- Mexico

- /

- Hospitality

- /

- BMV:ALSEA *

3 Global Growth Stocks With Insider Ownership Up To 38%

Reviewed by Simply Wall St

In a week marked by a significant de-escalation in trade tensions between the U.S. and China, global markets have responded positively, with major indices such as the Nasdaq Composite and S&P 500 posting strong gains. This improved sentiment comes amid cooling inflation rates and ongoing economic negotiations, providing an encouraging backdrop for investors seeking growth opportunities. In this environment, stocks with high insider ownership can be particularly appealing as they often indicate confidence from those closest to the company’s operations.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| KebNi (OM:KEBNI B) | 38.3% | 66.1% |

| Pharma Mar (BME:PHM) | 11.8% | 43.1% |

| Vow (OB:VOW) | 13.1% | 81% |

| Global Tax Free (KOSDAQ:A204620) | 20.8% | 35.1% |

| Elicera Therapeutics (OM:ELIC) | 23.8% | 107.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 44.2% |

| CD Projekt (WSE:CDR) | 29.7% | 37.4% |

| Elliptic Laboratories (OB:ELABS) | 22.6% | 51.9% |

| Nordic Halibut (OB:NOHAL) | 29.7% | 60.7% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.6% | 60.7% |

Underneath we present a selection of stocks filtered out by our screen.

Alsea. de (BMV:ALSEA *)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Alsea, S.A.B. de C.V. operates restaurants across Latin America and Europe with a market cap of MX$38.98 billion.

Operations: The company generates revenue from its operations in Food and Beverages across Europe (MX$23.50 billion), Latin America (LATAM) (MX$13.98 billion), and Mexico, including distribution and production activities (MX$43.67 billion).

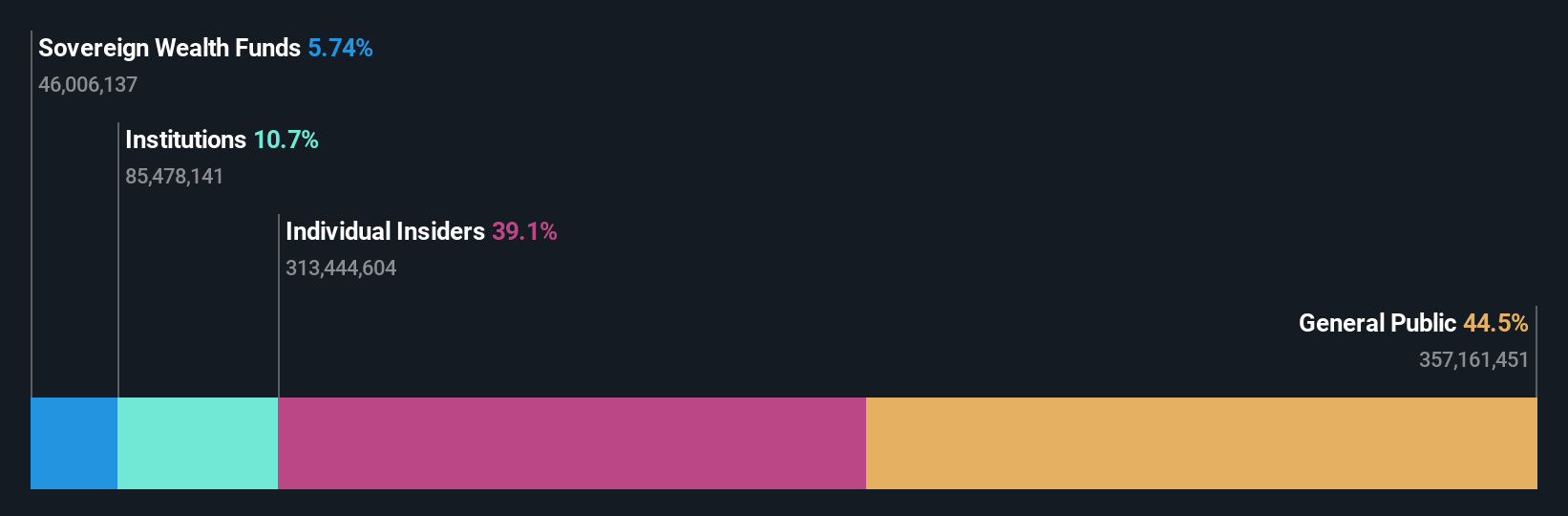

Insider Ownership: 38.9%

Alsea, S.A.B. de C.V., a leading restaurant operator, is poised for significant growth with earnings forecasted to rise 49.6% annually, outpacing the MX market's 11.2%. Despite lower profit margins compared to last year and debt concerns, Alsea's strategic alliance with Chipotle for expansion in Mexico highlights its growth potential. The stock trades at a discount to estimated fair value and plans substantial store openings this year further bolster its growth outlook.

- Dive into the specifics of Alsea. de here with our thorough growth forecast report.

- According our valuation report, there's an indication that Alsea. de's share price might be on the expensive side.

ABL Bio (KOSDAQ:A298380)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ABL Bio Inc., a biotech research company with a market cap of ₩2.94 trillion, focuses on developing therapeutic drugs for immuno-oncology and neurodegenerative diseases.

Operations: The company's revenue is primarily derived from its biotechnology segment, specifically startups, amounting to ₩33.40 billion.

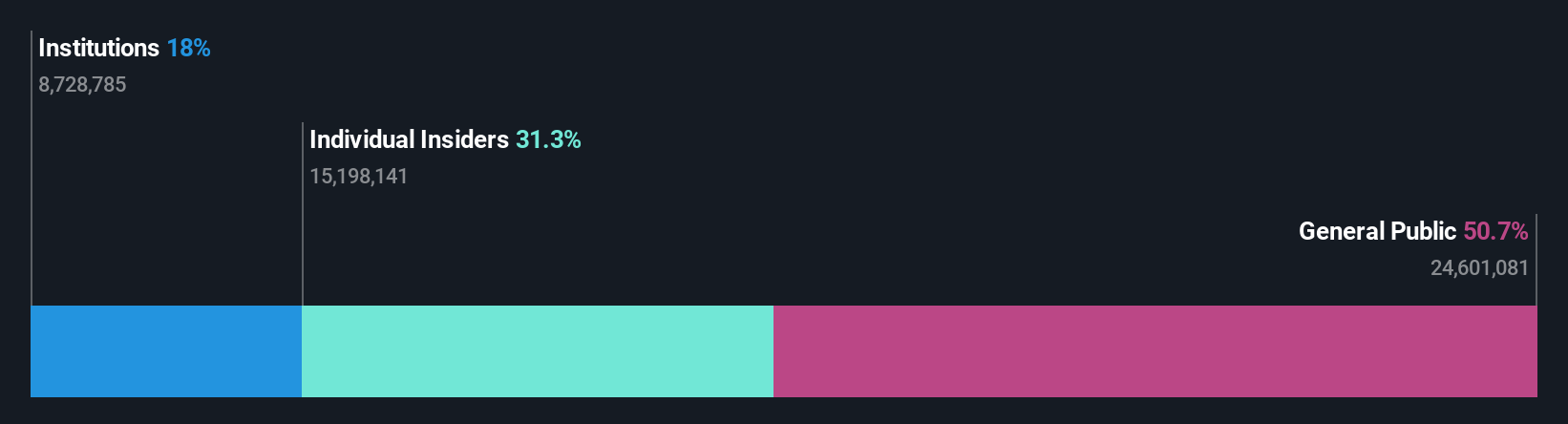

Insider Ownership: 29.9%

ABL Bio is positioned for growth with revenue expected to increase 21.7% annually, surpassing the KR market's 7.6%. Although its return on equity is forecasted to remain modest at 13.2%, the company anticipates becoming profitable within three years, exceeding average market growth rates. A recent licensing agreement with GSK could provide significant financial inflows, including up to £2.075 billion in milestone payments and royalties, enhancing its potential for future expansion in neurodegenerative disease treatments.

- Unlock comprehensive insights into our analysis of ABL Bio stock in this growth report.

- Upon reviewing our latest valuation report, ABL Bio's share price might be too optimistic.

China Ruyi Holdings (SEHK:136)

Simply Wall St Growth Rating: ★★★★★☆

Overview: China Ruyi Holdings Limited is an investment holding company involved in content production and online streaming across the People's Republic of China, Hong Kong, Europe, and internationally with a market cap of HK$31.97 billion.

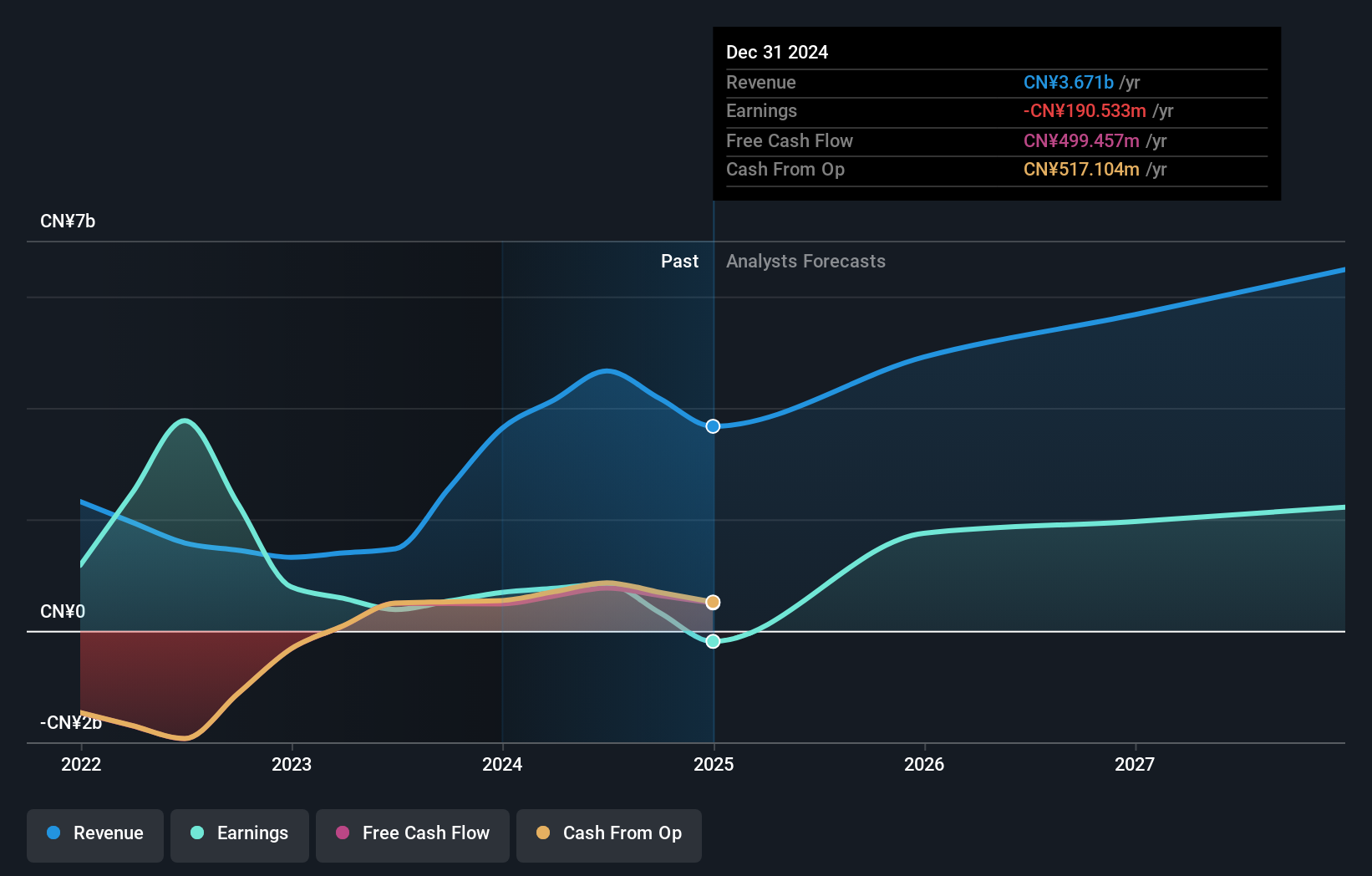

Operations: The company generates revenue primarily from its Content Production Business, which accounts for CN¥127.04 million, and its Online Streaming and Online Gaming Businesses, contributing CN¥3.51 billion.

Insider Ownership: 16.9%

China Ruyi Holdings is poised for significant growth, with revenue projected to rise 27.4% annually, outpacing the Hong Kong market's 8.4%. Despite a forecasted low return on equity of 10.7% in three years and recent shareholder dilution, the company is expected to become profitable within this period. Recent financial activities include a HK$2.341 billion fixed-income offering and plans for convertible bonds issuance, which may support its expansion efforts despite past net losses due to warrant-related adjustments.

- Navigate through the intricacies of China Ruyi Holdings with our comprehensive analyst estimates report here.

- In light of our recent valuation report, it seems possible that China Ruyi Holdings is trading beyond its estimated value.

Taking Advantage

- Dive into all 842 of the Fast Growing Global Companies With High Insider Ownership we have identified here.

- Curious About Other Options? This technology could replace computers: discover the 22 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BMV:ALSEA *

High growth potential with questionable track record.

Similar Companies

Market Insights

Community Narratives