As global markets react to shifting political landscapes and economic indicators, investors are navigating a complex environment marked by fluctuating sector performance and interest rate expectations. In this context, penny stocks—though an outdated term—remain a relevant investment area for those seeking opportunities in smaller or newer companies. These stocks can offer value at lower price points, especially when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.21 | MYR340.59M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.48 | MYR2.39B | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.775 | MYR134.24M | ★★★★★★ |

| Seafco (SET:SEAFCO) | THB1.97 | THB1.6B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.585 | A$68.57M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.87 | MYR288.79M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.225 | £828.88M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.87 | HK$539.57M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$146.79M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.67 | £373.95M | ★★★★☆☆ |

Click here to see the full list of 5,817 stocks from our Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Frontier Services Group (SEHK:500)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Frontier Services Group Limited is an investment holding company offering aviation, logistics, security, insurance, and infrastructure services with a market cap of HK$384.54 million.

Operations: The company's revenue is primarily derived from the Security, Insurance and Infrastructure Business at HK$510.76 million, followed by the Aviation and Logistics Business at HK$221.16 million, and the Healthcare Business contributing HK$14.75 million.

Market Cap: HK$384.54M

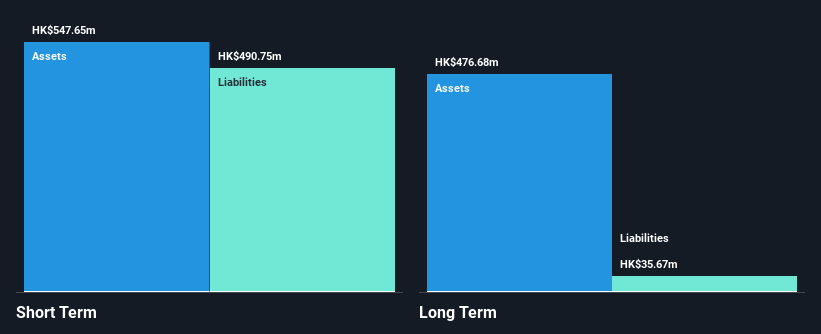

Frontier Services Group faces challenges as its earnings have declined significantly, with net income dropping to HK$0.034 million for the half-year ending June 2024 from HK$50.74 million the previous year. Despite a satisfactory net debt to equity ratio and strong short-term asset coverage of liabilities, profit margins have contracted sharply from 9.1% to 0.06%. The company's board has seen recent changes, including the resignation of Dr. Chan Wing Mui Helen and appointment of Mr. Yang Feng as a non-executive director, potentially impacting strategic direction amidst financial volatility and large one-off losses affecting results.

- Click here and access our complete financial health analysis report to understand the dynamics of Frontier Services Group.

- Explore historical data to track Frontier Services Group's performance over time in our past results report.

DeTai New Energy Group (SEHK:559)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: DeTai New Energy Group Limited is an investment holding company operating in the hotel hospitality sector across Hong Kong, the People's Republic of China, and Japan, with a market cap of HK$114.58 million.

Operations: The company's revenue is primarily derived from its hotel hospitality business (HK$22.53 million), followed by liquor and wine sales (HK$2.21 million), and investments in listed securities (HK$6.53 million).

Market Cap: HK$114.58M

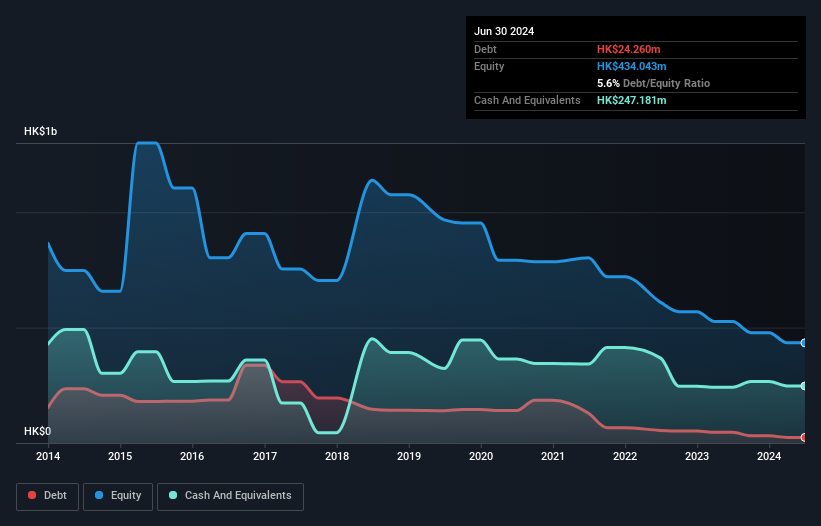

DeTai New Energy Group Limited, with a market cap of HK$114.58 million, operates primarily in the hotel hospitality sector and reported HK$31.27 million in revenue for fiscal year 2024. Despite its unprofitability, the company has reduced its debt to equity ratio from 14.5% to 5.6% over five years and maintains more cash than total debt, ensuring short-term liabilities are covered by assets of HK$260.7 million against liabilities of HK$34 million. However, increased share price volatility and a negative return on equity highlight risks amidst ongoing losses attributed mainly to fair value losses on financial assets.

- Take a closer look at DeTai New Energy Group's potential here in our financial health report.

- Gain insights into DeTai New Energy Group's historical outcomes by reviewing our past performance report.

Vanachai Group (SET:VNG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Vanachai Group Public Company Limited, with a market cap of THB5.87 billion, is involved in the production and distribution of wood plates, medium density fiberboards, particle boards, doorskin, and melamine on wood plates both in Thailand and internationally.

Operations: There are no reported revenue segments for Vanachai Group Public Company Limited.

Market Cap: THB5.87B

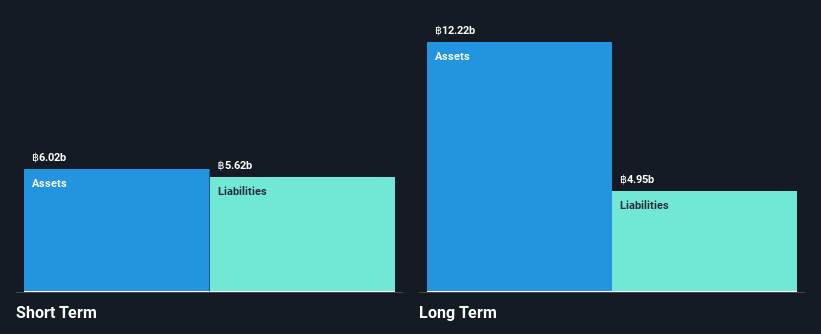

Vanachai Group has shown significant improvement in profitability, with net income rising to THB 165.89 million for Q3 2024 from THB 91.88 million the previous year. Despite this progress, its return on equity remains low at 7.5%, and interest payments are not well covered by earnings, indicating potential financial strain. The company's debt-to-equity ratio has decreased over five years but is still high at 85.4%. Short-term assets exceed liabilities, providing some financial stability, while seasoned management and board members contribute to operational experience amidst a volatile market environment for penny stocks.

- Unlock comprehensive insights into our analysis of Vanachai Group stock in this financial health report.

- Evaluate Vanachai Group's historical performance by accessing our past performance report.

Next Steps

- Jump into our full catalog of 5,817 Penny Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:500

Frontier Services Group

An investment holding company, provides aviation, logistics, security, insurance, and infrastructure related services.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives