The board of Pennon Group Plc (LON:PNN) has announced that it will pay a dividend of £0.1404 per share on the 5th of April. This makes the dividend yield 6.0%, which is above the industry average.

See our latest analysis for Pennon Group

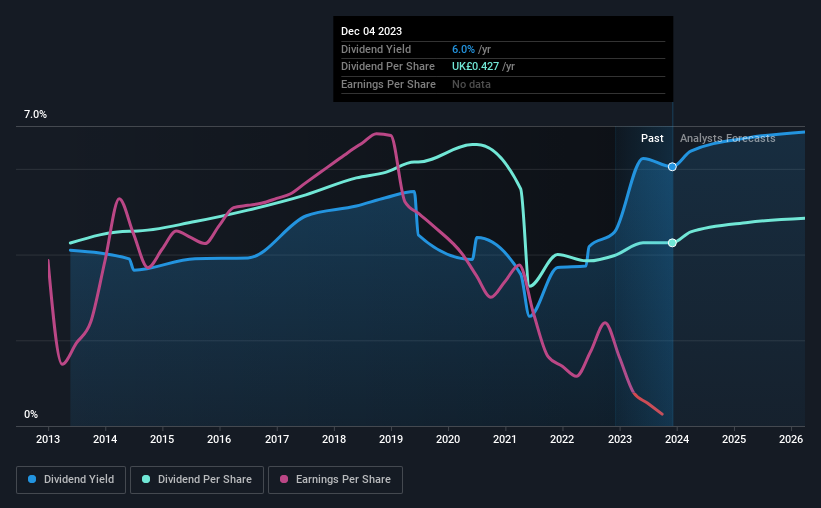

Pennon Group Is Paying Out More Than It Is Earning

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. Even though Pennon Group is not generating a profit, it is still paying a dividend. The company is also yet to generate cash flow, so the dividend sustainability is definitely questionable.

Over the next year, EPS is forecast to grow rapidly. If the dividend continues along recent trends, we estimate the payout ratio could reach 489%, which is unsustainable.

Dividend Volatility

The company's dividend history has been marked by instability, with at least one cut in the last 10 years. The annual payment during the last 10 years was £0.427 in 2013, and the most recent fiscal year payment was £0.427. Dividend payments have been growing, but very slowly over the period. It's encouraging to see some dividend growth, but the dividend has been cut at least once, and the size of the cut would eliminate most of the growth anyway, which makes this less attractive as an income investment.

Dividend Growth Potential Is Shaky

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. Pennon Group's earnings per share has shrunk at 52% a year over the past five years. Dividend payments are likely to come under some pressure unless EPS can pull out of the nosedive it is in. However, the next year is actually looking up, with earnings set to rise. We would just wait until it becomes a pattern before getting too excited.

We're Not Big Fans Of Pennon Group's Dividend

Overall, while the dividend being raised can be good, there are some concerns about its long term sustainability. The company seems to be stretching itself a bit to make such big payments, but it doesn't appear they can be consistent over time. Overall, this doesn't get us very excited from an income standpoint.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. However, there are other things to consider for investors when analysing stock performance. Taking the debate a bit further, we've identified 2 warning signs for Pennon Group that investors need to be conscious of moving forward. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:PNN

Pennon Group

Provides water and wastewater services in the United Kingdom.

Slight risk with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026