Fufeng Group's (HKG:546) Dividend Will Be Increased To HK$0.098

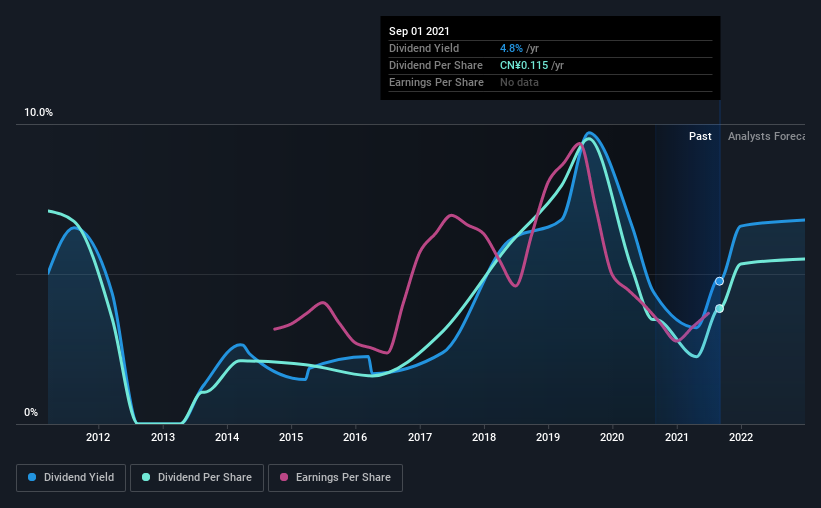

The board of Fufeng Group Limited (HKG:546) has announced that it will be increasing its dividend on the 30th of September to HK$0.098. This makes the dividend yield 4.8%, which is above the industry average.

View our latest analysis for Fufeng Group

Fufeng Group's Payment Has Solid Earnings Coverage

A big dividend yield for a few years doesn't mean much if it can't be sustained. Prior to this announcement, Fufeng Group's earnings easily covered the dividend, but free cash flows were negative. In general, we consider cash flow to be more important than earnings, so we would be cautious about relying on the sustainability of this dividend.

Looking forward, earnings per share is forecast to rise by 44.4% over the next year. Assuming the dividend continues along recent trends, we think the payout ratio could be 33% by next year, which is in a pretty sustainable range.

Dividend Volatility

While the company has been paying a dividend for a long time, it has cut the dividend at least once in the last 10 years. The dividend has gone from CN¥0.21 in 2011 to the most recent annual payment of CN¥0.12. This works out to be a decline of approximately 5.9% per year over that time. Declining dividends isn't generally what we look for as they can indicate that the company is running into some challenges.

Fufeng Group Could Grow Its Dividend

Dividends have been going in the wrong direction, so we definitely want to see a different trend in the earnings per share. Fufeng Group has seen EPS rising for the last five years, at 9.3% per annum. With a decent amount of growth and a low payout ratio, we think this bodes well for Fufeng Group's prospects of growing its dividend payments in the future.

In Summary

In summary, while it's always good to see the dividend being raised, we don't think Fufeng Group's payments are rock solid. With cash flows lacking, it is difficult to see how the company can sustain a dividend payment. We don't think Fufeng Group is a great stock to add to your portfolio if income is your focus.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For instance, we've picked out 1 warning sign for Fufeng Group that investors should take into consideration. If you are a dividend investor, you might also want to look at our curated list of high performing dividend stock.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:546

Fufeng Group

An investment holding company, engages in the manufacture and sale of fermentation-based food additives, and biochemical and starch-based products in the People’s Republic of China and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026