In the current global market landscape, investors are navigating a complex environment marked by cautious Federal Reserve commentary and political uncertainties, such as looming government shutdowns. Despite these challenges, strong economic data in the U.S., including robust GDP growth and retail sales figures, offer a glimmer of optimism amidst broader market declines. In such conditions, identifying stocks that may be trading below their estimated value can present opportunities for investors seeking to capitalize on potential undervaluation.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Argan (NYSE:AGX) | US$140.28 | US$279.10 | 49.7% |

| HangzhouS MedTech (SHSE:688581) | CN¥62.17 | CN¥124.03 | 49.9% |

| Shenzhen Lifotronic Technology (SHSE:688389) | CN¥15.43 | CN¥30.82 | 49.9% |

| Lindab International (OM:LIAB) | SEK226.40 | SEK451.11 | 49.8% |

| GlobalData (AIM:DATA) | £1.87 | £3.74 | 50% |

| Absolent Air Care Group (OM:ABSO) | SEK255.00 | SEK509.90 | 50% |

| HealthEquity (NasdaqGS:HQY) | US$95.09 | US$189.22 | 49.7% |

| GRCS (TSE:9250) | ¥1413.00 | ¥2824.56 | 50% |

| Surgical Science Sweden (OM:SUS) | SEK159.10 | SEK317.61 | 49.9% |

| RENK Group (DB:R3NK) | €18.342 | €36.50 | 49.7% |

Let's dive into some prime choices out of the screener.

United Company RUSAL International (SEHK:486)

Overview: United Company RUSAL International Public Joint-Stock Company is involved in the production and trading of aluminum and related products in Russia, with a market cap of HK$48.41 billion.

Operations: The company generates revenue from its alumina segment amounting to $4.49 billion and its aluminium segment contributing $10.48 billion.

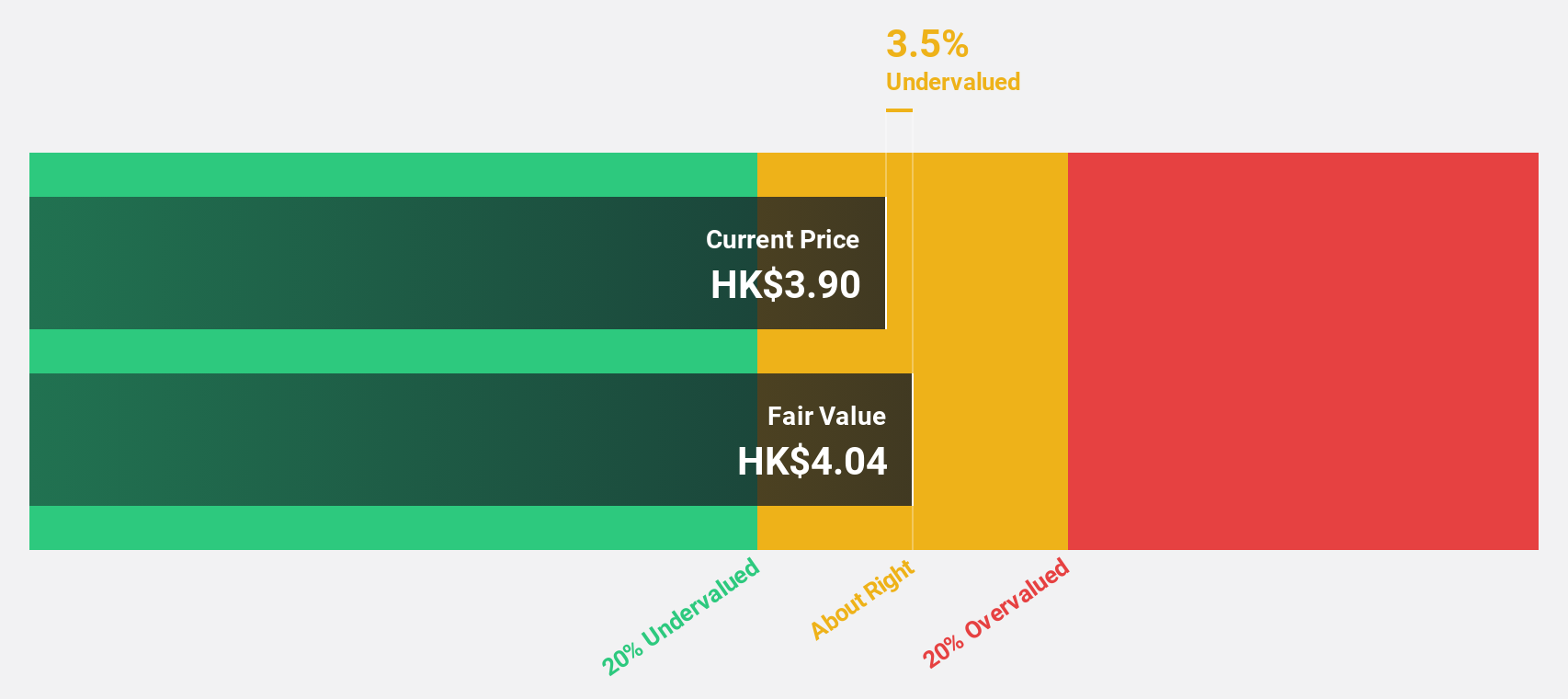

Estimated Discount To Fair Value: 34.4%

United Company RUSAL International is trading at 34.4% below its estimated fair value of HK$4.88, making it highly undervalued based on discounted cash flow analysis. Despite this, the company's debt coverage by operating cash flow is inadequate, posing a financial risk. Recent announcements include a potential share buyback program worth up to HK$15 billion, which could impact shareholder value positively if executed effectively. Earnings are forecasted to grow significantly faster than the Hong Kong market average.

- Insights from our recent growth report point to a promising forecast for United Company RUSAL International's business outlook.

- Click here to discover the nuances of United Company RUSAL International with our detailed financial health report.

Ficont Industry (Beijing) (SHSE:605305)

Overview: Ficont Industry (Beijing) Co., Ltd. manufactures and supplies wind turbine tower internals and safety systems for wind turbine manufacturers in China and internationally, with a market cap of CN¥5.93 billion.

Operations: The company's revenue from the Construction Machinery & Equipment segment is CN¥1.34 billion.

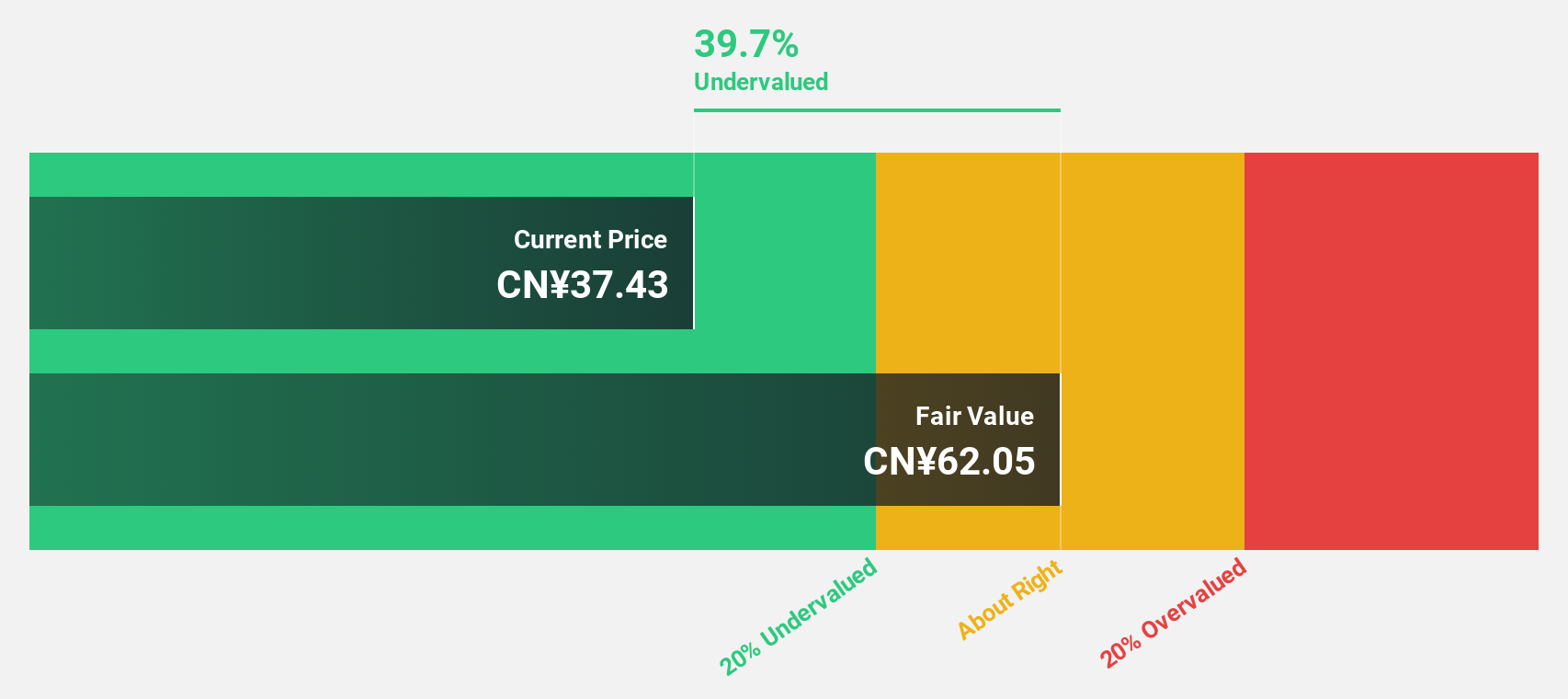

Estimated Discount To Fair Value: 47.4%

Ficont Industry (Beijing) Co., Ltd. is trading at 47.4% below its estimated fair value of CNY 56.16, highlighting its undervaluation based on discounted cash flow analysis. The company reported a substantial earnings increase of CNY 238.29 million for the first nine months of 2024, doubling from the previous year, though it has an unstable dividend track record. Revenue growth is expected to outpace the Chinese market significantly, despite slightly lagging in profit growth forecasts.

- Our comprehensive growth report raises the possibility that Ficont Industry (Beijing) is poised for substantial financial growth.

- Get an in-depth perspective on Ficont Industry (Beijing)'s balance sheet by reading our health report here.

China Resources Boya Bio-pharmaceutical GroupLtd (SZSE:300294)

Overview: China Resources Boya Bio-pharmaceutical Group Co., Ltd operates in the blood product industry in China and has a market capitalization of approximately CN¥15.40 billion.

Operations: The company generates revenue through its blood product businesses in China.

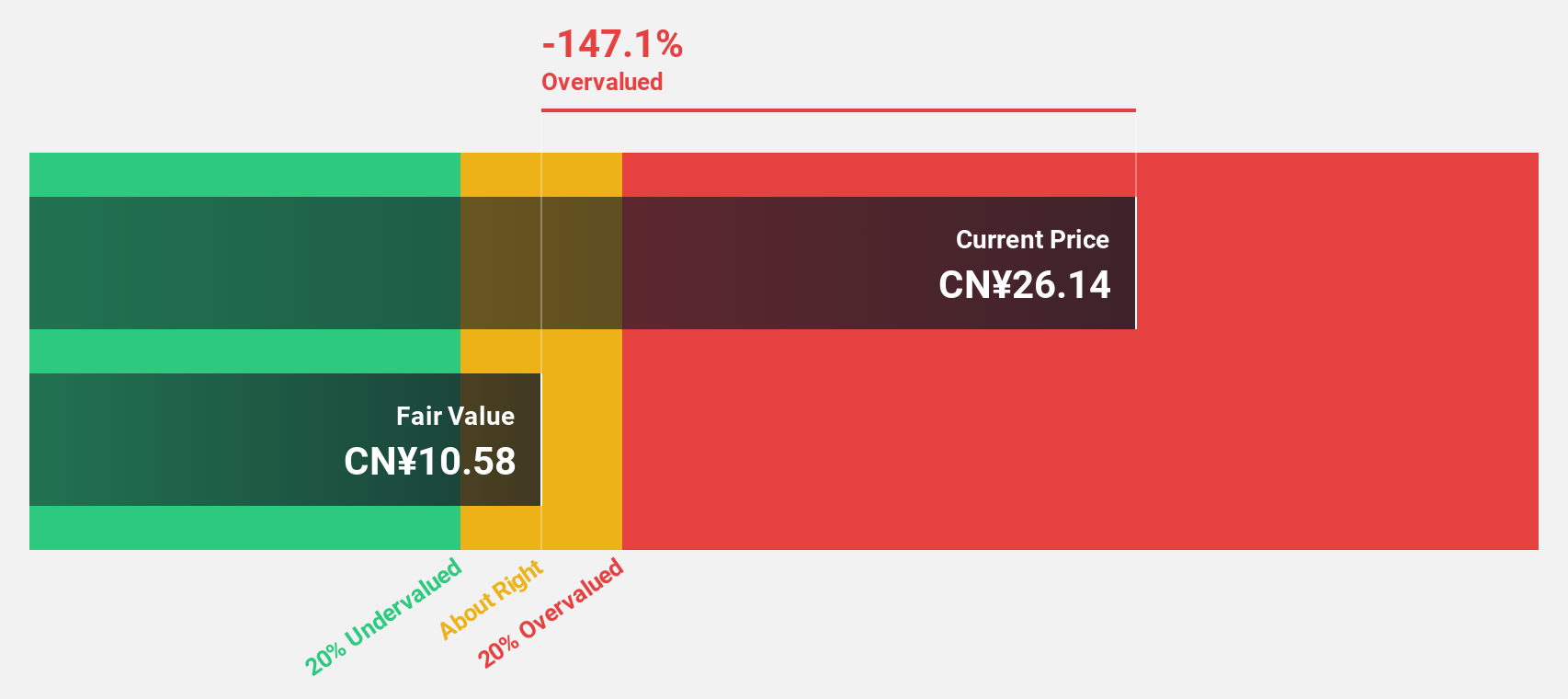

Estimated Discount To Fair Value: 29.1%

China Resources Boya Bio-pharmaceutical Group Ltd. is trading 29.1% below its estimated fair value of CNY 43.71, indicating a potential undervaluation based on cash flows. Despite a decline in net income to CNY 412.7 million for the first nine months of 2024, earnings are forecasted to grow significantly at over 44% annually, though profit margins have decreased from last year and one-off items impact financial results.

- Our earnings growth report unveils the potential for significant increases in China Resources Boya Bio-pharmaceutical GroupLtd's future results.

- Take a closer look at China Resources Boya Bio-pharmaceutical GroupLtd's balance sheet health here in our report.

Key Takeaways

- Unlock our comprehensive list of 872 Undervalued Stocks Based On Cash Flows by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:605305

Ficont Industry (Beijing)

Engages in the manufacture and supply of wind turbine tower internals and safety systems for wind turbine manufactures in China and internationally.

Flawless balance sheet and undervalued.