- Hong Kong

- /

- Commercial Services

- /

- SEHK:587

China Conch Environment Protection Holdings Limited Earnings Missed Analyst Estimates: Here's What Analysts Are Forecasting Now

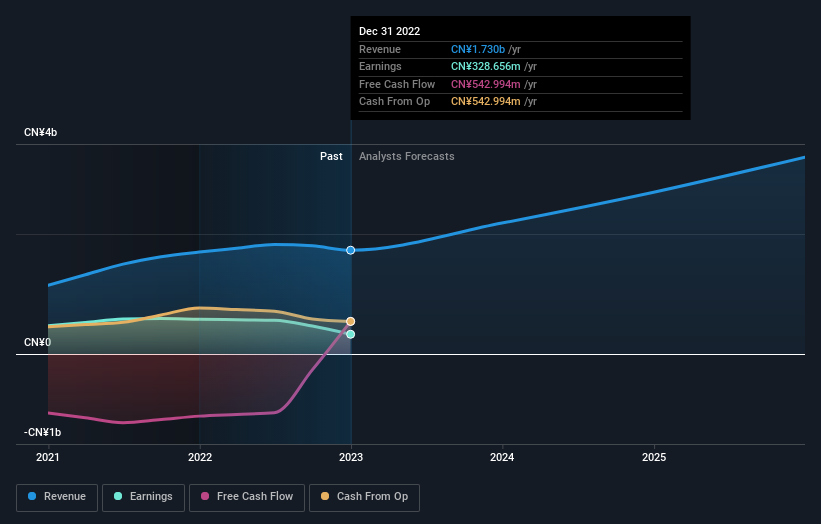

Shareholders might have noticed that China Conch Environment Protection Holdings Limited (HKG:587) filed its annual result this time last week. The early response was not positive, with shares down 7.0% to HK$2.51 in the past week. Revenues were in line with forecasts, at CN¥1.7b, although statutory earnings per share came in 11% below what the analyst expected, at CN¥0.18 per share. Following the result, the analyst has updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. With this in mind, we've gathered the latest statutory forecasts to see what the analyst is expecting for next year.

Check out our latest analysis for China Conch Environment Protection Holdings

Taking into account the latest results, the consensus forecast from China Conch Environment Protection Holdings' solitary analyst is for revenues of CN¥2.18b in 2023, which would reflect a sizeable 26% improvement in sales compared to the last 12 months. Statutory earnings per share are predicted to jump 26% to CN¥0.23. In the lead-up to this report, the analyst had been modelling revenues of CN¥2.47b and earnings per share (EPS) of CN¥0.27 in 2023. It looks like sentiment has declined substantially in the aftermath of these results, with a substantial drop in revenue estimates and a real cut to earnings per share numbers as well.

The consensus price target fell 24% to HK$2.70, with the weaker earnings outlook clearly leading valuation estimates.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. The analyst is definitely expecting China Conch Environment Protection Holdings' growth to accelerate, with the forecast 26% annualised growth to the end of 2023 ranking favourably alongside historical growth of 1.9% per annum over the past year. Compare this with other companies in the same industry, which are forecast to grow their revenue 9.4% annually. It seems obvious that, while the growth outlook is brighter than the recent past, the analyst also expect China Conch Environment Protection Holdings to grow faster than the wider industry.

The Bottom Line

The biggest concern is that the analyst reduced their earnings per share estimates, suggesting business headwinds could lay ahead for China Conch Environment Protection Holdings. Regrettably, they also downgraded their revenue estimates, but the latest forecasts still imply the business will grow faster than the wider industry. The consensus price target fell measurably, with the analyst seemingly not reassured by the latest results, leading to a lower estimate of China Conch Environment Protection Holdings' future valuation.

Following on from that line of thought, we think that the long-term prospects of the business are much more relevant than next year's earnings. We have analyst estimates for China Conch Environment Protection Holdings going out as far as 2025, and you can see them free on our platform here.

It is also worth noting that we have found 2 warning signs for China Conch Environment Protection Holdings (1 can't be ignored!) that you need to take into consideration.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:587

China Conch Environment Protection Holdings

An investment holding company, provides treatment solutions for industrial solid and hazardous waste utilizing cement kiln waste treatment technologies in the People’s Republic of China.

Slightly overvalued with limited growth.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)