- Hong Kong

- /

- Communications

- /

- SEHK:9963

We Discuss Why Transtech Optelecom Science Holdings Limited's (HKG:9963) CEO Compensation May Be Closely Reviewed

Key Insights

- Transtech Optelecom Science Holdings' Annual General Meeting to take place on 30th of May

- CEO Xingfu He's total compensation includes salary of HK$1.35m

- The total compensation is similar to the average for the industry

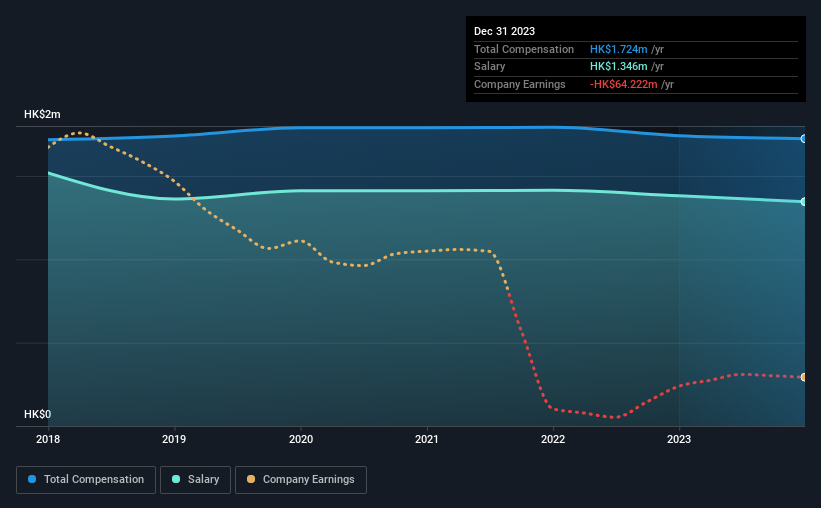

- Transtech Optelecom Science Holdings' EPS declined by 52% over the past three years while total shareholder loss over the past three years was 82%

The results at Transtech Optelecom Science Holdings Limited (HKG:9963) have been quite disappointing recently and CEO Xingfu He bears some responsibility for this. At the upcoming AGM on 30th of May, shareholders can hear from the board including their plans for turning around performance. They will also get a chance to influence managerial decision-making through voting on resolutions such as executive remuneration, which may impact firm value in the future. From our analysis, we think CEO compensation may need a review in light of the recent performance.

Check out our latest analysis for Transtech Optelecom Science Holdings

How Does Total Compensation For Xingfu He Compare With Other Companies In The Industry?

At the time of writing, our data shows that Transtech Optelecom Science Holdings Limited has a market capitalization of HK$68m, and reported total annual CEO compensation of HK$1.7m for the year to December 2023. This means that the compensation hasn't changed much from last year. In particular, the salary of HK$1.35m, makes up a huge portion of the total compensation being paid to the CEO.

For comparison, other companies in the Hong Kong Communications industry with market capitalizations below HK$1.6b, reported a median total CEO compensation of HK$1.7m. From this we gather that Xingfu He is paid around the median for CEOs in the industry.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | HK$1.3m | HK$1.4m | 78% |

| Other | HK$378k | HK$361k | 22% |

| Total Compensation | HK$1.7m | HK$1.7m | 100% |

On an industry level, roughly 77% of total compensation represents salary and 23% is other remuneration. Transtech Optelecom Science Holdings is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Transtech Optelecom Science Holdings Limited's Growth Numbers

Over the last three years, Transtech Optelecom Science Holdings Limited has shrunk its earnings per share by 52% per year. In the last year, its revenue is down 25%.

Overall this is not a very positive result for shareholders. This is compounded by the fact revenue is actually down on last year. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Transtech Optelecom Science Holdings Limited Been A Good Investment?

Few Transtech Optelecom Science Holdings Limited shareholders would feel satisfied with the return of -82% over three years. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

Not only have shareholders not seen a favorable return on their investment, but the business hasn't performed well either. Few shareholders would be willing to award the CEO with a pay raise. At the upcoming AGM, management will get a chance to explain how they plan to get the business back on track and address the concerns from investors.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. We identified 3 warning signs for Transtech Optelecom Science Holdings (2 can't be ignored!) that you should be aware of before investing here.

Important note: Transtech Optelecom Science Holdings is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Transtech Optelecom Science Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:9963

Transtech Optelecom Science Holdings

An investment holding company, engages in the manufacturing and sale of optical fiber in Hong Kong.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)