- Hong Kong

- /

- Telecom Services and Carriers

- /

- SEHK:728

Top Asian Dividend Stocks To Consider In October 2025

Reviewed by Simply Wall St

As global markets grapple with renewed U.S.-China trade tensions and economic uncertainties, Asian equities have shown resilience, with Japan's stock markets notably rising amid political developments. In such a climate, dividend stocks in Asia can offer investors stability and income potential, serving as a buffer against market volatility while providing regular cash flow.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.19% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 3.75% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.12% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 3.93% | ★★★★★★ |

| NCD (TSE:4783) | 4.37% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.92% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.47% | ★★★★★★ |

| Daicel (TSE:4202) | 4.50% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.44% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.29% | ★★★★★★ |

Click here to see the full list of 1064 stocks from our Top Asian Dividend Stocks screener.

We'll examine a selection from our screener results.

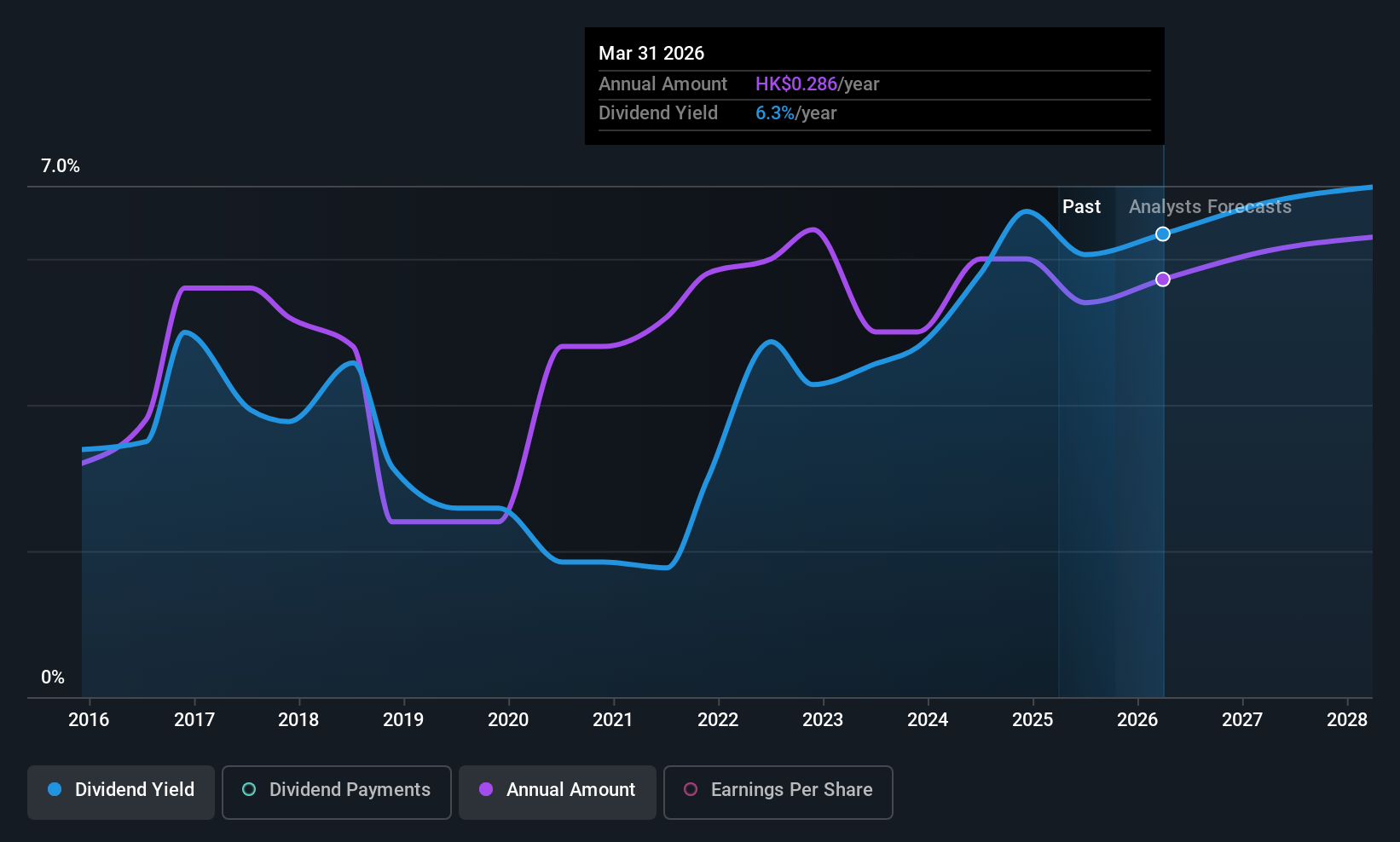

Man Wah Holdings (SEHK:1999)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Man Wah Holdings Limited is an investment holding company that manufactures and distributes sofas and ancillary products across the People's Republic of China, Europe, Vietnam, Mexico, and internationally, with a market cap of HK$17.65 billion.

Operations: Man Wah Holdings Limited generates revenue primarily from Sofa and Ancillary Products at HK$11.74 billion, followed by Bedding and Ancillary Products at HK$2.41 billion, and Home Group Business at HK$777.39 million.

Dividend Yield: 5.9%

Man Wah Holdings' dividend payments have been volatile over the past decade, with a lower yield (5.93%) compared to top Hong Kong dividend payers. However, dividends are covered by both earnings and cash flows, with payout ratios of 50.8% and 40.5%, respectively. Recent auditor changes from PwC to EY aim to enhance audit cost-effectiveness without compromising quality, though significant insider selling raises concerns about stability and sustainability for long-term investors.

- Unlock comprehensive insights into our analysis of Man Wah Holdings stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Man Wah Holdings is priced lower than what may be justified by its financials.

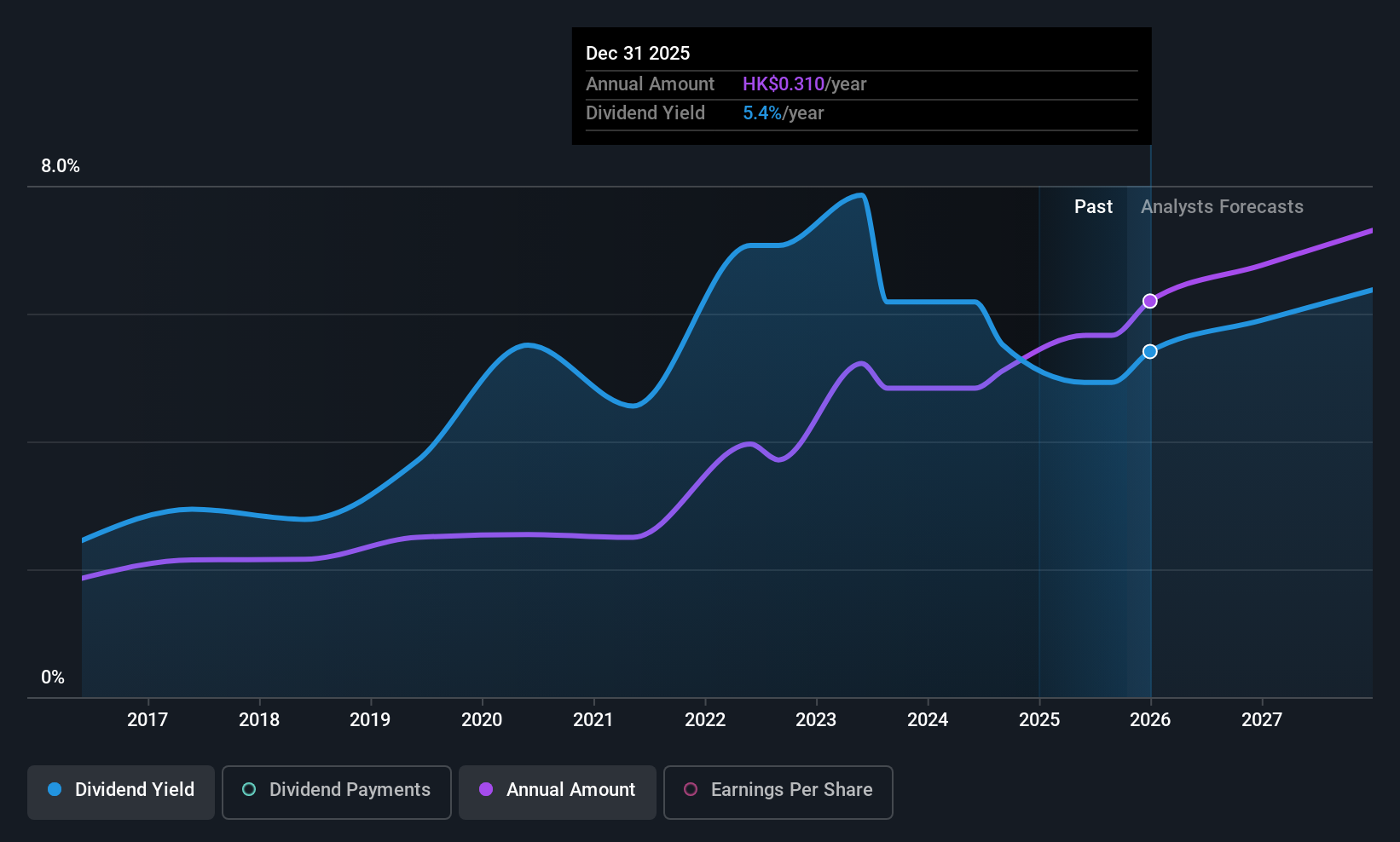

China Telecom (SEHK:728)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Telecom Corporation Limited, along with its subsidiaries, offers mobile communications, wireline and satellite communications, internet access, cloud computing and computing power, AI, big data, quantum technology and ICT integration services in the People’s Republic of China and has a market cap of approximately HK$653.26 billion.

Operations: China Telecom Corporation Limited generates revenue from its Integrated Telecommunications Business, amounting to CN¥532.87 billion.

Dividend Yield: 5%

China Telecom's dividend payments have been inconsistent over the past decade, with a yield of 4.99%, falling short of top-tier Hong Kong dividend payers. Despite this, dividends are supported by earnings and cash flows, with payout ratios of 73.2% and 45.7%, respectively. Recent inclusion in the Hang Seng Index may enhance visibility among investors, while an interim dividend increase signals potential commitment to shareholder returns amid stable earnings growth and undervaluation relative to estimated fair value.

- Click here to discover the nuances of China Telecom with our detailed analytical dividend report.

- According our valuation report, there's an indication that China Telecom's share price might be on the cheaper side.

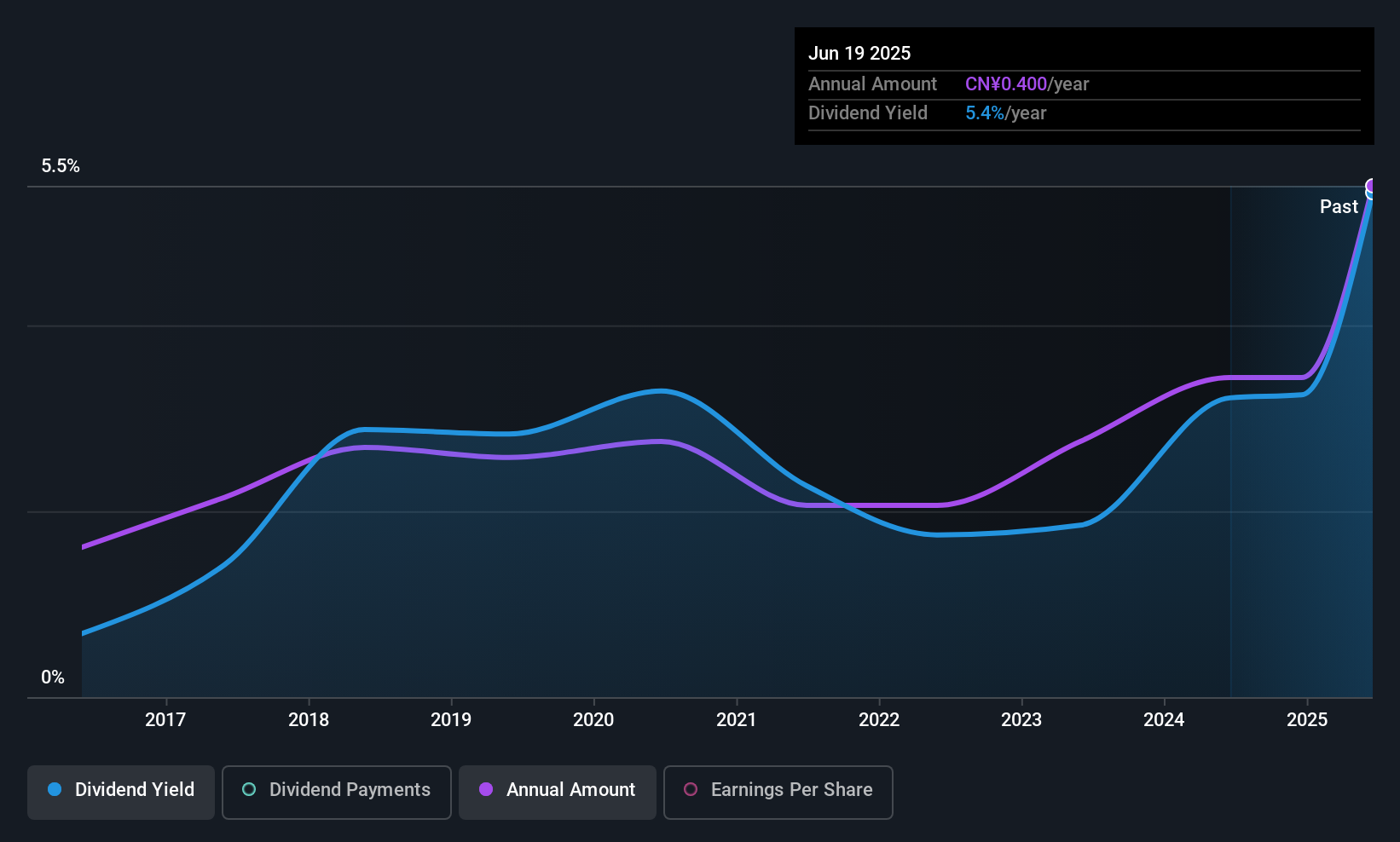

Xiamen R&T Plumbing TechnologyLtd (SZSE:002790)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Xiamen R&T Plumbing Technology Co., Ltd. specializes in the research, development, production, and sale of bathroom products and accessories globally, with a market cap of CN¥3.23 billion.

Operations: Xiamen R&T Plumbing Technology Co., Ltd.'s revenue is derived from Smart Toilet and Cover products (CN¥1.28 billion), Water Tanks and Accessories (CN¥578.63 million), and Same Floor Drainage System Products (CN¥175.19 million).

Dividend Yield: 5.2%

Xiamen R&T Plumbing Technology's dividend yield of 5.17% ranks in the top 25% of CN market payers, supported by a payout ratio of 59.4% and a cash payout ratio of 88.1%. However, its dividends have been volatile over nine years, with inconsistent growth and stability. Recent earnings showed a decline to CNY 51.67 million from CNY 90.97 million year-on-year, potentially impacting future dividend reliability despite current coverage by earnings and cash flows.

- Click to explore a detailed breakdown of our findings in Xiamen R&T Plumbing TechnologyLtd's dividend report.

- In light of our recent valuation report, it seems possible that Xiamen R&T Plumbing TechnologyLtd is trading beyond its estimated value.

Turning Ideas Into Actions

- Unlock our comprehensive list of 1064 Top Asian Dividend Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:728

China Telecom

Provides mobile communications, wireline and satellite communications, internet access, cloud computing and computing power, AI, big data, quantum, ICT integration in the People’s Republic of China.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)