- Hong Kong

- /

- Metals and Mining

- /

- SEHK:3993

CMOC Group (SEHK:3993): Assessing Valuation After a 22% Share Price Surge

Reviewed by Kshitija Bhandaru

CMOC Group (SEHK:3993) is in focus after a recent uptick that caught investors’ attention. Over the past month, the stock has gained 22%, prompting questions about the drivers behind this move and whether it reflects the company’s fundamentals.

See our latest analysis for CMOC Group.

CMOC Group has seen significant momentum this year, with a remarkable 22.15% 1-month share price return building on a year-to-date surge of 199.24%. Investors seem to be growing more optimistic, especially as the company’s 1-year total shareholder return stands at 131.59%. This puts its longer-term track record in the spotlight.

If this level of outperformance has you wondering what else is catching investors’ attention, now is a perfect time to expand your search and explore fast growing stocks with high insider ownership

With such a rapid surge in price, is CMOC Group now trading at a bargain relative to its potential, or has the market already factored in all of its expected growth?

Price-to-Earnings of 18.4x: Is it justified?

CMOC Group is trading at a price-to-earnings (P/E) ratio of 18.4x, placing it slightly above both the Hong Kong Metals and Mining industry average of 17.8x and its own fair P/E ratio estimate of 18.3x. At the current close of HK$15.77, the stock appears to be priced at a premium.

The P/E ratio measures how much investors are willing to pay for each dollar of earnings. It is a key metric for comparing companies within sectors like metals and mining, where earnings performance is closely watched. In this case, the market seems to be expecting continued earnings strength from CMOC Group, but those expectations are higher than both industry peers and what our fair ratio model suggests could be appropriate.

Relative to the industry, CMOC Group’s P/E ratio reflects a more optimistic outlook than most of its peers. However, when compared to the fair ratio of 18.3x, the premium investors are paying is only marginal. This could signal the potential for the stock to normalize if sentiment cools.

Explore the SWS fair ratio for CMOC Group

Result: Price-to-Earnings of 18.4x (OVERVALUED)

However, rising optimism faces risks from slower annual revenue growth and the stock's current discount to analyst price targets. These factors could temper further gains.

Find out about the key risks to this CMOC Group narrative.

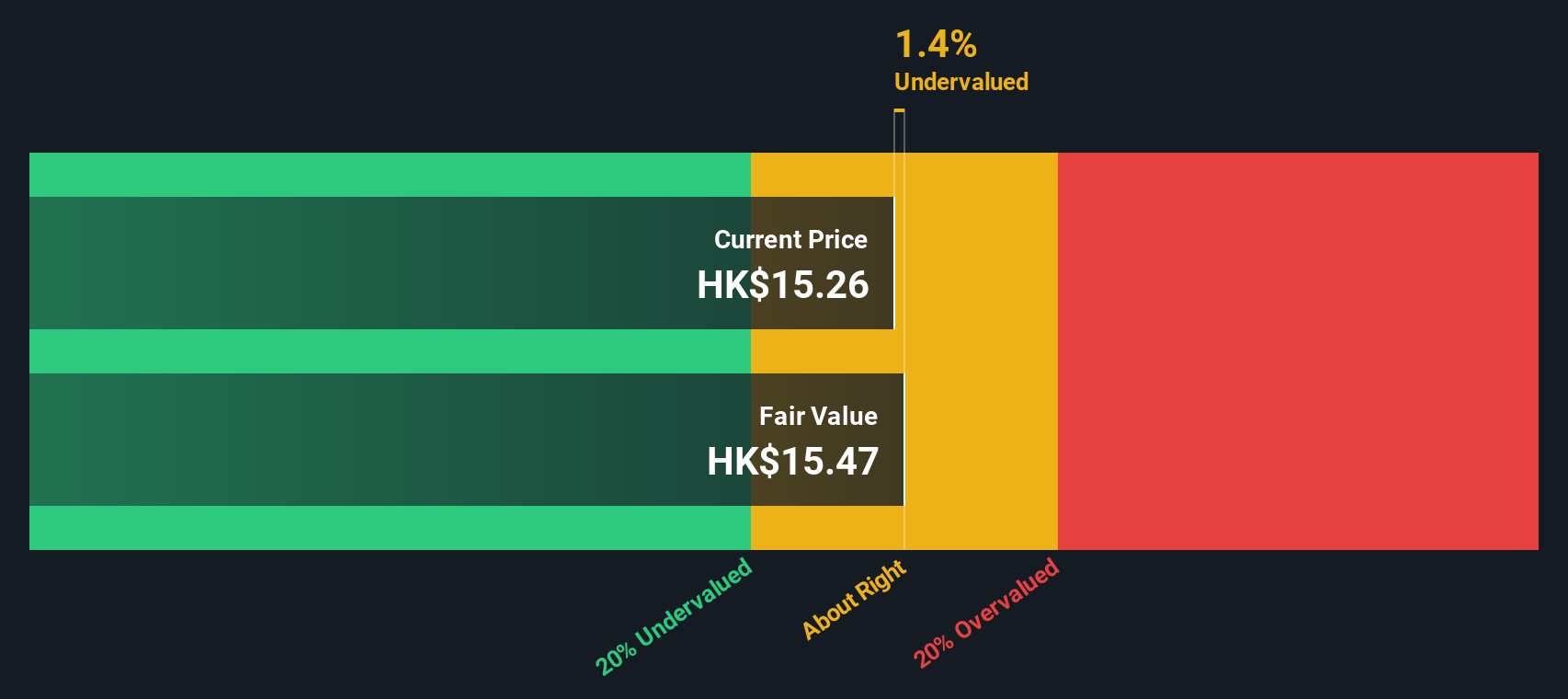

Another View: SWS DCF Model Suggests Undervaluation

Looking beyond earnings multiples, our SWS DCF model offers a different outlook. It estimates that CMOC Group is trading about 9.4% below its fair value. This suggests the market may actually be underpricing the company at current levels. Could the recent surge be just the beginning?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out CMOC Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own CMOC Group Narrative

If you have a different perspective or prefer hands-on analysis, you can quickly build your own view in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding CMOC Group.

Looking for more investment ideas?

Great investing is about never settling for just one opportunity. Take the next step on your wealth-building journey and seize your edge with these exciting stock ideas:

- Earn passive income and enjoy financial resilience by adding to your income stream from these 18 dividend stocks with yields > 3% with attractive yields above 3%.

- Embrace the future of healthcare by targeting innovation with these 33 healthcare AI stocks at the intersection of artificial intelligence and medicine.

- Capitalize on the fast-moving market by securing positions in these 877 undervalued stocks based on cash flows, which are primed for growth based on healthy cash flows and current pricing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3993

CMOC Group

Engages in the mining, beneficiation, smelting, and refining of base and rare metals.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Cheap if able to sustain revenue, and a potential bargain if able to turn store openings into revenue growth

Butler National (Buks) outperforms.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)