- Hong Kong

- /

- Water Utilities

- /

- SEHK:1026

Shareholders in Universal Technologies Holdings (HKG:1026) have lost 47%, as stock drops 15% this past week

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But every investor is virtually certain to have both over-performing and under-performing stocks. So we wouldn't blame long term Universal Technologies Holdings Limited (HKG:1026) shareholders for doubting their decision to hold, with the stock down 47% over a half decade. And some of the more recent buyers are probably worried, too, with the stock falling 26% in the last year. Furthermore, it's down 26% in about a quarter. That's not much fun for holders.

If the past week is anything to go by, investor sentiment for Universal Technologies Holdings isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

Check out our latest analysis for Universal Technologies Holdings

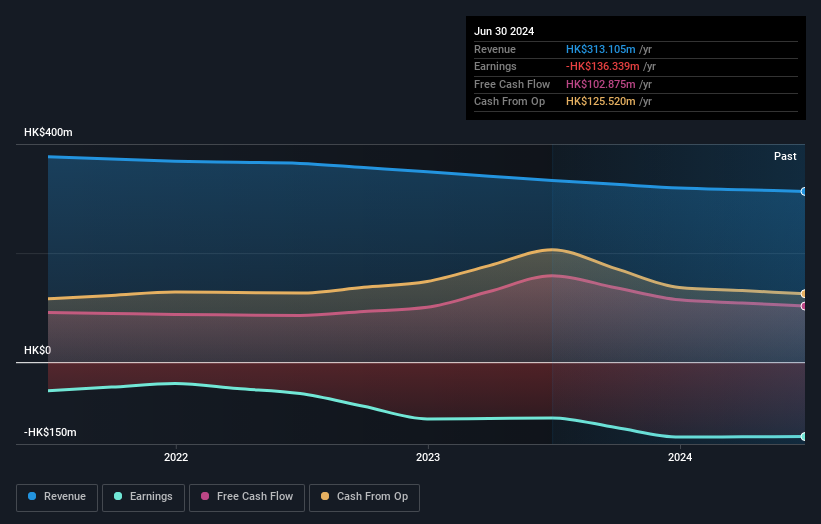

Given that Universal Technologies Holdings didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually desire strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last half decade, Universal Technologies Holdings saw its revenue increase by 1.5% per year. That's far from impressive given all the money it is losing. Given the weak growth, the share price fall of 8% isn't particularly surprising. Investors should consider how bad the losses are, and whether the company can make it to profitability with ease. It could be worth putting it on your watchlist and revisiting when it makes its maiden profit.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

If you are thinking of buying or selling Universal Technologies Holdings stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

While the broader market gained around 33% in the last year, Universal Technologies Holdings shareholders lost 26%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 8% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for Universal Technologies Holdings (of which 1 is a bit unpleasant!) you should know about.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

If you're looking to trade Universal Technologies Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1026

Universal Technologies Holdings

An investment holding company, primarily engages in the water supply and related services business in the People’s Republic of China, Hong Kong, and internationally.

Mediocre balance sheet low.

Market Insights

Community Narratives