- United Kingdom

- /

- Infrastructure

- /

- LSE:OCN

Top 3 UK Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index has recently experienced a downturn, influenced by weak trade data from China, highlighting the interconnectedness of global markets and the challenges faced by economies in recovery. Amidst these fluctuations, dividend stocks can provide a stable income stream, offering potential resilience and balance to an investment portfolio during uncertain times.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| James Latham (AIM:LTHM) | 5.71% | ★★★★★★ |

| 4imprint Group (LSE:FOUR) | 3.02% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 8.32% | ★★★★★☆ |

| Impax Asset Management Group (AIM:IPX) | 6.97% | ★★★★★☆ |

| Man Group (LSE:EMG) | 6.03% | ★★★★★☆ |

| Plus500 (LSE:PLUS) | 6.00% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 3.70% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 6.60% | ★★★★★☆ |

| DCC (LSE:DCC) | 3.87% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.52% | ★★★★★☆ |

Click here to see the full list of 59 stocks from our Top UK Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

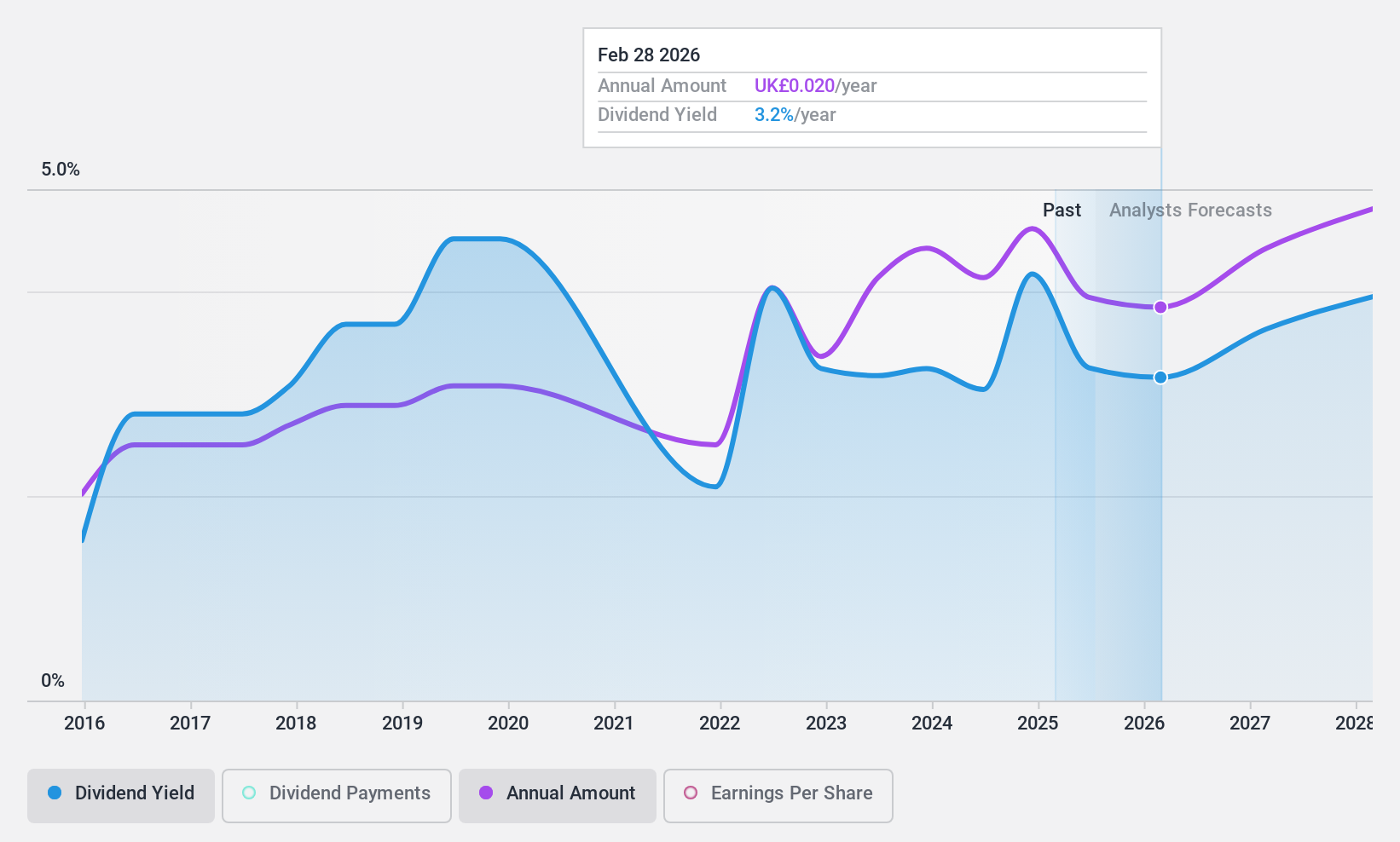

Vertu Motors (AIM:VTU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Vertu Motors plc is an automotive retailer in the United Kingdom with a market cap of £198.25 million.

Operations: Vertu Motors plc generates revenue from its operations in the United Kingdom primarily through its Retail - Gasoline & Auto Dealers segment, which accounts for £4.72 billion.

Dividend Yield: 3.6%

Vertu Motors' dividend payments are well covered by earnings and cash flows, with a payout ratio of 30.9% and a cash payout ratio of 12.4%. While dividends have increased over the past decade, they have been volatile, experiencing drops over 20%, making them unreliable. The current yield of 3.58% is lower than the top UK dividend payers. Despite trading at an attractive valuation, its unstable dividend history raises concerns for consistent income investors.

- Delve into the full analysis dividend report here for a deeper understanding of Vertu Motors.

- The analysis detailed in our Vertu Motors valuation report hints at an deflated share price compared to its estimated value.

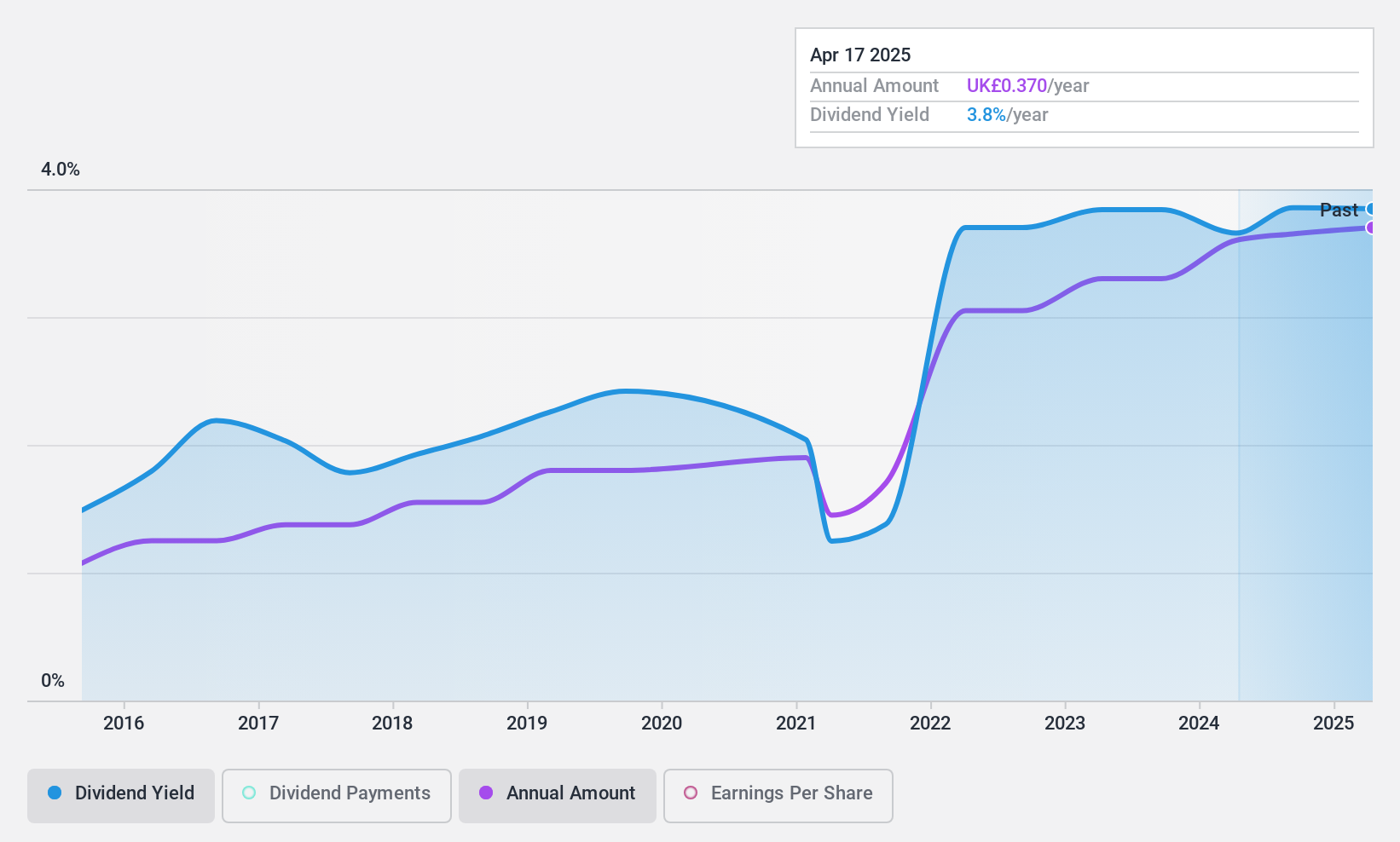

Grafton Group (LSE:GFTU)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Grafton Group plc operates in the distribution, retailing, and manufacturing sectors across Ireland, the Netherlands, Finland, and the United Kingdom with a market cap of £2.07 billion.

Operations: Grafton Group plc's revenue is primarily derived from UK Distribution (£793.17 million), Ireland Distribution (£630.06 million), Netherlands Distribution (£342.09 million), Retailing (£257.64 million), Finland Distribution (£134.42 million), and Manufacturing (£123.80 million).

Dividend Yield: 3.5%

Grafton Group offers a stable dividend yield of 3.52%, supported by earnings and cash flows with payout ratios of 57.1% and 37.1% respectively, indicating sustainability. The company has consistently increased dividends over the past decade, recently raising its interim dividend by 5%. Despite challenging trading conditions, Grafton's strong balance sheet supports ongoing acquisitions and share buybacks, enhancing shareholder returns while trading at a discount to estimated fair value.

- Unlock comprehensive insights into our analysis of Grafton Group stock in this dividend report.

- According our valuation report, there's an indication that Grafton Group's share price might be on the cheaper side.

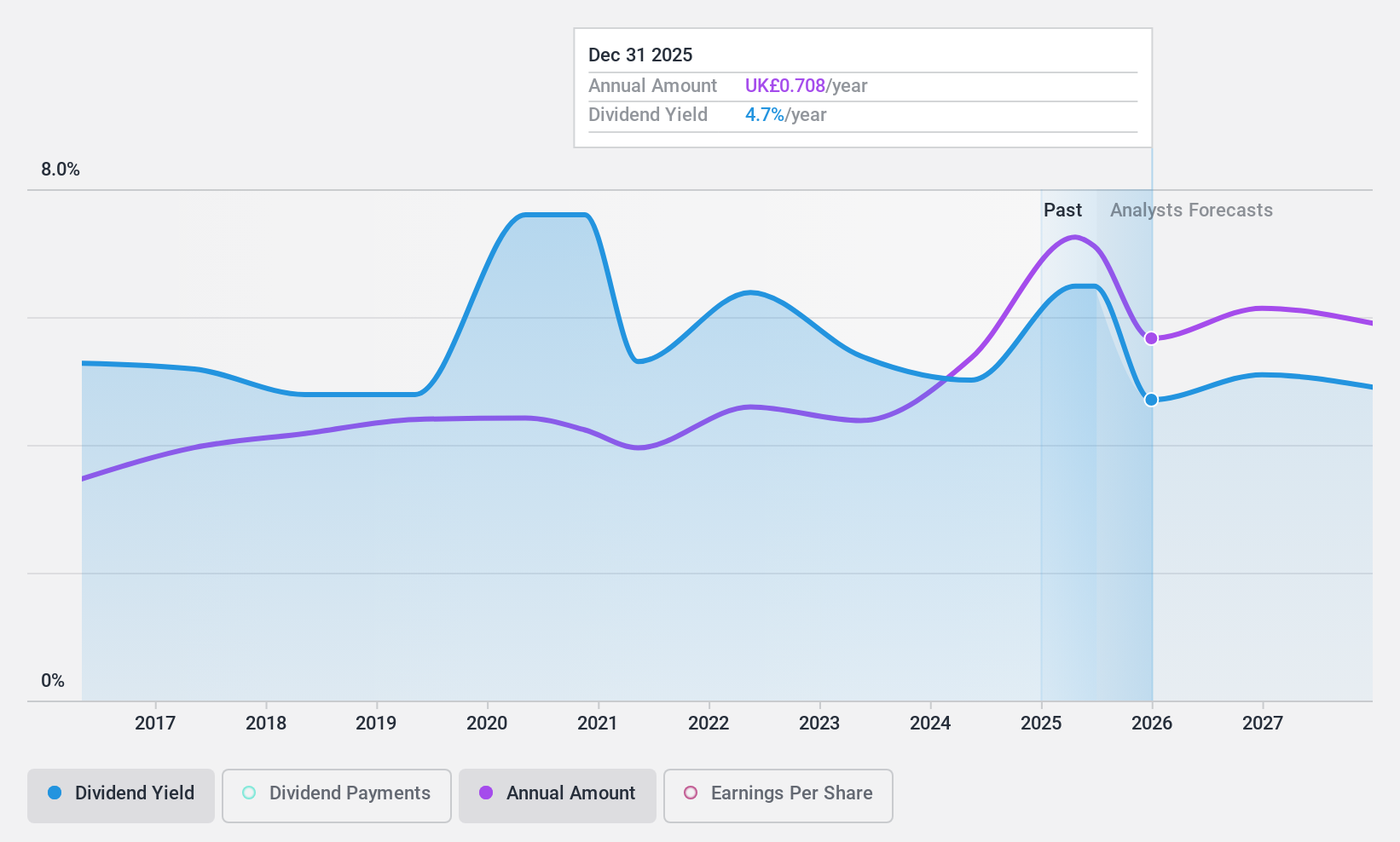

Ocean Wilsons Holdings (LSE:OCN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Ocean Wilsons Holdings Limited is an investment holding company that provides maritime and logistics services in Brazil, with a market cap of £509.23 million.

Operations: Ocean Wilsons Holdings Limited generates revenue of $519.35 million from its maritime services in Brazil.

Dividend Yield: 4.5%

Ocean Wilsons Holdings maintains a stable dividend yield of 4.52%, supported by a low payout ratio of 48.7% and cash payout ratio of 26.6%, ensuring sustainability. Dividends have grown steadily over the past decade, though the yield is below top-tier UK dividend payers. Recent discussions about selling its stake in Wilson Sons could impact future dividends and strategic direction, but currently, earnings growth remains robust at 32.7% over the past year with further growth expected.

- Navigate through the intricacies of Ocean Wilsons Holdings with our comprehensive dividend report here.

- The valuation report we've compiled suggests that Ocean Wilsons Holdings' current price could be inflated.

Make It Happen

- Click this link to deep-dive into the 59 companies within our Top UK Dividend Stocks screener.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:OCN

Ocean Wilsons Holdings

An investment holding company, offers maritime and logistics services in Brazil.

Flawless balance sheet established dividend payer.