- United Kingdom

- /

- Semiconductors

- /

- LSE:AWE

Unveiling 3 UK Penny Stocks With Market Caps Larger Than $200M

Reviewed by Simply Wall St

The United Kingdom's market landscape has recently been influenced by global economic developments, with the FTSE 100 index experiencing declines following weak trade data from China. Amid such fluctuations, investors often seek opportunities that balance potential growth with financial stability. Penny stocks, though an older term, remain relevant as they can offer unique prospects in smaller or newer companies that demonstrate robust financial health and long-term potential.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Croma Security Solutions Group (AIM:CSSG) | £0.86 | £11.84M | ✅ 3 ⚠️ 3 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.85 | £293.89M | ✅ 5 ⚠️ 1 View Analysis > |

| Helios Underwriting (AIM:HUW) | £2.20 | £159.37M | ✅ 4 ⚠️ 2 View Analysis > |

| Warpaint London (AIM:W7L) | £4.75 | £383.74M | ✅ 4 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.74 | £421.42M | ✅ 4 ⚠️ 1 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £4.10 | £395.29M | ✅ 3 ⚠️ 2 View Analysis > |

| Stelrad Group (LSE:SRAD) | £1.40 | £178.29M | ✅ 5 ⚠️ 2 View Analysis > |

| Cairn Homes (LSE:CRN) | £1.814 | £1.13B | ✅ 4 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.00 | £159.53M | ✅ 4 ⚠️ 2 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.41 | £44.36M | ✅ 5 ⚠️ 2 View Analysis > |

Click here to see the full list of 404 stocks from our UK Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Alphawave IP Group (LSE:AWE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Alphawave IP Group plc specializes in developing and selling wired connectivity solutions across various global regions, including North America, China, the Asia Pacific, Europe, the Middle East, Africa, and the United Kingdom; it has a market cap of approximately £1.06 billion.

Operations: The company's revenue is primarily derived from its Communications Equipment segment, totaling $307.59 million.

Market Cap: £1.06B

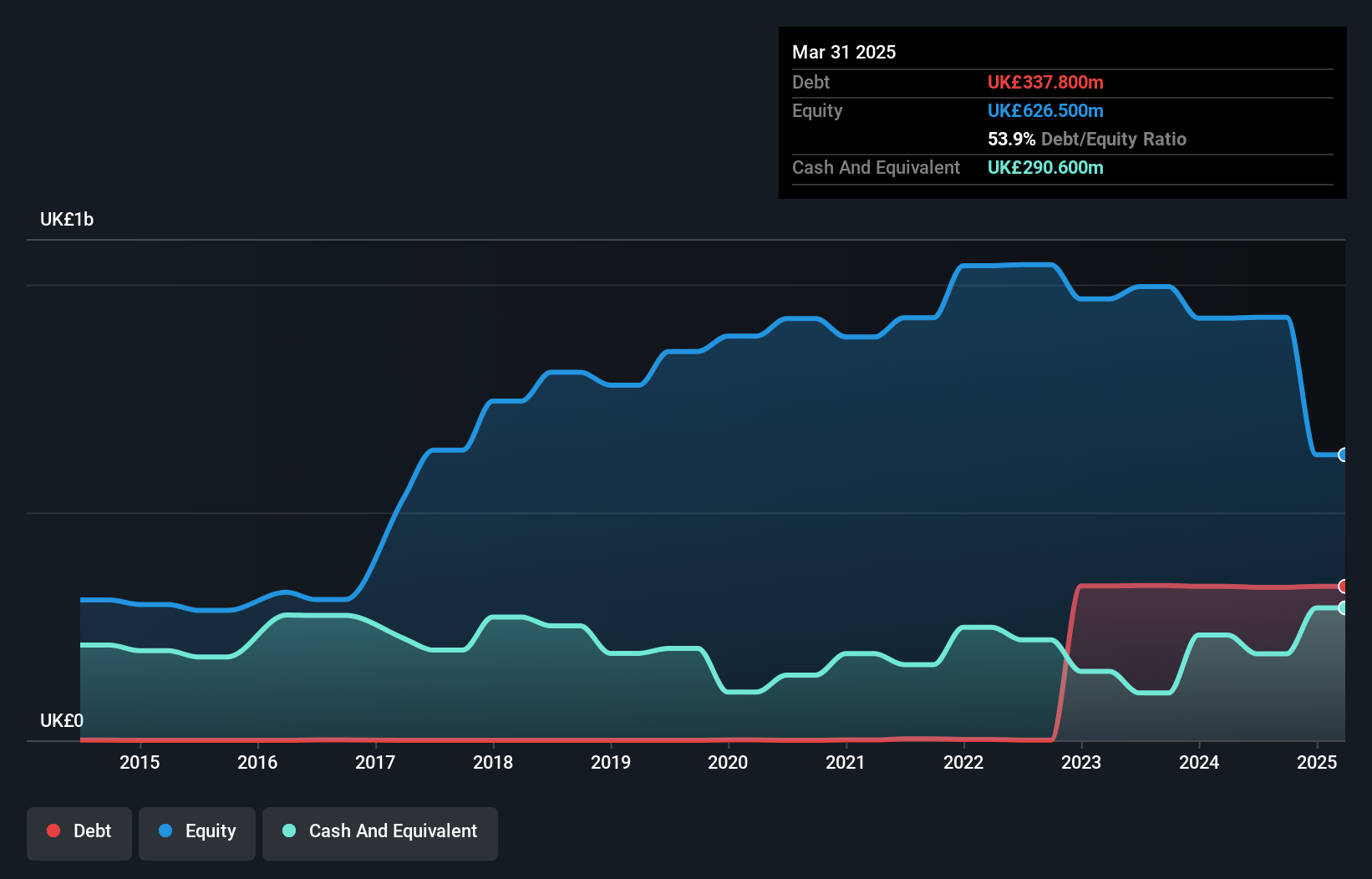

Alphawave IP Group is navigating a complex landscape, marked by ongoing acquisition discussions with Qualcomm. Despite a strong cash runway exceeding three years and short-term assets covering liabilities, the company faces challenges with long-term liabilities and profitability. Recent earnings reveal a net loss of US$42.52 million on sales of US$307.59 million, highlighting financial pressures despite reduced losses compared to the previous year. The stock's volatility has increased recently, complicating its investment profile further amidst industry competition and market dynamics in semiconductor technology solutions.

- Click to explore a detailed breakdown of our findings in Alphawave IP Group's financial health report.

- Review our growth performance report to gain insights into Alphawave IP Group's future.

QinetiQ Group (LSE:QQ.)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: QinetiQ Group plc is a science and engineering company serving the defense, security, and infrastructure sectors in the UK, US, Australia, and internationally with a market cap of £2.54 billion.

Operations: The company generates its revenue primarily from EMEA Services, contributing £1.48 billion, and Global Solutions, which adds £453.9 million.

Market Cap: £2.54B

QinetiQ Group plc, despite its substantial market cap of £2.54 billion, faces challenges with profitability, reporting a net loss of £185.7 million for the fiscal year ending March 2025. The company's earnings per share also declined significantly compared to the previous year. However, QinetiQ's financial resilience is evident as its debt is well covered by operating cash flow and short-term assets exceed both short and long-term liabilities. Recent developments include a significant contract extension with the UK's Ministry of Defence worth £1.54 billion and an active share buyback program enhancing shareholder value through strategic repurchases totalling £119 million to date.

- Click here and access our complete financial health analysis report to understand the dynamics of QinetiQ Group.

- Evaluate QinetiQ Group's prospects by accessing our earnings growth report.

Taylor Maritime (LSE:TMI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Taylor Maritime Limited is an investment company focused on acquiring, managing, and operating dry bulk ships, with a market cap of $273.04 million.

Operations: The company generates revenue of $92.25 million from its shipping vessels aimed at investment returns while preserving capital.

Market Cap: $273.04M

Taylor Maritime Limited, with a market cap of $273.04 million, recently declared an interim dividend of 2 US cents per share, reinforcing its commitment to shareholder returns. The company operates without debt and has become profitable in the past year, which is noteworthy given the broader shipping industry's challenges. Its short-term assets of $4.3 million comfortably cover liabilities of $2.6 million, indicating solid financial health despite a low return on equity at 16.6%. Recent board changes highlight a lack of experience with an average tenure under one year but could bring fresh perspectives to governance strategies.

- Dive into the specifics of Taylor Maritime here with our thorough balance sheet health report.

- Gain insights into Taylor Maritime's past trends and performance with our report on the company's historical track record.

Where To Now?

- Jump into our full catalog of 404 UK Penny Stocks here.

- Want To Explore Some Alternatives? AI is about to change healthcare. These 22 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:AWE

Alphawave IP Group

Develops and sells wired connectivity solutions in North America, China, the Asia Pacific, Europe, the Middle East, Africa, and the United Kingdom.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives