- Hong Kong

- /

- Paper and Forestry Products

- /

- SEHK:2689

A Piece Of The Puzzle Missing From Nine Dragons Paper (Holdings) Limited's (HKG:2689) 27% Share Price Climb

Nine Dragons Paper (Holdings) Limited (HKG:2689) shareholders have had their patience rewarded with a 27% share price jump in the last month. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 18% in the last twelve months.

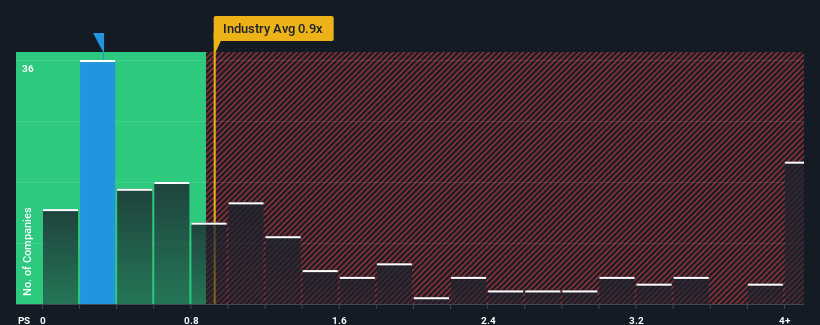

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Nine Dragons Paper (Holdings)'s P/S ratio of 0.3x, since the median price-to-sales (or "P/S") ratio for the Forestry industry in Hong Kong is also close to 0.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Nine Dragons Paper (Holdings)

How Has Nine Dragons Paper (Holdings) Performed Recently?

Nine Dragons Paper (Holdings) has been doing a reasonable job lately as its revenue hasn't declined as much as most other companies. One possibility is that the P/S ratio is moderate because investors think this relatively better revenue performance might be about to evaporate. You'd much rather the company continue improving its revenue if you still believe in the business. In saying that, existing shareholders probably aren't too pessimistic about the share price if the company's revenue continues outplaying the industry.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Nine Dragons Paper (Holdings).Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Nine Dragons Paper (Holdings)'s is when the company's growth is tracking the industry closely.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 8.3%. Regardless, revenue has managed to lift by a handy 5.2% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Looking ahead now, revenue is anticipated to climb by 20% during the coming year according to the analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 11%, which is noticeably less attractive.

With this in consideration, we find it intriguing that Nine Dragons Paper (Holdings)'s P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Bottom Line On Nine Dragons Paper (Holdings)'s P/S

Its shares have lifted substantially and now Nine Dragons Paper (Holdings)'s P/S is back within range of the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Nine Dragons Paper (Holdings) currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

It is also worth noting that we have found 1 warning sign for Nine Dragons Paper (Holdings) that you need to take into consideration.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Nine Dragons Paper (Holdings) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2689

Nine Dragons Paper (Holdings)

Manufactures and sells packaging paper, printing and writing paper, and specialty paper products and pulp in the People’s Republic of China.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026