Amidst a backdrop of cautious Federal Reserve commentary and looming political uncertainties, global markets have experienced notable fluctuations, with U.S. stocks seeing broad-based declines despite some recovery towards the week's end. In such an environment, investors often look to growth companies with high insider ownership as potential opportunities, as these firms may benefit from aligned interests between management and shareholders, offering resilience in volatile market conditions.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Propel Holdings (TSX:PRL) | 23.9% | 37.6% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| On Holding (NYSE:ONON) | 19.1% | 29.4% |

| Pharma Mar (BME:PHM) | 11.8% | 56.2% |

| CD Projekt (WSE:CDR) | 29.7% | 27% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.4% | 66.3% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 111.4% |

Let's uncover some gems from our specialized screener.

Yijiahe Technology (SHSE:603666)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Yijiahe Technology Co., Ltd. focuses on the research, development, design, and sale of intelligent robots in China with a market capitalization of approximately CN¥5.01 billion.

Operations: Yijiahe Technology Co., Ltd. generates revenue primarily through the research, development, design, and sale of intelligent robots in China.

Insider Ownership: 28.2%

Earnings Growth Forecast: 71.6% p.a.

Yijiahe Technology is experiencing rapid revenue growth, forecasted at 33.8% annually, outpacing the broader CN market. Despite a volatile share price and low future return on equity projections (7.6%), it is expected to become profitable within three years. Recent transactions include a CNY 170 million acquisition of a 5.90% stake by investment funds, signaling confidence from institutional investors despite its removal from the S&P Global BMI Index on December 23, 2024.

- Dive into the specifics of Yijiahe Technology here with our thorough growth forecast report.

- Our expertly prepared valuation report Yijiahe Technology implies its share price may be too high.

Baowu Magnesium Technology (SZSE:002182)

Simply Wall St Growth Rating: ★★★★★☆

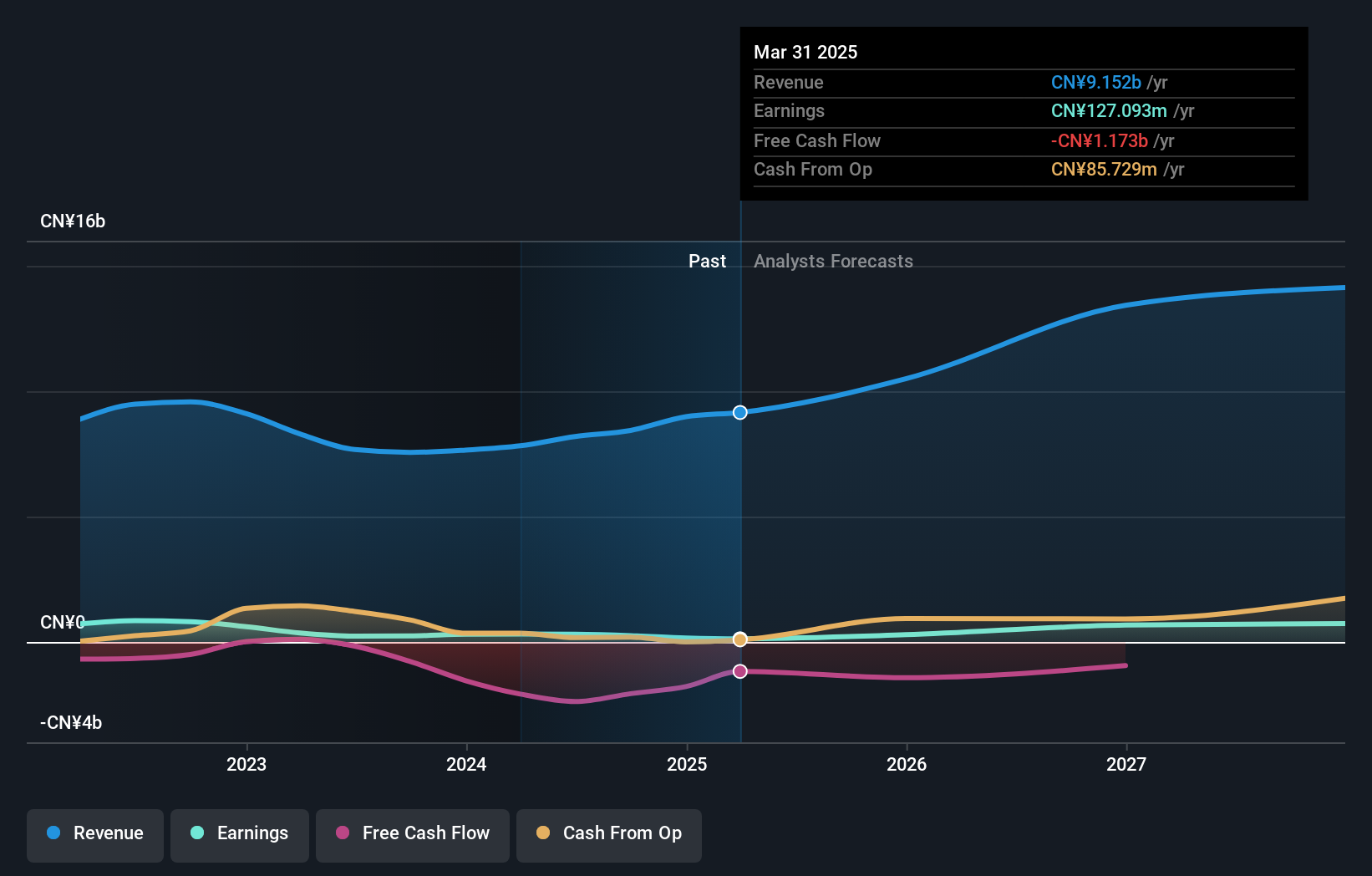

Overview: Baowu Magnesium Technology Co., Ltd. operates in mining and non-ferrous metal smelting and processing both in China and internationally, with a market cap of CN¥11.38 billion.

Operations: The company generates revenue primarily from its Non-Ferrous Metal Smelting and Rolling processing segment, amounting to CN¥8.15 billion.

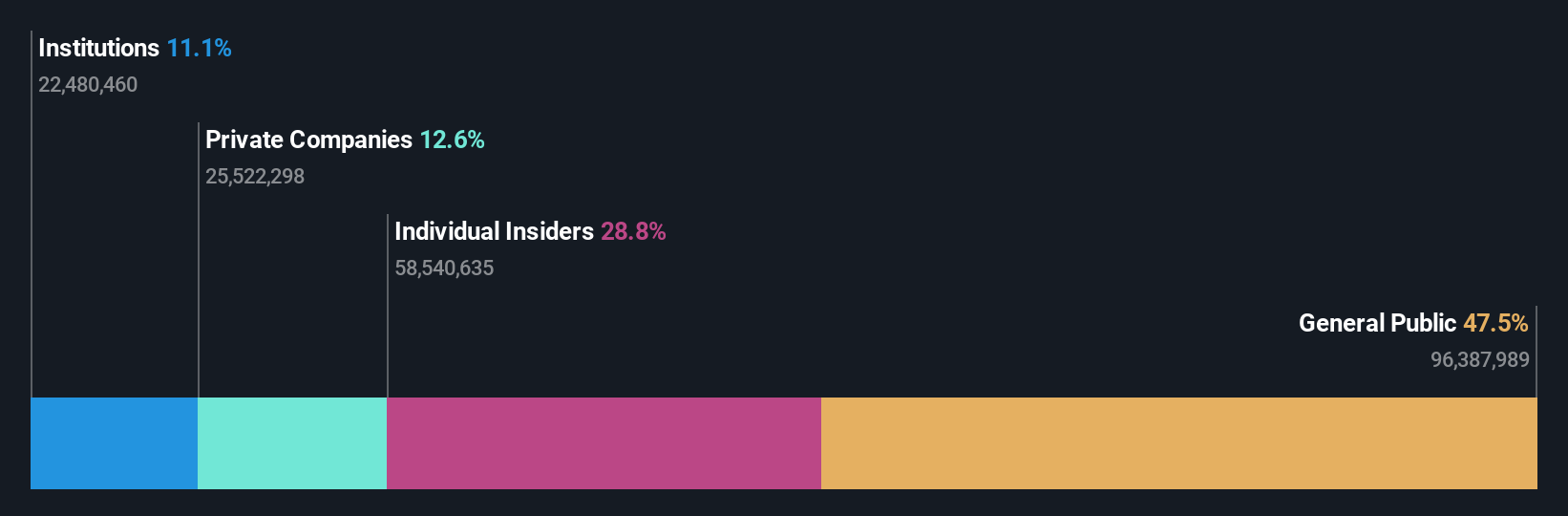

Insider Ownership: 17%

Earnings Growth Forecast: 61.5% p.a.

Baowu Magnesium Technology is poised for significant growth, with revenue expected to rise by 25.2% annually, surpassing the broader CN market. Despite a decline in net income to CNY 153.76 million over nine months ending September 2024, earnings are forecasted to grow at an impressive rate of 61.5% per year. Insider ownership remains stable with no recent trading activity reported, and financial challenges persist as debt coverage by operating cash flow is inadequate.

- Click here and access our complete growth analysis report to understand the dynamics of Baowu Magnesium Technology.

- The analysis detailed in our Baowu Magnesium Technology valuation report hints at an inflated share price compared to its estimated value.

Jiangsu Azure (SZSE:002245)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Jiangsu Azure Corporation operates in the lithium batteries, LED chips, and metal logistics and distribution sectors both in China and internationally, with a market cap of CN¥11.64 billion.

Operations: The company's revenue segments include lithium batteries, LED chips, and metal logistics and distribution.

Insider Ownership: 15.1%

Earnings Growth Forecast: 31.8% p.a.

Jiangsu Azure has demonstrated substantial growth, with earnings increasing by 310.6% over the past year and revenue rising to CNY 4.84 billion for the nine months ending September 2024. Earnings are forecasted to grow at a significant rate of 31.8% annually, outpacing the broader CN market's expectations. Despite this growth trajectory, insider trading activity remains minimal, and future return on equity is projected to be modest at 8.8%.

- Navigate through the intricacies of Jiangsu Azure with our comprehensive analyst estimates report here.

- The valuation report we've compiled suggests that Jiangsu Azure's current price could be inflated.

Seize The Opportunity

- Embark on your investment journey to our 1514 Fast Growing Companies With High Insider Ownership selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002245

Jiangsu Azure

Engages in lithium batteries, LED chips, and metal logistics and distribution businesses in China and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives