Fox-Wizel Ltd.'s (TLV:FOX) dividend will be increasing to ₪11.99 on 1st of May. This takes the annual payment to 4.5% of the current stock price, which unfortunately is below what the industry is paying.

View our latest analysis for Fox-Wizel

Fox-Wizel Is Paying Out More Than It Is Earning

Even a low dividend yield can be attractive if it is sustained for years on end. Before this announcement, Fox-Wizel was paying out 78% of earnings, but a comparatively small 24% of free cash flows. This leaves plenty of cash for reinvestment into the business.

Over the next year, EPS could expand by 35.2% if the company continues along the path it has been on recently. Assuming the dividend continues along recent trends, we think the payout ratio could reach 100%, which probably can't continue without starting to put some pressure on the balance sheet.

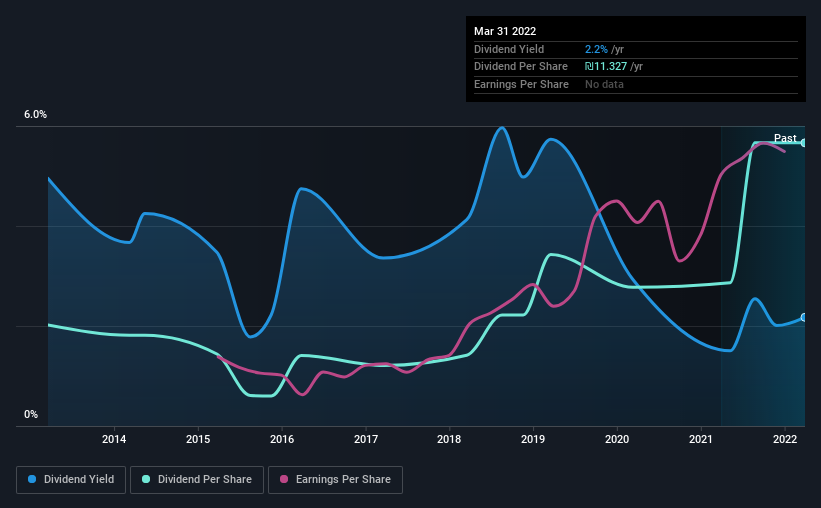

Fox-Wizel's Dividend Has Lacked Consistency

Even in its relatively short history, the company has reduced the dividend at least once. Due to this, we are a little bit cautious about the dividend consistency over a full economic cycle. Since 2013, the dividend has gone from ₪4.04 to ₪11.33. This works out to be a compound annual growth rate (CAGR) of approximately 12% a year over that time. Dividends have grown rapidly over this time, but with cuts in the past we are not certain that this stock will be a reliable source of income in the future.

Fox-Wizel Might Find It Hard To Grow Its Dividend

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. It's encouraging to see Fox-Wizel has been growing its earnings per share at 35% a year over the past five years. Earnings per share is growing nicely, but the company is paying out most of its earnings as dividends. This might be sustainable, but we wonder why Fox-Wizel is not retaining those earnings to reinvest in growth.

Our Thoughts On Fox-Wizel's Dividend

Overall, we always like to see the dividend being raised, but we don't think Fox-Wizel will make a great income stock. In the past, the payments have been unstable, but over the short term the dividend could be reliable, with the company generating enough cash to cover it. We would be a touch cautious of relying on this stock primarily for the dividend income.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For example, we've picked out 2 warning signs for Fox-Wizel that investors should know about before committing capital to this stock. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:FOX

Fox-Wizel

Designs, acquires, markets, and distributes clothing, fashion accessories, lingerie, footwear, fashion and sports accessories, home fashion, and baby and children's products in Israel, Canada, Europe, Asia, and internationally.

Mediocre balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026