- Israel

- /

- Capital Markets

- /

- TASE:MIA

Mia Dynamics Motors (TLV:MIA) shareholder returns have been solid, earning 217% in 5 years

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But on the bright side, you can make far more than 100% on a really good stock. One great example is Mia Dynamics Motors Ltd (TLV:MIA) which saw its share price drive 217% higher over five years. Better yet, the share price has gained 285% in the last quarter.

The past week has proven to be lucrative for Mia Dynamics Motors investors, so let's see if fundamentals drove the company's five-year performance.

See our latest analysis for Mia Dynamics Motors

Given that Mia Dynamics Motors didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last 5 years Mia Dynamics Motors saw its revenue grow at 87% per year. Even measured against other revenue-focussed companies, that's a good result. So it's not entirely surprising that the share price reflected this performance by increasing at a rate of 26% per year, in that time. So it seems likely that buyers have paid attention to the strong revenue growth. Mia Dynamics Motors seems like a high growth stock - so growth investors might want to add it to their watchlist.

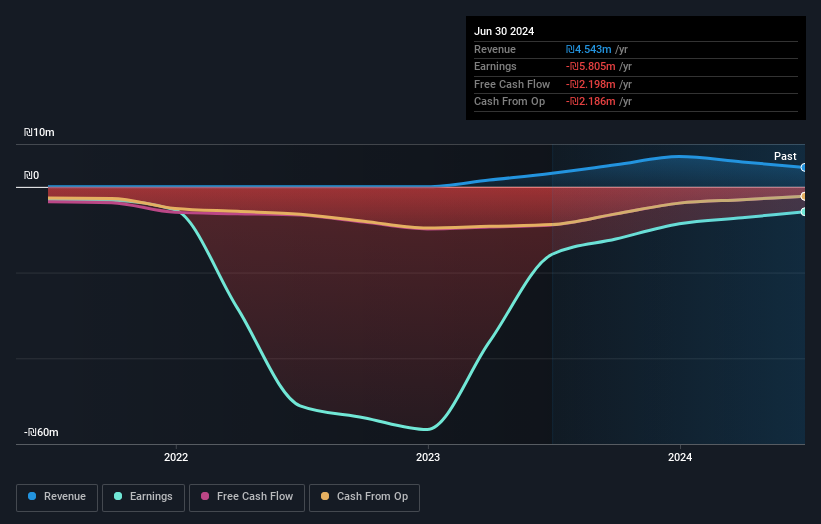

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

It's nice to see that Mia Dynamics Motors shareholders have received a total shareholder return of 150% over the last year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 26% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Mia Dynamics Motors has 7 warning signs (and 5 which shouldn't be ignored) we think you should know about.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Israeli exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:MIA

Mia Dynamics Motors

Engages in the research and development of technology for tiny electric vehicles in Israel.

Medium-low with weak fundamentals.

Market Insights

Community Narratives