- Hong Kong

- /

- Marine and Shipping

- /

- SEHK:1919

The Market Doesn't Like What It Sees From COSCO SHIPPING Holdings Co., Ltd.'s (HKG:1919) Earnings Yet As Shares Tumble 27%

The COSCO SHIPPING Holdings Co., Ltd. (HKG:1919) share price has softened a substantial 27% over the previous 30 days, handing back much of the gains the stock has made lately. Still, a bad month hasn't completely ruined the past year with the stock gaining 31%, which is great even in a bull market.

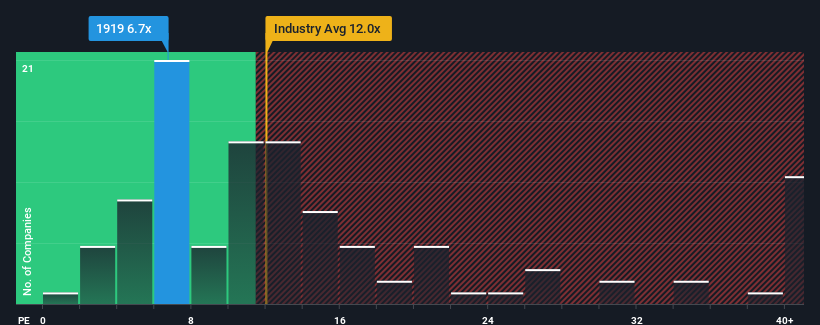

Even after such a large drop in price, COSCO SHIPPING Holdings' price-to-earnings (or "P/E") ratio of 6.7x might still make it look like a buy right now compared to the market in Hong Kong, where around half of the companies have P/E ratios above 10x and even P/E's above 19x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

While the market has experienced earnings growth lately, COSCO SHIPPING Holdings' earnings have gone into reverse gear, which is not great. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for COSCO SHIPPING Holdings

Is There Any Growth For COSCO SHIPPING Holdings?

The only time you'd be truly comfortable seeing a P/E as low as COSCO SHIPPING Holdings' is when the company's growth is on track to lag the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 74%. As a result, earnings from three years ago have also fallen 10% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Looking ahead now, EPS is anticipated to slump, contracting by 11% per year during the coming three years according to the eleven analysts following the company. That's not great when the rest of the market is expected to grow by 15% per annum.

In light of this, it's understandable that COSCO SHIPPING Holdings' P/E would sit below the majority of other companies. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Key Takeaway

The softening of COSCO SHIPPING Holdings' shares means its P/E is now sitting at a pretty low level. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that COSCO SHIPPING Holdings maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 3 warning signs for COSCO SHIPPING Holdings you should be aware of, and 1 of them is potentially serious.

If these risks are making you reconsider your opinion on COSCO SHIPPING Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1919

COSCO SHIPPING Holdings

An investment holding company, engages in the container shipping and terminal operations in the United States, Europe, the Asia Pacific, Mainland China, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives