- China

- /

- Energy Services

- /

- SHSE:603800

Undiscovered Gems With Strong Fundamentals To Explore This December 2024

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by cautious Federal Reserve commentary and political uncertainties, smaller-cap indexes have experienced notable declines, reflecting investor apprehension. Amidst these fluctuations, the S&P 600 and other small-cap indices have struggled to maintain momentum, highlighting the importance of identifying stocks with robust fundamentals that can withstand broader market pressures. In this context, finding companies with strong balance sheets and sustainable growth potential becomes crucial for investors looking to explore undiscovered gems in December 2024.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Shipping Corporation of India | 25.17% | 7.01% | 13.70% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| BLS E-Services | NA | 5.87% | 46.48% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| KP Green Engineering | 51.37% | 120.79% | 51.32% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Jiangsu Hongtian TechnologyLtd (SHSE:603800)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Jiangsu Hongtian Technology Co., Ltd. specializes in the research, development, production, and sale of drilling and production equipment for oil, natural gas, and shale gas in China with a market cap of CN¥4.96 billion.

Operations: Jiangsu Hongtian generates revenue primarily through the sale of drilling and production equipment for oil, natural gas, and shale gas. The company's financial performance is highlighted by a notable trend in its gross profit margin.

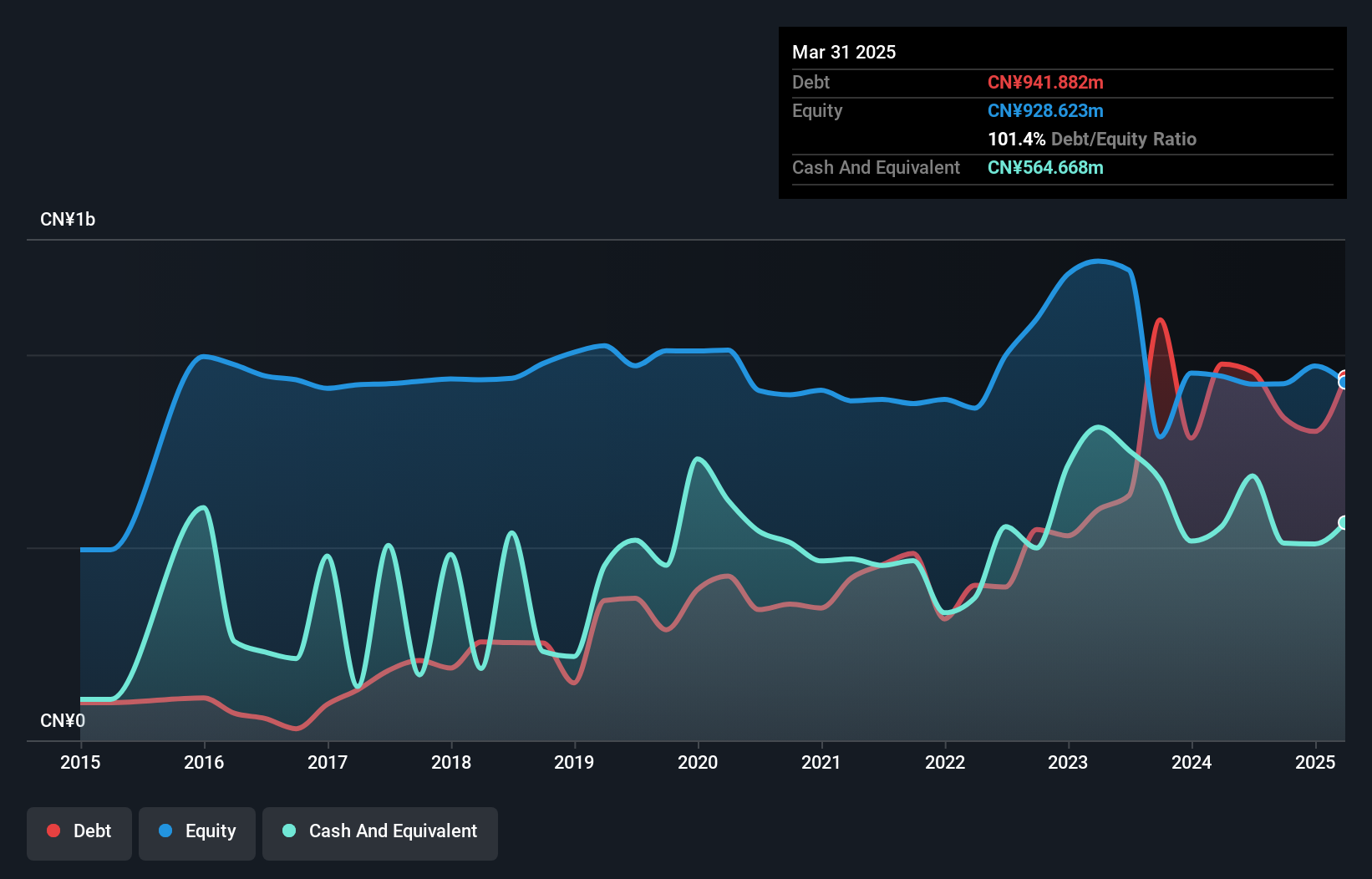

Jiangsu Hongtian Technology, a small cap player in the tech space, has shown impressive earnings growth of 120% over the past year, outpacing its industry peers. Despite a hefty one-off gain of CN¥81 million affecting recent results, its net income rose to CN¥85.14 million for the nine months ending September 2024. The company repurchased 1.87 million shares worth CN¥65.55 million this year, reflecting strategic capital management. However, its debt to equity ratio has climbed from 28% to 91% over five years, which may warrant attention despite being offset by a satisfactory net debt to equity ratio of 35%.

- Take a closer look at Jiangsu Hongtian TechnologyLtd's potential here in our health report.

Learn about Jiangsu Hongtian TechnologyLtd's historical performance.

MLS (SZSE:002745)

Simply Wall St Value Rating: ★★★★★★

Overview: MLS Co., Ltd. focuses on the research, development, production, and sale of LED package and application products with a market cap of CN¥12.76 billion.

Operations: MLS generates revenue primarily from the sale of LED package and application products. The company's financial performance includes a market cap of CN¥12.76 billion, reflecting its scale in the industry.

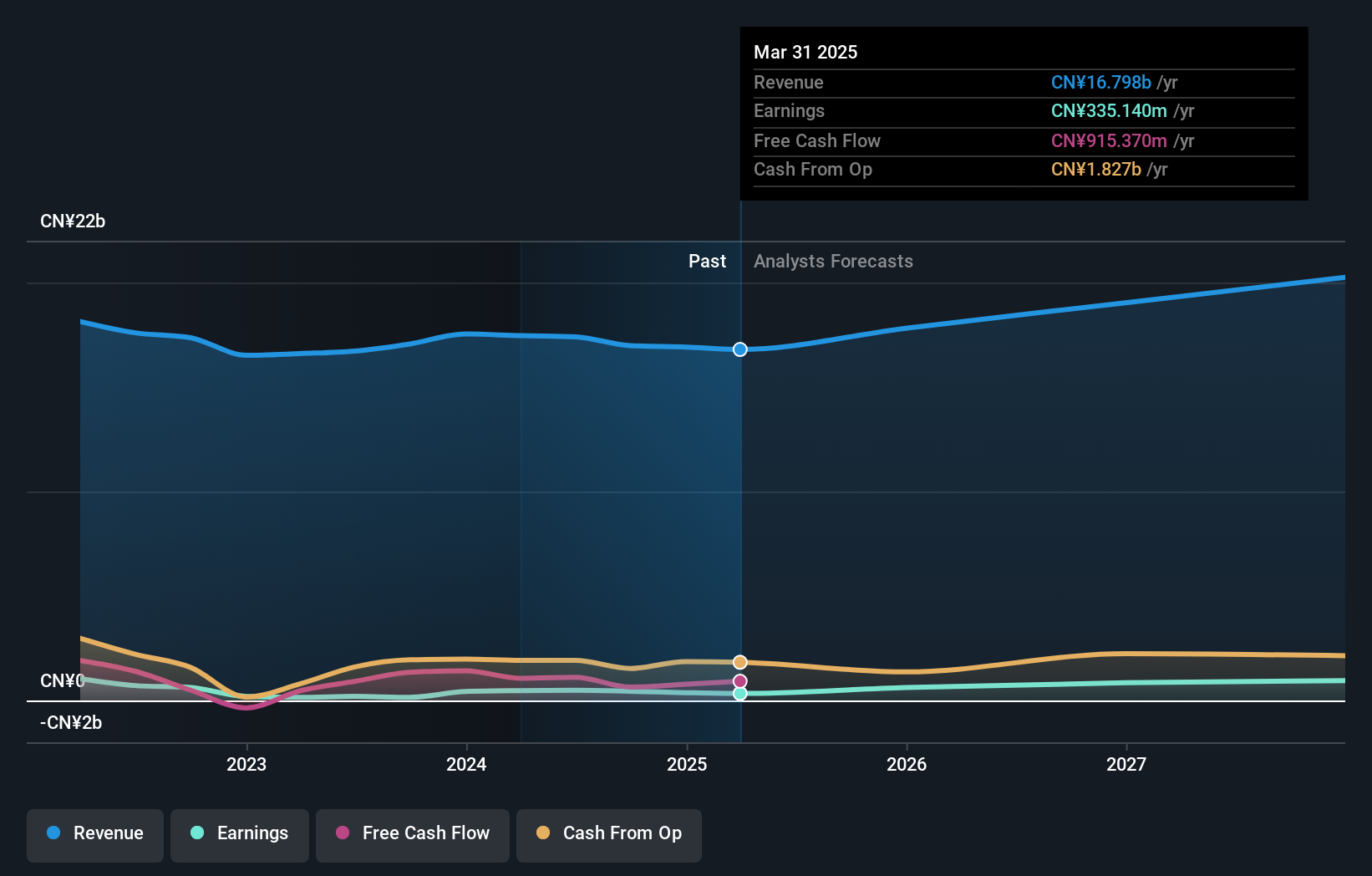

MLS Co., Ltd. shows promise with its earnings growing 194% over the past year, outpacing the Semiconductor industry’s 13%. Its price-to-earnings ratio of 29x is attractive compared to the CN market average of 36x. The company’s debt-to-equity ratio has impressively decreased from 104% to just 3% in five years, indicating strong financial management. Recent news highlights a cash dividend plan offering CNY 3.60 per share and net income rising slightly to CNY 363 million for nine months ending September, despite a dip in sales to CNY 12 billion from last year's CNY 13 billion.

- Navigate through the intricacies of MLS with our comprehensive health report here.

Explore historical data to track MLS' performance over time in our Past section.

Sakura DevelopmentLtd (TWSE:2539)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Sakura Development Co., Ltd specializes in the sale and lease of residential properties, primarily in the Zhongzhangtou area of Taiwan, with a market capitalization of NT$51.10 billion.

Operations: Sakura Development generates revenue through the sale and lease of residential properties in Taiwan, focusing on the Zhongzhangtou area. The company's market capitalization stands at NT$51.10 billion.

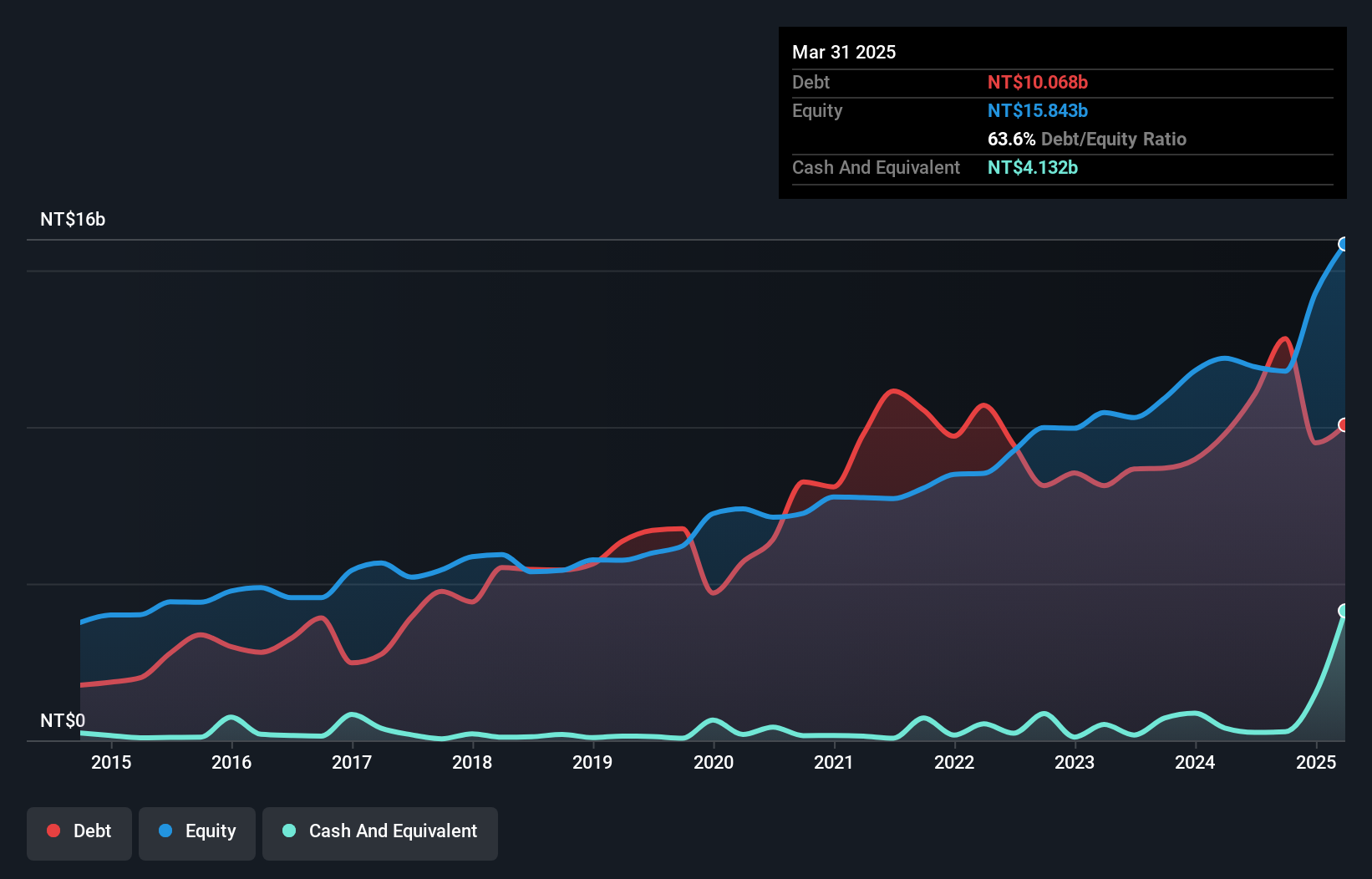

Sakura Development, a nimble player in the real estate sector, has experienced notable shifts recently. Over the past five years, earnings have grown 9.8% annually, though recent performance shows challenges with a net loss of TWD 139.92 million in Q3 2024 compared to a net income of TWD 592.77 million last year. The company’s debt-to-equity ratio slightly improved from 108.9% to 108.8%, yet remains high at a net debt to equity ratio of 106.5%. Recent expansions include acquiring land in Yuanlin City for TWD 510 million, reflecting strategic growth moves despite current financial hurdles.

- Click here and access our complete health analysis report to understand the dynamics of Sakura DevelopmentLtd.

Assess Sakura DevelopmentLtd's past performance with our detailed historical performance reports.

Next Steps

- Click this link to deep-dive into the 4625 companies within our Undiscovered Gems With Strong Fundamentals screener.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603800

Jiangsu Hongtian TechnologyLtd

Engages in the oil and gas electrical, and electrolytic copper foil equipment business in China.

Adequate balance sheet with low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion