Zhou Hei Ya International Holdings Company Limited's (HKG:1458) CEO Compensation Is Looking A Bit Stretched At The Moment

Key Insights

- Zhou Hei Ya International Holdings to hold its Annual General Meeting on 30th of May

- CEO Yuchen Zhang's total compensation includes salary of CN¥4.62m

- Total compensation is 55% above industry average

- Over the past three years, Zhou Hei Ya International Holdings' EPS fell by 7.5% and over the past three years, the total loss to shareholders 80%

Shareholders of Zhou Hei Ya International Holdings Company Limited (HKG:1458) will have been dismayed by the negative share price return over the last three years. Per share earnings growth is also lacking, despite revenue growth. In light of this performance, shareholders will have a chance to question the board in the upcoming AGM on 30th of May, where they can impact on future company performance by voting on resolutions, including executive compensation. Here's our take on why we think shareholders might be hesitant about approving a raise at the moment.

View our latest analysis for Zhou Hei Ya International Holdings

Comparing Zhou Hei Ya International Holdings Company Limited's CEO Compensation With The Industry

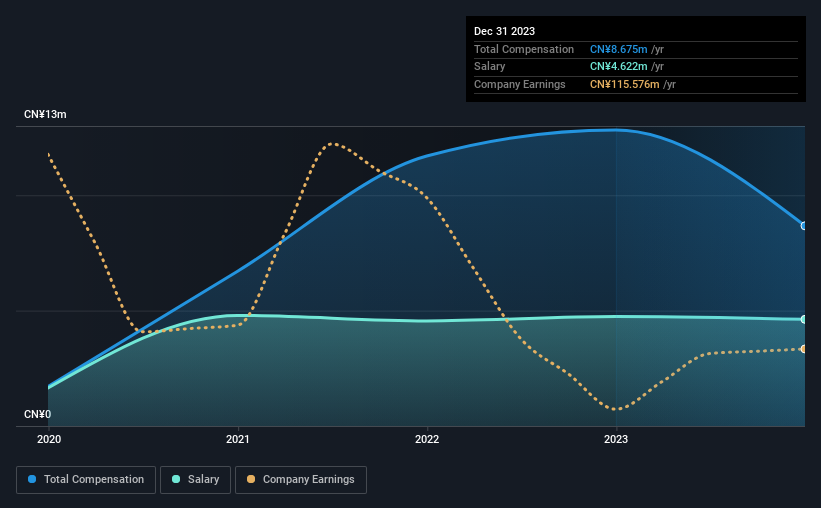

At the time of writing, our data shows that Zhou Hei Ya International Holdings Company Limited has a market capitalization of HK$4.3b, and reported total annual CEO compensation of CN¥8.7m for the year to December 2023. Notably, that's a decrease of 32% over the year before. We note that the salary of CN¥4.62m makes up a sizeable portion of the total compensation received by the CEO.

On comparing similar companies from the Hong Kong Food industry with market caps ranging from HK$1.6b to HK$6.2b, we found that the median CEO total compensation was CN¥5.6m. Accordingly, our analysis reveals that Zhou Hei Ya International Holdings Company Limited pays Yuchen Zhang north of the industry median. Moreover, Yuchen Zhang also holds HK$468k worth of Zhou Hei Ya International Holdings stock directly under their own name.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | CN¥4.6m | CN¥4.7m | 53% |

| Other | CN¥4.1m | CN¥8.1m | 47% |

| Total Compensation | CN¥8.7m | CN¥13m | 100% |

On an industry level, roughly 74% of total compensation represents salary and 26% is other remuneration. It's interesting to note that Zhou Hei Ya International Holdings allocates a smaller portion of compensation to salary in comparison to the broader industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Zhou Hei Ya International Holdings Company Limited's Growth Numbers

Over the last three years, Zhou Hei Ya International Holdings Company Limited has shrunk its earnings per share by 7.5% per year. Its revenue is up 17% over the last year.

Investors would be a bit wary of companies that have lower EPS But in contrast the revenue growth is strong, suggesting future potential for EPS growth. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Zhou Hei Ya International Holdings Company Limited Been A Good Investment?

With a total shareholder return of -80% over three years, Zhou Hei Ya International Holdings Company Limited shareholders would by and large be disappointed. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

The loss to shareholders over the past three years is certainly concerning and possibly has something to do with the fact that the company's earnings haven't grown. The upcoming AGM will provide shareholders the opportunity to revisit the company’s remuneration policies and evaluate if the board’s judgement and decision-making is aligned with that of the company’s shareholders.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 1 warning sign for Zhou Hei Ya International Holdings that investors should think about before committing capital to this stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

Valuation is complex, but we're here to simplify it.

Discover if Zhou Hei Ya International Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1458

Zhou Hei Ya International Holdings

An investment holding company, produces, markets, and retails casual braised food in the People’s Republic of China.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives