- China

- /

- Renewable Energy

- /

- SHSE:601619

3 Promising Penny Stocks With Market Caps Below US$2B

Reviewed by Simply Wall St

Global markets have experienced a turbulent week, with U.S. stocks declining amid cautious Federal Reserve commentary and political uncertainties, while economic data showed mixed signals of growth and inflation pressures. For investors seeking opportunities beyond the established giants, penny stocks—though an outdated term—remain a relevant investment area for those interested in smaller or newer companies. By focusing on those with solid financial foundations and potential for growth, investors can uncover promising opportunities among these lesser-known equities.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.49B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.415 | MYR1.17B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.07 | £779.9M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.14 | HK$45.48B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.94 | £148.28M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.55 | £67.7M | ★★★★☆☆ |

Click here to see the full list of 5,841 stocks from our Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Archosaur Games (SEHK:9990)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Archosaur Games Inc. is an investment holding company that develops and operates mobile games in Mainland China and internationally, with a market cap of approximately HK$995.48 million.

Operations: The company's revenue is primarily generated from its Computer Graphics segment, amounting to CN¥945.67 million.

Market Cap: HK$995.48M

Archosaur Games, with a market cap of approximately HK$995.48 million, is trading at a good value compared to peers and the industry. Despite being unprofitable and experiencing increased losses over the past five years, it has no debt and its short-term assets significantly exceed both short- and long-term liabilities. The company holds sufficient cash runway for over three years even if free cash flow reduces at historical rates. Revenue is forecasted to grow 26.35% annually, although profitability isn't expected in the next three years. Its experienced board and management team add stability amidst high volatility levels.

- Navigate through the intricacies of Archosaur Games with our comprehensive balance sheet health report here.

- Understand Archosaur Games' earnings outlook by examining our growth report.

Jiaze Renewables (SHSE:601619)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Jiaze Renewables Corporation Limited is involved in the development, construction, sale, operation, and maintenance of new energy projects, with a market cap of CN¥8.01 billion.

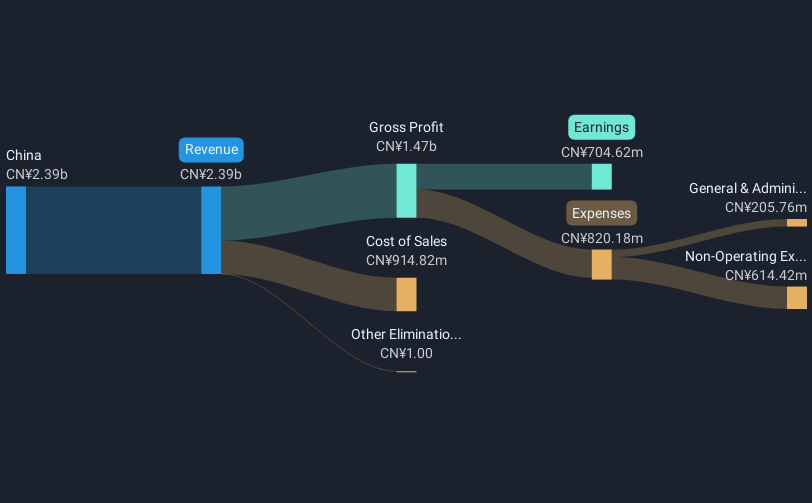

Operations: The company generates its revenue of CN¥2.39 billion primarily from operations within China.

Market Cap: CN¥8.01B

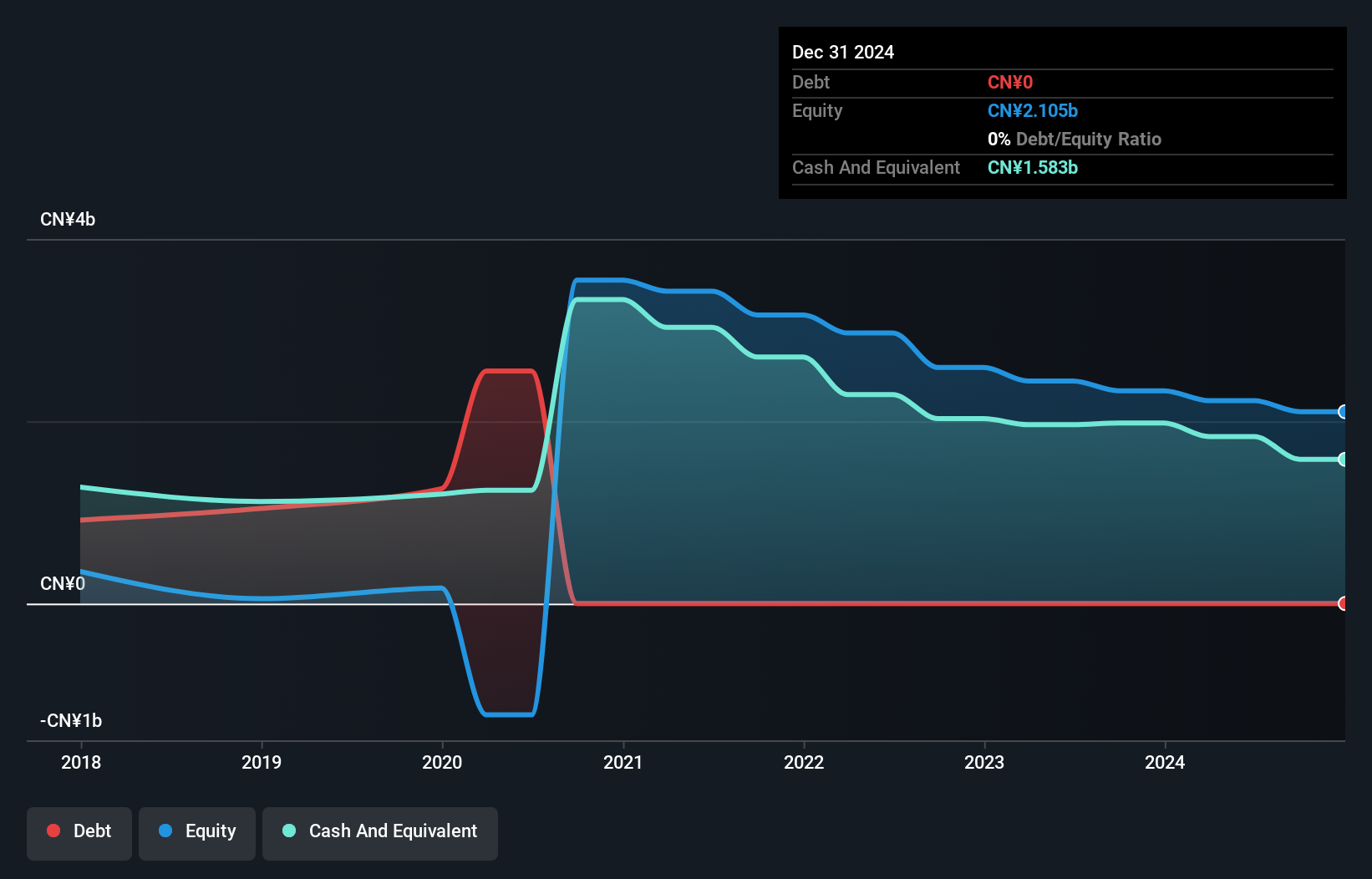

Jiaze Renewables, with a market cap of CN¥8.01 billion, shows a mixed financial profile. While its revenue for the first nine months of 2024 was CN¥1.82 billion, net income declined from the previous year to CN¥550.76 million. The company maintains high-quality earnings but faces challenges with a high net debt to equity ratio of 78.6% and long-term liabilities exceeding short-term assets by a significant margin. However, interest payments are well-covered by EBIT at 9.2 times coverage, and operating cash flow adequately covers debt obligations at 28.1%. Recent private placement efforts may impact future shareholder dilution risks.

- Jump into the full analysis health report here for a deeper understanding of Jiaze Renewables.

- Explore historical data to track Jiaze Renewables' performance over time in our past results report.

Jinzi HamLtd (SZSE:002515)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Jinzi Ham Co., Ltd. is involved in the research, development, production, and sale of fermented meat products both in China and internationally, with a market cap of CN¥5.81 billion.

Operations: Revenue segments for the company are not reported.

Market Cap: CN¥5.81B

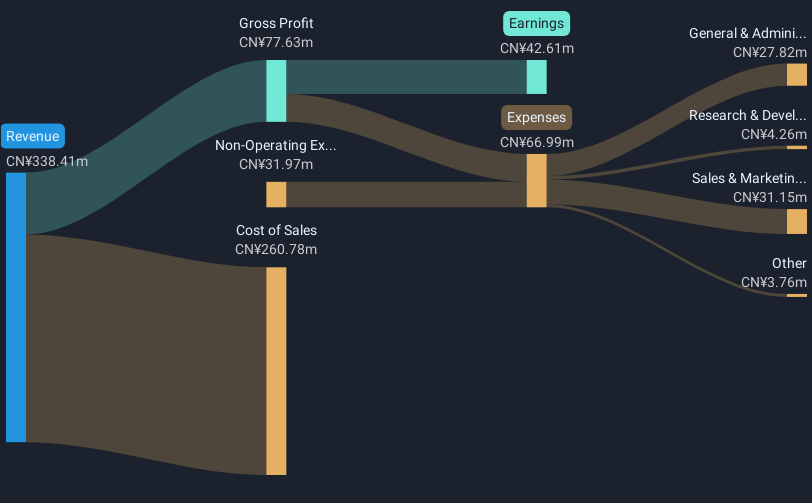

Jinzi Ham Co., Ltd., with a market cap of CN¥5.81 billion, has demonstrated improved financial performance over the past year, with net profit margins rising to 12.6% from 6.9%. The company's earnings growth of 79.8% surpasses both its historical average and the broader food industry trend, which saw a decline. Jinzi Ham benefits from high-quality earnings and remains debt-free, eliminating concerns about interest coverage or debt levels. Despite stable weekly volatility at 7%, its Return on Equity is low at 1.6%. Recent earnings reports show modest revenue growth to CN¥258.41 million for the first nine months of 2024 compared to last year’s figures.

- Unlock comprehensive insights into our analysis of Jinzi HamLtd stock in this financial health report.

- Assess Jinzi HamLtd's previous results with our detailed historical performance reports.

Turning Ideas Into Actions

- Gain an insight into the universe of 5,841 Penny Stocks by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601619

Jiaze Renewables

Engages in the development, construction, sale, operation, and maintenance of new energy projects.

Adequate balance sheet average dividend payer.