- Hong Kong

- /

- Entertainment

- /

- SEHK:777

Here's Why I Think NetDragon Websoft Holdings (HKG:777) Might Deserve Your Attention Today

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

So if you're like me, you might be more interested in profitable, growing companies, like NetDragon Websoft Holdings (HKG:777). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

Check out our latest analysis for NetDragon Websoft Holdings

How Fast Is NetDragon Websoft Holdings Growing Its Earnings Per Share?

Over the last three years, NetDragon Websoft Holdings has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. Thus, it makes sense to focus on more recent growth rates, instead. Like a falcon taking flight, NetDragon Websoft Holdings's EPS soared from CN¥1.34 to CN¥1.92, over the last year. That's a commendable gain of 43%.

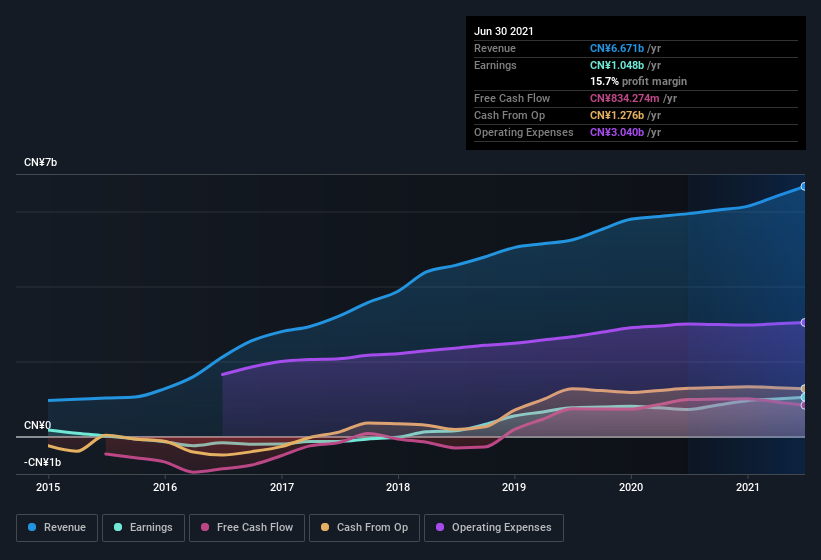

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. The good news is that NetDragon Websoft Holdings is growing revenues, and EBIT margins improved by 8.4 percentage points to 24%, over the last year. That's great to see, on both counts.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. To that end, right now and today, you can check our visualization of consensus analyst forecasts for future NetDragon Websoft Holdings EPS 100% free.

Are NetDragon Websoft Holdings Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So as you can imagine, the fact that NetDragon Websoft Holdings insiders own a significant number of shares certainly appeals to me. Actually, with 48% of the company to their names, insiders are profoundly invested in the business. I'm always comforted by solid insider ownership like this, as it implies that those running the business are genuinely motivated to create shareholder value. At the current share price, that insider holding is worth a whopping CN¥4.6b. Now that's what I call some serious skin in the game!

It means a lot to see insiders invested in the business, but I find myself wondering if remuneration policies are shareholder friendly. Well, based on the CEO pay, I'd say they are indeed. I discovered that the median total compensation for the CEOs of companies like NetDragon Websoft Holdings with market caps between CN¥6.4b and CN¥20b is about CN¥3.5m.

The NetDragon Websoft Holdings CEO received total compensation of just CN¥946k in the year to . That's clearly well below average, so at a glance, that arrangement seems generous to shareholders, and points to a modest remuneration culture. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Should You Add NetDragon Websoft Holdings To Your Watchlist?

You can't deny that NetDragon Websoft Holdings has grown its earnings per share at a very impressive rate. That's attractive. If you need more convincing beyond that EPS growth rate, don't forget about the reasonable remuneration and the high insider ownership. Each to their own, but I think all this makes NetDragon Websoft Holdings look rather interesting indeed. We should say that we've discovered 1 warning sign for NetDragon Websoft Holdings that you should be aware of before investing here.

Although NetDragon Websoft Holdings certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if NetDragon Websoft Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:777

NetDragon Websoft Holdings

Provides online and mobile games the People’s Republic of China, the United States, the United Kingdom, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion