- Hong Kong

- /

- Communications

- /

- SEHK:2342

Does Comba Telecom Systems Holdings (HKG:2342) Have A Healthy Balance Sheet?

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Comba Telecom Systems Holdings Limited (HKG:2342) does use debt in its business. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Comba Telecom Systems Holdings

How Much Debt Does Comba Telecom Systems Holdings Carry?

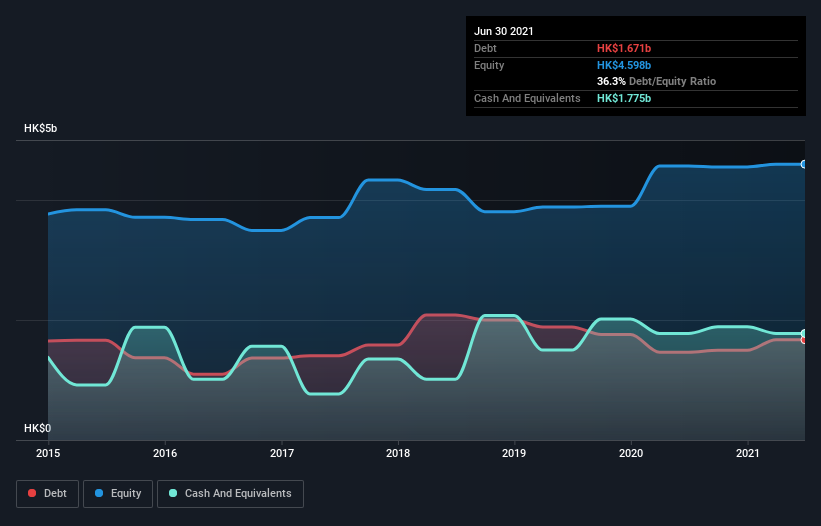

The image below, which you can click on for greater detail, shows that at June 2021 Comba Telecom Systems Holdings had debt of HK$1.67b, up from HK$1.46b in one year. However, its balance sheet shows it holds HK$1.78b in cash, so it actually has HK$104.1m net cash.

How Healthy Is Comba Telecom Systems Holdings' Balance Sheet?

We can see from the most recent balance sheet that Comba Telecom Systems Holdings had liabilities of HK$6.10b falling due within a year, and liabilities of HK$502.8m due beyond that. On the other hand, it had cash of HK$1.78b and HK$4.23b worth of receivables due within a year. So it has liabilities totalling HK$597.0m more than its cash and near-term receivables, combined.

Of course, Comba Telecom Systems Holdings has a market capitalization of HK$6.02b, so these liabilities are probably manageable. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time. Despite its noteworthy liabilities, Comba Telecom Systems Holdings boasts net cash, so it's fair to say it does not have a heavy debt load! The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Comba Telecom Systems Holdings's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Over 12 months, Comba Telecom Systems Holdings saw its revenue hold pretty steady, and it did not report positive earnings before interest and tax. While that hardly impresses, its not too bad either.

So How Risky Is Comba Telecom Systems Holdings?

We have no doubt that loss making companies are, in general, riskier than profitable ones. And the fact is that over the last twelve months Comba Telecom Systems Holdings lost money at the earnings before interest and tax (EBIT) line. And over the same period it saw negative free cash outflow of HK$224m and booked a HK$337m accounting loss. With only HK$104.1m on the balance sheet, it would appear that its going to need to raise capital again soon. Overall, we'd say the stock is a bit risky, and we're usually very cautious until we see positive free cash flow. When we look at a riskier company, we like to check how their profits (or losses) are trending over time. Today, we're providing readers this interactive graph showing how Comba Telecom Systems Holdings's profit, revenue, and operating cashflow have changed over the last few years.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:2342

Comba Telecom Systems Holdings

An investment holding company, engages in the research and development, manufacture, and sale of wireless telecommunications network system equipment and related engineering services.

Flawless balance sheet and overvalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)