- Hong Kong

- /

- Communications

- /

- SEHK:2342

Does Comba Telecom Systems Holdings (HKG:2342) Have A Healthy Balance Sheet?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Comba Telecom Systems Holdings Limited (HKG:2342) does use debt in its business. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Comba Telecom Systems Holdings

How Much Debt Does Comba Telecom Systems Holdings Carry?

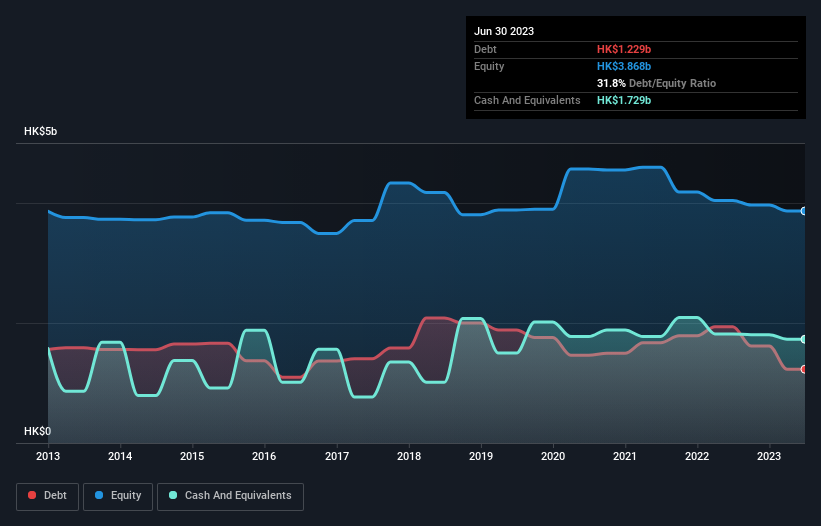

You can click the graphic below for the historical numbers, but it shows that Comba Telecom Systems Holdings had HK$1.23b of debt in June 2023, down from HK$1.94b, one year before. But it also has HK$1.73b in cash to offset that, meaning it has HK$500.0m net cash.

A Look At Comba Telecom Systems Holdings' Liabilities

We can see from the most recent balance sheet that Comba Telecom Systems Holdings had liabilities of HK$5.63b falling due within a year, and liabilities of HK$494.5m due beyond that. On the other hand, it had cash of HK$1.73b and HK$3.93b worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by HK$457.8m.

Comba Telecom Systems Holdings has a market capitalization of HK$2.17b, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution. While it does have liabilities worth noting, Comba Telecom Systems Holdings also has more cash than debt, so we're pretty confident it can manage its debt safely.

Notably, Comba Telecom Systems Holdings made a loss at the EBIT level, last year, but improved that to positive EBIT of HK$137m in the last twelve months. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Comba Telecom Systems Holdings can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. Comba Telecom Systems Holdings may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Happily for any shareholders, Comba Telecom Systems Holdings actually produced more free cash flow than EBIT over the last year. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Summing Up

While Comba Telecom Systems Holdings does have more liabilities than liquid assets, it also has net cash of HK$500.0m. The cherry on top was that in converted 467% of that EBIT to free cash flow, bringing in HK$639m. So we don't have any problem with Comba Telecom Systems Holdings's use of debt. We'd be motivated to research the stock further if we found out that Comba Telecom Systems Holdings insiders have bought shares recently. If you would too, then you're in luck, since today we're sharing our list of reported insider transactions for free.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2342

Comba Telecom Systems Holdings

An investment holding company, engages in the research and development, manufacture, and sale of wireless telecommunications network system equipment and related engineering services.

Flawless balance sheet and overvalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion