- Hong Kong

- /

- Wireless Telecom

- /

- SEHK:941

China Mobile (HKG:941) shareholders have earned a 28% CAGR over the last three years

By buying an index fund, you can roughly match the market return with ease. But if you buy good businesses at attractive prices, your portfolio returns could exceed the average market return. For example, China Mobile Limited (HKG:941) shareholders have seen the share price rise 74% over three years, well in excess of the market return (12%, not including dividends). On the other hand, the returns haven't been quite so good recently, with shareholders up just 26%, including dividends.

So let's assess the underlying fundamentals over the last 3 years and see if they've moved in lock-step with shareholder returns.

We check all companies for important risks. See what we found for China Mobile in our free report.To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

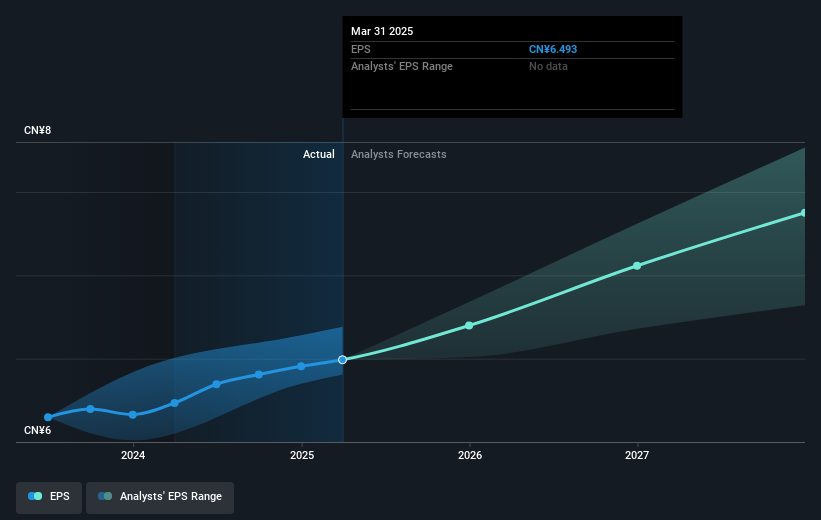

China Mobile was able to grow its EPS at 4.3% per year over three years, sending the share price higher. In comparison, the 20% per year gain in the share price outpaces the EPS growth. This suggests that, as the business progressed over the last few years, it gained the confidence of market participants. It's not unusual to see the market 're-rate' a stock, after a few years of growth.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Dive deeper into the earnings by checking this interactive graph of China Mobile's earnings, revenue and cash flow.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for China Mobile the TSR over the last 3 years was 109%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

China Mobile's TSR for the year was broadly in line with the market average, at 26%. That gain looks pretty satisfying, and it is even better than the five-year TSR of 17% per year. It is possible that management foresight will bring growth well into the future, even if the share price slows down. Importantly, we haven't analysed China Mobile's dividend history. This free visual report on its dividends is a must-read if you're thinking of buying.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:941

China Mobile

Provides telecommunications and information related services in Mainland China and Hong Kong.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives