- Hong Kong

- /

- Real Estate

- /

- SEHK:1821

After Leaping 25% ESR Group Limited (HKG:1821) Shares Are Not Flying Under The Radar

ESR Group Limited (HKG:1821) shareholders would be excited to see that the share price has had a great month, posting a 25% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 14% over that time.

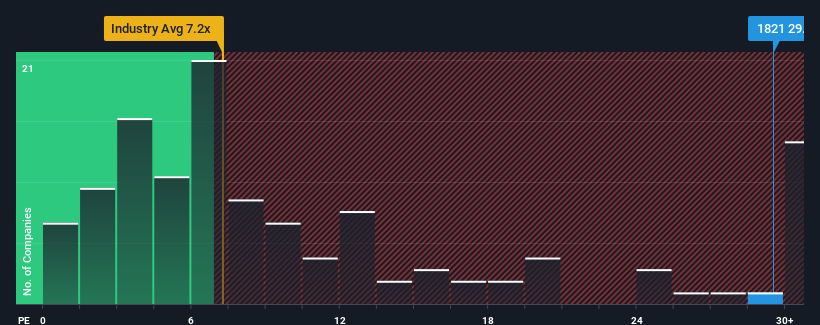

After such a large jump in price, given close to half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") below 9x, you may consider ESR Group as a stock to avoid entirely with its 29.5x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

While the market has experienced earnings growth lately, ESR Group's earnings have gone into reverse gear, which is not great. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Check out our latest analysis for ESR Group

Does Growth Match The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like ESR Group's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 64% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 49% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 52% per annum as estimated by the ten analysts watching the company. With the market only predicted to deliver 16% per year, the company is positioned for a stronger earnings result.

In light of this, it's understandable that ESR Group's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On ESR Group's P/E

ESR Group's P/E is flying high just like its stock has during the last month. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of ESR Group's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

Before you settle on your opinion, we've discovered 4 warning signs for ESR Group (1 can't be ignored!) that you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

If you're looking to trade ESR Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if ESR Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1821

ESR Group

Engages in providing solutions for logistics, data centres, and infrastructure and renewables activities in Hong Kong, China, Japan, South Korea, Australia, New Zealand, Southeast Asia, India, Europe, and internationally.

Reasonable growth potential and overvalued.

Market Insights

Community Narratives