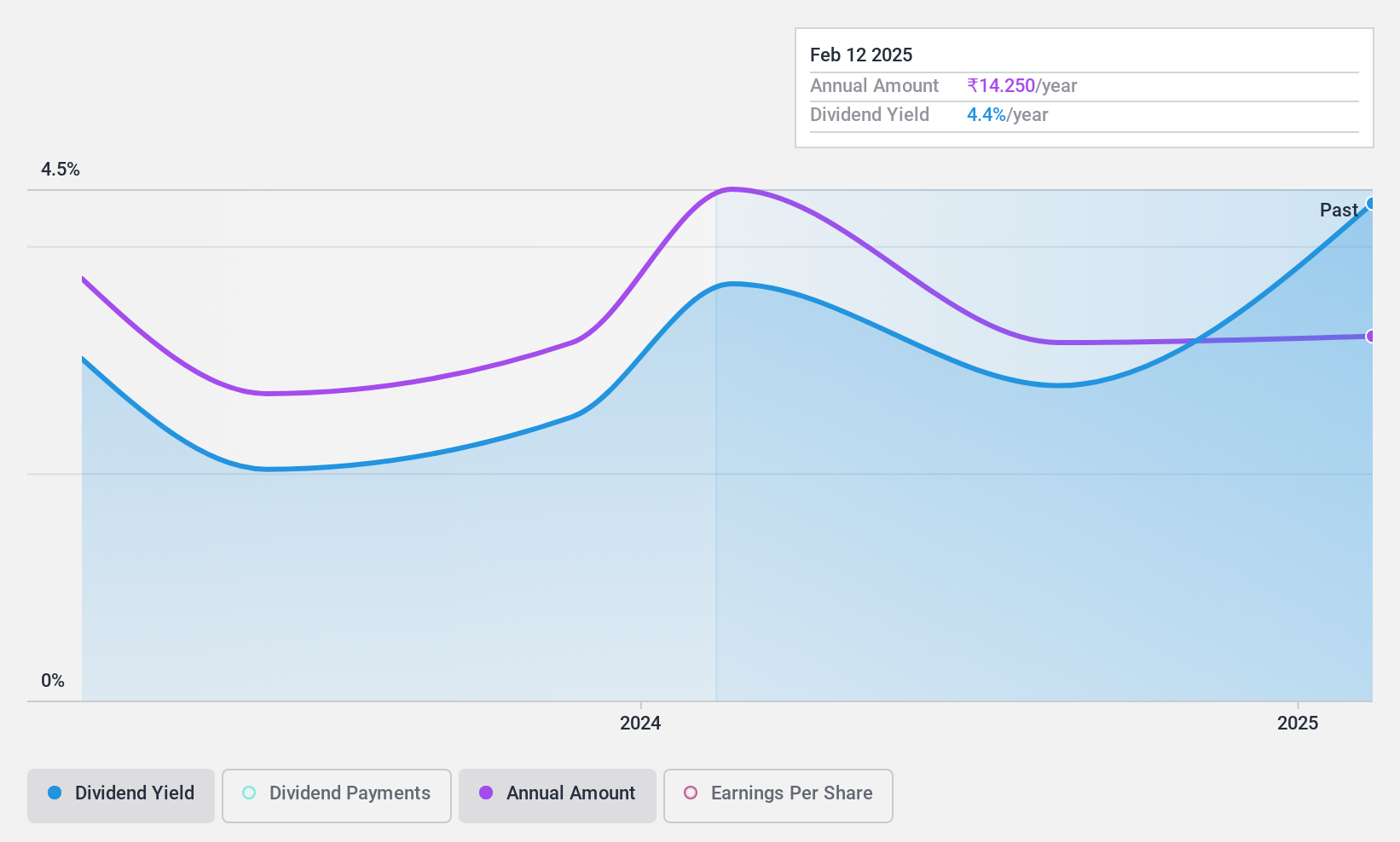

Dividend Yield: 4.6%

Uniparts India recently affirmed two interim dividends totaling INR 14 per share, reflecting a competitive yield in the Indian market. Despite being covered by earnings and cash flows with payout ratios of 73.8% and 56.7%, respectively, the dividend history is brief and marked by volatility over its two-year span. The stock offers good value with a price-to-earnings ratio below the market average, though recent earnings have declined compared to last year.

- Click here to discover the nuances of Uniparts India with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Uniparts India is priced lower than what may be justified by its financials.

Taking Advantage

- Unlock more gems! Our Top Indian Dividend Stocks screener has unearthed 16 more companies for you to explore.Click here to unveil our expertly curated list of 19 Top Indian Dividend Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Canara Bank, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:CANBK

Canara Bank

Provides various banking products and services in India and internationally.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives