- Hong Kong

- /

- Oil and Gas

- /

- SEHK:866

Shareholders Will Probably Hold Off On Increasing China Qinfa Group Limited's (HKG:866) CEO Compensation For The Time Being

Key Insights

- China Qinfa Group will host its Annual General Meeting on 20th of June

- Total pay for CEO Tao Bai includes CN¥1.74m salary

- The overall pay is 166% above the industry average

- China Qinfa Group's total shareholder return over the past three years was 496% while its EPS grew by 56% over the past three years

CEO Tao Bai has done a decent job of delivering relatively good performance at China Qinfa Group Limited (HKG:866) recently. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 20th of June. However, some shareholders may still want to keep CEO compensation within reason.

View our latest analysis for China Qinfa Group

Comparing China Qinfa Group Limited's CEO Compensation With The Industry

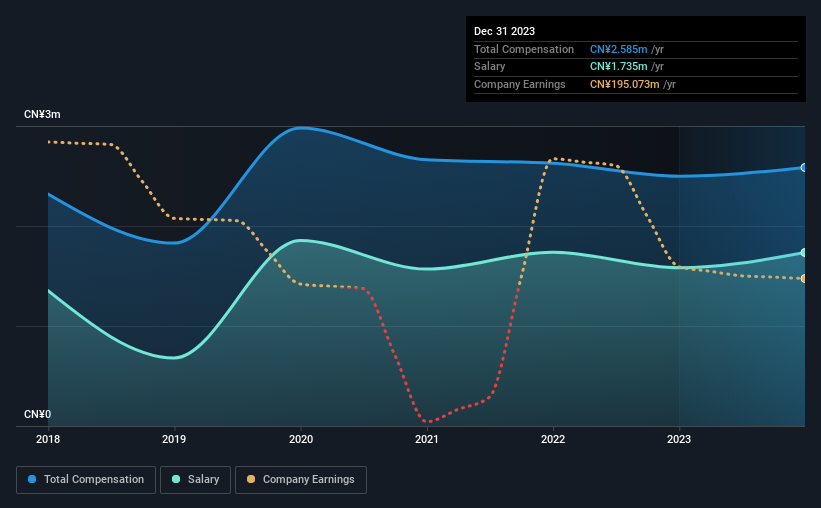

At the time of writing, our data shows that China Qinfa Group Limited has a market capitalization of HK$2.0b, and reported total annual CEO compensation of CN¥2.6m for the year to December 2023. That's a fairly small increase of 3.5% over the previous year. In particular, the salary of CN¥1.74m, makes up a huge portion of the total compensation being paid to the CEO.

For comparison, other companies in the Hong Kong Oil and Gas industry with market capitalizations ranging between HK$781m and HK$3.1b had a median total CEO compensation of CN¥971k. Accordingly, our analysis reveals that China Qinfa Group Limited pays Tao Bai north of the industry median. Moreover, Tao Bai also holds HK$41m worth of China Qinfa Group stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | CN¥1.7m | CN¥1.6m | 67% |

| Other | CN¥850k | CN¥915k | 33% |

| Total Compensation | CN¥2.6m | CN¥2.5m | 100% |

Speaking on an industry level, nearly 93% of total compensation represents salary, while the remainder of 7% is other remuneration. In China Qinfa Group's case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at China Qinfa Group Limited's Growth Numbers

China Qinfa Group Limited has seen its earnings per share (EPS) increase by 56% a year over the past three years. Its revenue is down 9.1% over the previous year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. The lack of revenue growth isn't ideal, but it is the bottom line that counts most in business. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has China Qinfa Group Limited Been A Good Investment?

Boasting a total shareholder return of 496% over three years, China Qinfa Group Limited has done well by shareholders. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

Seeing that the company has put up a decent performance, only a few shareholders, if any at all, might have questions about the CEO pay in the upcoming AGM. Still, not all shareholders might be in favor of a pay raise to the CEO, seeing that they are already being paid higher than the industry.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. We've identified 3 warning signs for China Qinfa Group that investors should be aware of in a dynamic business environment.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:866

China Qinfa Group

An investment holding company, engages in the mining, purchase and sale, filtering, storage, and blending of coal in the People’s Republic of China and Indonesia.

Excellent balance sheet and good value.

Market Insights

Community Narratives