Global markets have been rattled by a series of higher-than-expected tariffs, leading to significant declines in major indices and raising concerns about economic growth and inflation. Amid this uncertainty, investors often turn their attention to smaller companies that may offer unique opportunities for growth at lower price points. Penny stocks, despite being an older term, continue to capture interest due to their potential for delivering impressive returns when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.345 | SGD139.82M | ✅ 4 ⚠️ 1 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD1.94 | SGD7.65B | ✅ 5 ⚠️ 0 View Analysis > |

| SKP Resources Bhd (KLSE:SKPRES) | MYR0.785 | MYR1.23B | ✅ 5 ⚠️ 2 View Analysis > |

| NEXG Berhad (KLSE:NEXG) | MYR0.23 | MYR639.9M | ✅ 4 ⚠️ 2 View Analysis > |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.485 | MYR2.41B | ✅ 5 ⚠️ 0 View Analysis > |

| Sarawak Plantation Berhad (KLSE:SWKPLNT) | MYR2.19 | MYR611.08M | ✅ 5 ⚠️ 2 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.17 | HK$738.21M | ✅ 4 ⚠️ 2 View Analysis > |

| Next 15 Group (AIM:NFG) | £2.46 | £244.66M | ✅ 4 ⚠️ 5 View Analysis > |

| Warpaint London (AIM:W7L) | £3.60 | £290.83M | ✅ 5 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.32 | A$62.27M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 5,675 stocks from our Global Penny Stocks screener.

Let's uncover some gems from our specialized screener.

House of Investments (PSE:HI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: House of Investments, Inc. is an investment holding company operating in the automotive, property and property services, financial services, and education sectors both in the Philippines and internationally, with a market cap of ₱5.11 billion.

Operations: The company's revenue is primarily derived from its automotive sector at ₱5.90 billion, followed by education at ₱5.15 billion, and property & property services at ₱1.23 billion, with additional contributions from other services totaling ₱799.93 million.

Market Cap: ₱5.11B

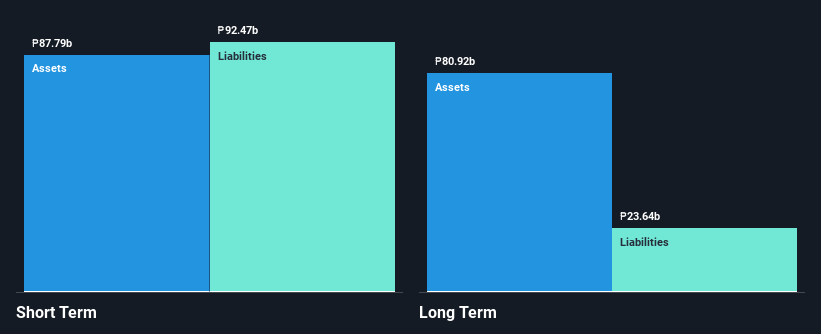

House of Investments, Inc. shows a robust financial profile with its net profit margins improving to 6.1% from last year's 3.6%, and substantial earnings growth of 353.9% over the past year, significantly outpacing the industry average. The company's debt management is commendable, with a reduced debt-to-equity ratio of 15.1% and satisfactory interest coverage by profits. However, short-term liabilities exceed short-term assets slightly at ₱92.5 billion versus ₱87.8 billion, indicating potential liquidity challenges despite overall financial stability bolstered by experienced management and board members with long tenures averaging over eight years each.

- Get an in-depth perspective on House of Investments' performance by reading our balance sheet health report here.

- Gain insights into House of Investments' past trends and performance with our report on the company's historical track record.

C.banner International Holdings (SEHK:1028)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: C.banner International Holdings Limited is an investment holding company that produces, sells, and retails women's formal and casual footwear primarily in the People’s Republic of China and the United States, with a market cap of HK$529.64 million.

Operations: The company generates revenue through three main segments: Retail and Wholesale of Shoes (CN¥1.15 billion), Contract Manufacturing of Shoes (CN¥161.48 million), and Retail of Toys (CN¥79.17 million).

Market Cap: HK$529.63M

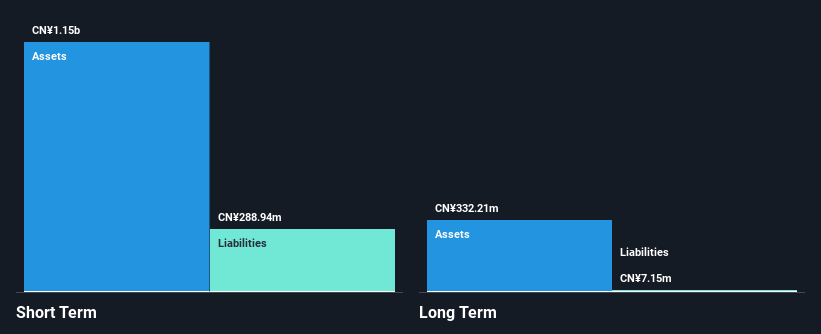

C.banner International Holdings Limited has demonstrated strong earnings growth, with profits increasing by a very large margin of 131.6% over the past year, surpassing its five-year average growth rate. The company is debt-free and maintains stable short-term assets (CN¥1.1 billion) that comfortably cover both short-term (CN¥288.9 million) and long-term liabilities (CN¥7.2 million). Despite a volatile share price recently, C.banner's management and board are experienced, contributing to improved net profit margins from 1.4% to 3.5%. Recent amendments to company bylaws aim to enhance governance and align with regulatory standards for electronic meetings and proxy submissions.

- Take a closer look at C.banner International Holdings' potential here in our financial health report.

- Assess C.banner International Holdings' previous results with our detailed historical performance reports.

Mainland Headwear Holdings (SEHK:1100)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Mainland Headwear Holdings Limited is an investment holding company that designs, manufactures, trades in, and distributes casual headwear products across the United States, Europe, China, Hong Kong, and other international markets with a market cap of HK$635.16 million.

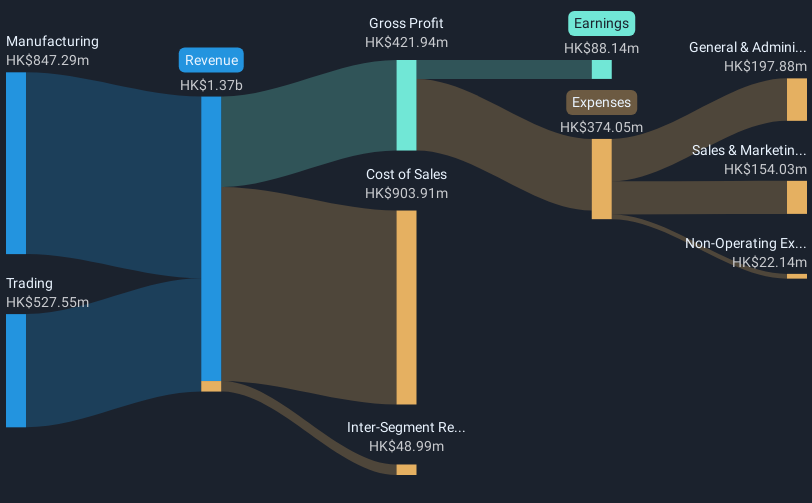

Operations: The company's revenue is derived from two main segments: Trading, which contributes HK$542.68 million, and Manufacturing, accounting for HK$977.58 million.

Market Cap: HK$635.16M

Mainland Headwear Holdings Limited, with a market cap of HK$635.16 million, has shown financial resilience despite recent challenges. The company reported sales of HK$1.47 billion for 2024, though net income declined significantly to HK$57.07 million from the previous year. Its debt management is commendable, with a reduced debt-to-equity ratio and interest well covered by EBIT at 9.8 times. While profit margins have contracted to 3.9%, the firm maintains high-quality earnings and strong asset coverage for liabilities. Recent dividend reductions reflect cautious fiscal management amid declining profits and negative earnings growth over the past year.

- Jump into the full analysis health report here for a deeper understanding of Mainland Headwear Holdings.

- Evaluate Mainland Headwear Holdings' historical performance by accessing our past performance report.

Taking Advantage

- Navigate through the entire inventory of 5,675 Global Penny Stocks here.

- Searching for a Fresh Perspective? We've found 30 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Mainland Headwear Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1100

Mainland Headwear Holdings

An investment holding company, designs, manufactures, trades in, and distributes casual headwear products in the United States, Europe, the People’s Republic of China, Hong Kong, and internationally.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives