- Hong Kong

- /

- Real Estate

- /

- SEHK:1821

3 Asian Growth Companies With Significant Insider Ownership

Reviewed by Simply Wall St

As global markets react positively to the recent U.S.-China tariff suspension, Asian stocks have shown resilience, with Chinese indices experiencing a notable uptick. In this environment of easing trade tensions and shifting economic dynamics, companies with strong growth potential and significant insider ownership can offer unique insights into their future prospects.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Sineng ElectricLtd (SZSE:300827) | 36% | 26.8% |

| Samyang Foods (KOSE:A003230) | 11.6% | 23.1% |

| Nanya New Material TechnologyLtd (SHSE:688519) | 11% | 63.1% |

| Global Tax Free (KOSDAQ:A204620) | 20.8% | 35.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 44.2% |

| Schooinc (TSE:264A) | 26.6% | 68.9% |

| M31 Technology (TPEX:6643) | 30.8% | 63.4% |

| Oscotec (KOSDAQ:A039200) | 21.1% | 85.9% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.6% | 60.7% |

| giftee (TSE:4449) | 34.5% | 63.7% |

Underneath we present a selection of stocks filtered out by our screen.

ESR Group (SEHK:1821)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ESR Group Limited operates in logistics, data centres, and infrastructure and renewables across various regions including Asia-Pacific and Europe, with a market cap of approximately HK$54.36 billion.

Operations: The company's revenue segments include Fund Management at $525.98 million and New Economy Development at $94.01 million, while the Investment segment shows a negative contribution of -$10.71 million.

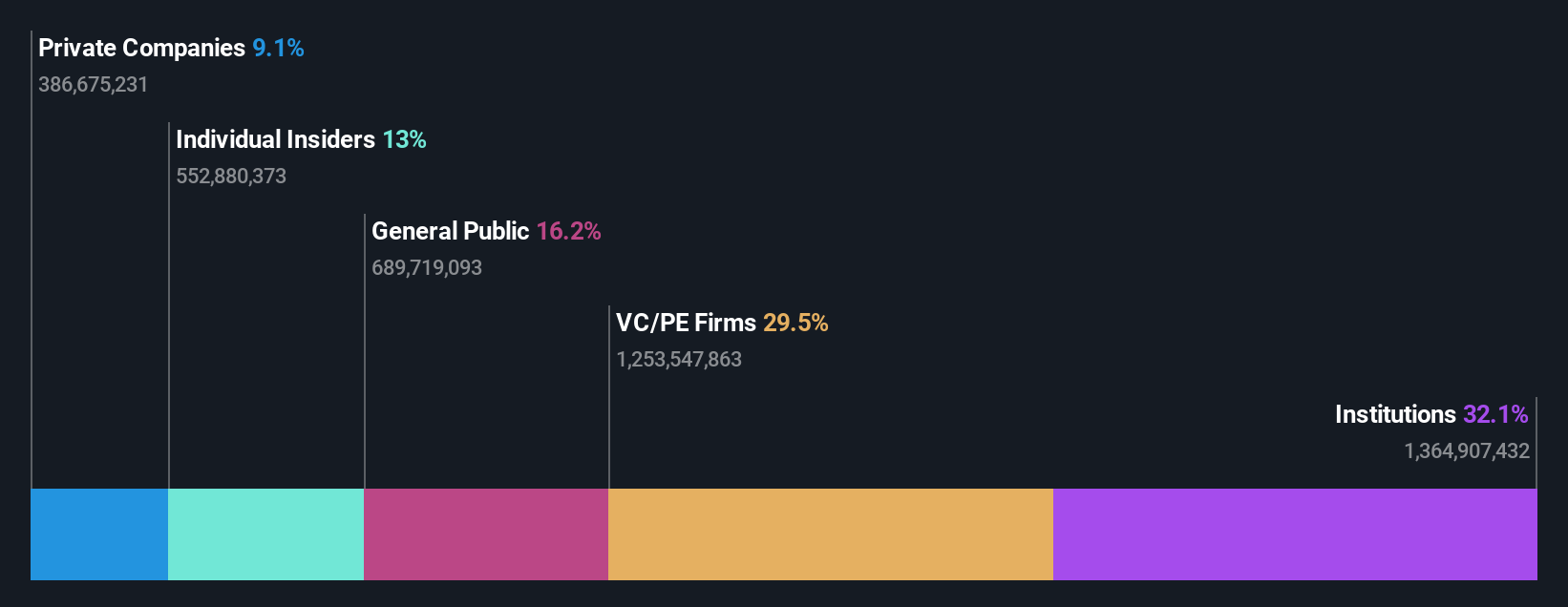

Insider Ownership: 13%

ESR Group, trading below its estimated fair value, is poised for substantial earnings growth at 58.93% annually despite a challenging financial position with insufficient interest coverage. Forecasts indicate revenue growth of 15.1% per year, outpacing the Hong Kong market but trailing ideal benchmarks for high-growth companies. Recent results showed a significant net loss of US$699.81 million due to asset revaluation losses and reduced fees, impacting dividends and profitability expectations in the near term.

- Delve into the full analysis future growth report here for a deeper understanding of ESR Group.

- Our valuation report unveils the possibility ESR Group's shares may be trading at a premium.

Newborn Town (SEHK:9911)

Simply Wall St Growth Rating: ★★★★★☆

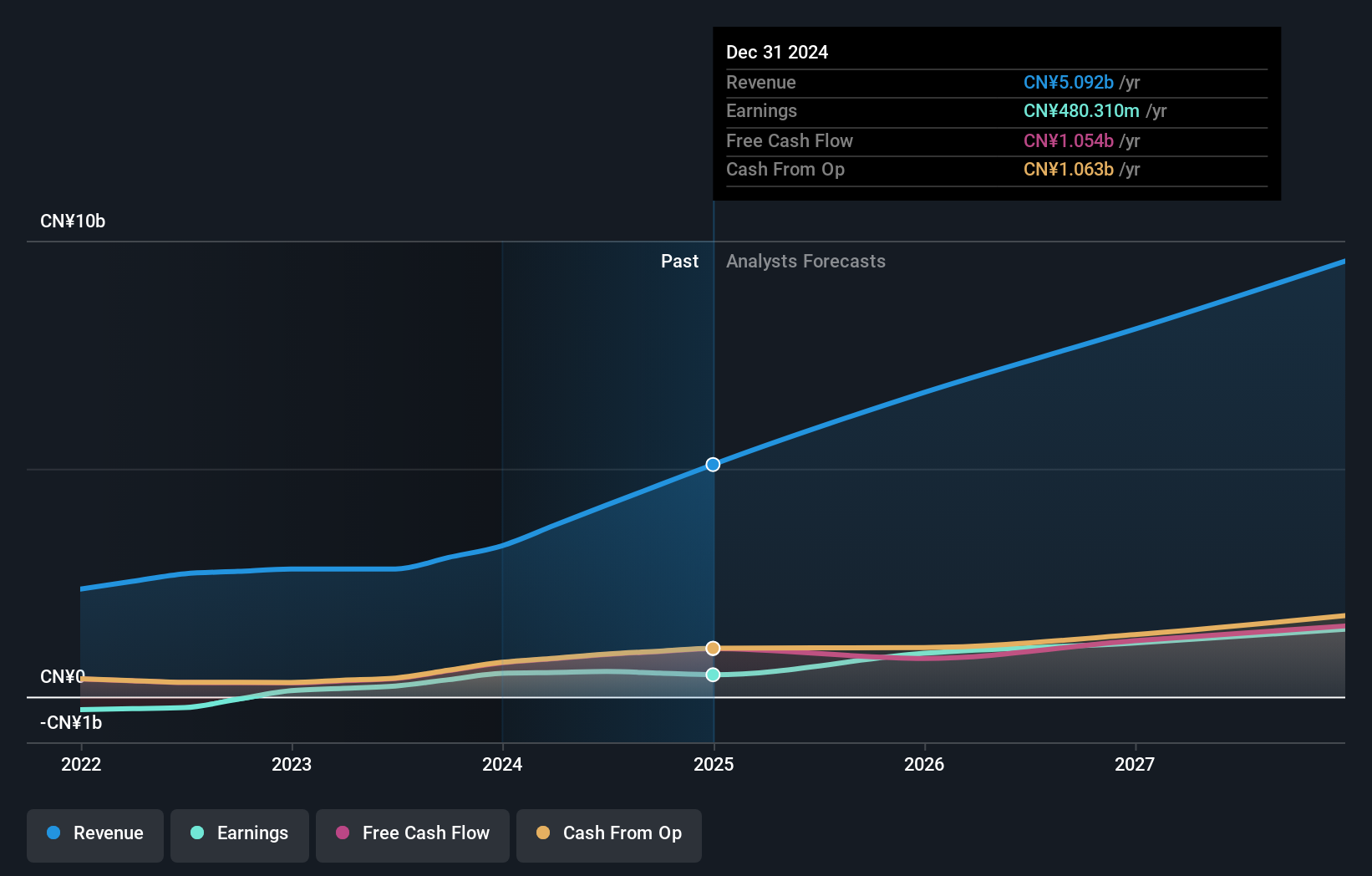

Overview: Newborn Town Inc., an investment holding company, operates in the global social networking sector with a market cap of HK$12.83 billion.

Operations: The company generates revenue primarily from its Social Networking Business, amounting to CN¥4.63 billion, and its Innovative Business segment, which contributes CN¥459.64 million.

Insider Ownership: 32.7%

Newborn Town's high insider ownership aligns with its robust growth prospects, as earnings are expected to grow significantly at 29% annually, outpacing the Hong Kong market. Despite recent share price volatility and a decrease in profit margins from 15.5% to 9.4%, the company trades at a substantial discount to its estimated fair value. Revenue guidance for Q1 2025 suggests strong performance, with an increase of up to 48.1% year-on-year anticipated.

- Click here and access our complete growth analysis report to understand the dynamics of Newborn Town.

- In light of our recent valuation report, it seems possible that Newborn Town is trading beyond its estimated value.

RemeGen (SEHK:9995)

Simply Wall St Growth Rating: ★★★★★★

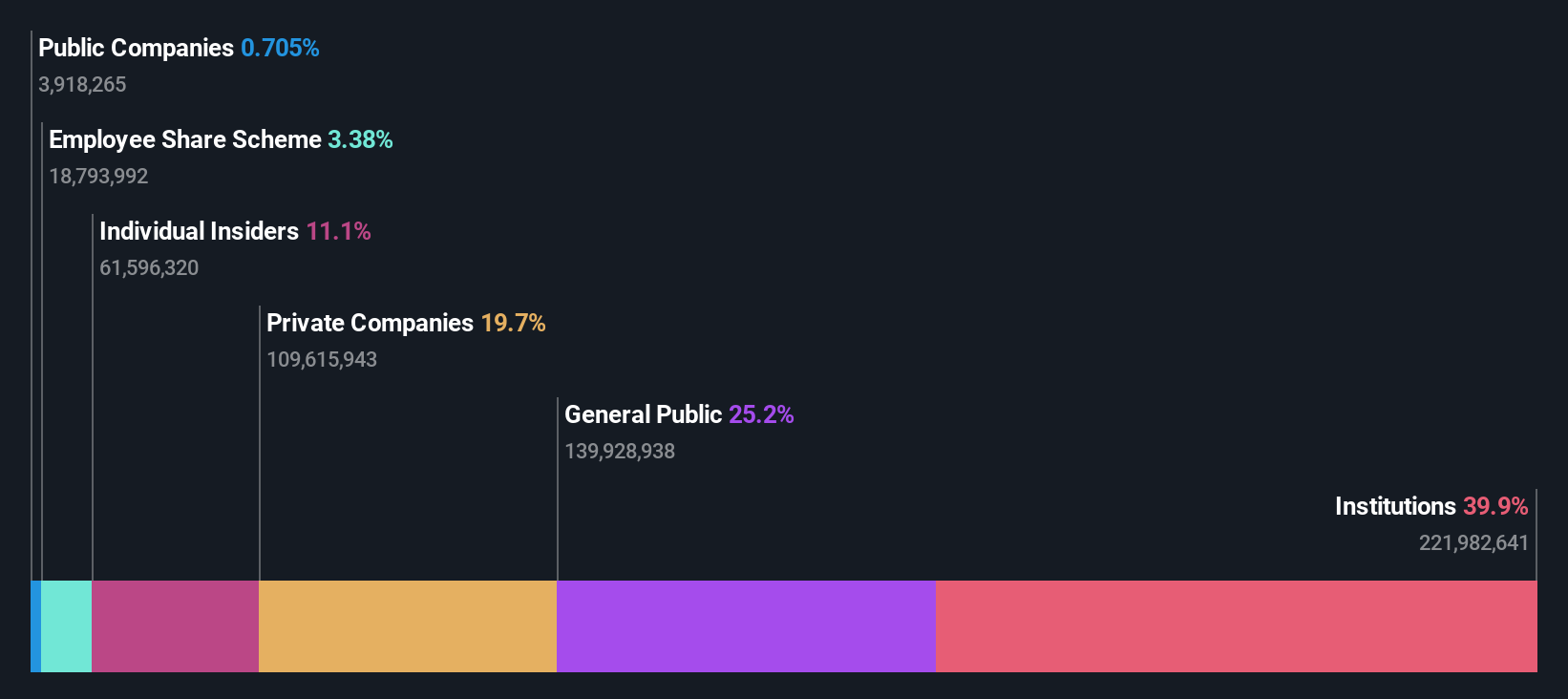

Overview: RemeGen Co., Ltd. is a biopharmaceutical company focused on the discovery, development, and commercialization of biologics for autoimmune, oncology, and ophthalmic diseases in Mainland China and the United States with a market cap of approximately HK$26.73 billion.

Operations: The company's revenue from biopharmaceutical research, service, production, and sales amounts to approximately CN¥1.91 billion.

Insider Ownership: 11.6%

RemeGen demonstrates strong growth potential with expected annual earnings growth of 64.67% and revenue projected to rise by 22.7% annually, surpassing the Hong Kong market average. The company is poised to become profitable within three years and trades at a significant discount to its estimated fair value. Recent positive clinical trial results for disitamab vedotin in cancer treatment bolster its innovative pipeline, though it faces challenges like high share price volatility and limited cash runway.

- Unlock comprehensive insights into our analysis of RemeGen stock in this growth report.

- Our comprehensive valuation report raises the possibility that RemeGen is priced higher than what may be justified by its financials.

Where To Now?

- Discover the full array of 619 Fast Growing Asian Companies With High Insider Ownership right here.

- Want To Explore Some Alternatives? The end of cancer? These 23 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade ESR Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if ESR Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1821

ESR Group

Engages in providing solutions for logistics, data centres, and infrastructure and renewables activities in Hong Kong, China, Japan, South Korea, Australia, New Zealand, Southeast Asia, India, Europe, and internationally.

Reasonable growth potential and overvalued.

Market Insights

Community Narratives