- United Kingdom

- /

- Building

- /

- AIM:JHD

3 Promising UK Penny Stocks With Market Caps Under £800M

Reviewed by Simply Wall St

The UK market has been experiencing some turbulence, with the FTSE 100 index recently closing lower due to weak trade data from China, highlighting global economic challenges. For investors looking beyond established names, penny stocks present intriguing opportunities as they often involve smaller or newer companies that can surprise with their potential. Despite the term's somewhat outdated nature, these stocks remain a relevant investment area and can offer value when backed by strong financial health.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Begbies Traynor Group (AIM:BEG) | £0.976 | £153.96M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.095 | £789.32M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.42 | £180.84M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.55 | £67.7M | ★★★★☆☆ |

| Union Jack Oil (AIM:UJO) | £0.0875 | £9.32M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.30 | £200.5M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.87 | £384.89M | ★★★★☆☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.46 | $267.41M | ★★★★★★ |

| Impax Asset Management Group (AIM:IPX) | £2.495 | £318.8M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.135 | £96.97M | ★★★★★★ |

Click here to see the full list of 468 stocks from our UK Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

James Halstead (AIM:JHD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: James Halstead plc manufactures and supplies flooring products for commercial and domestic uses across the UK, Europe, Scandinavia, Australasia, Asia, and internationally with a market cap of £737.71 million.

Operations: The company generated £274.88 million in revenue from its flooring products manufacturing and distribution segment.

Market Cap: £737.71M

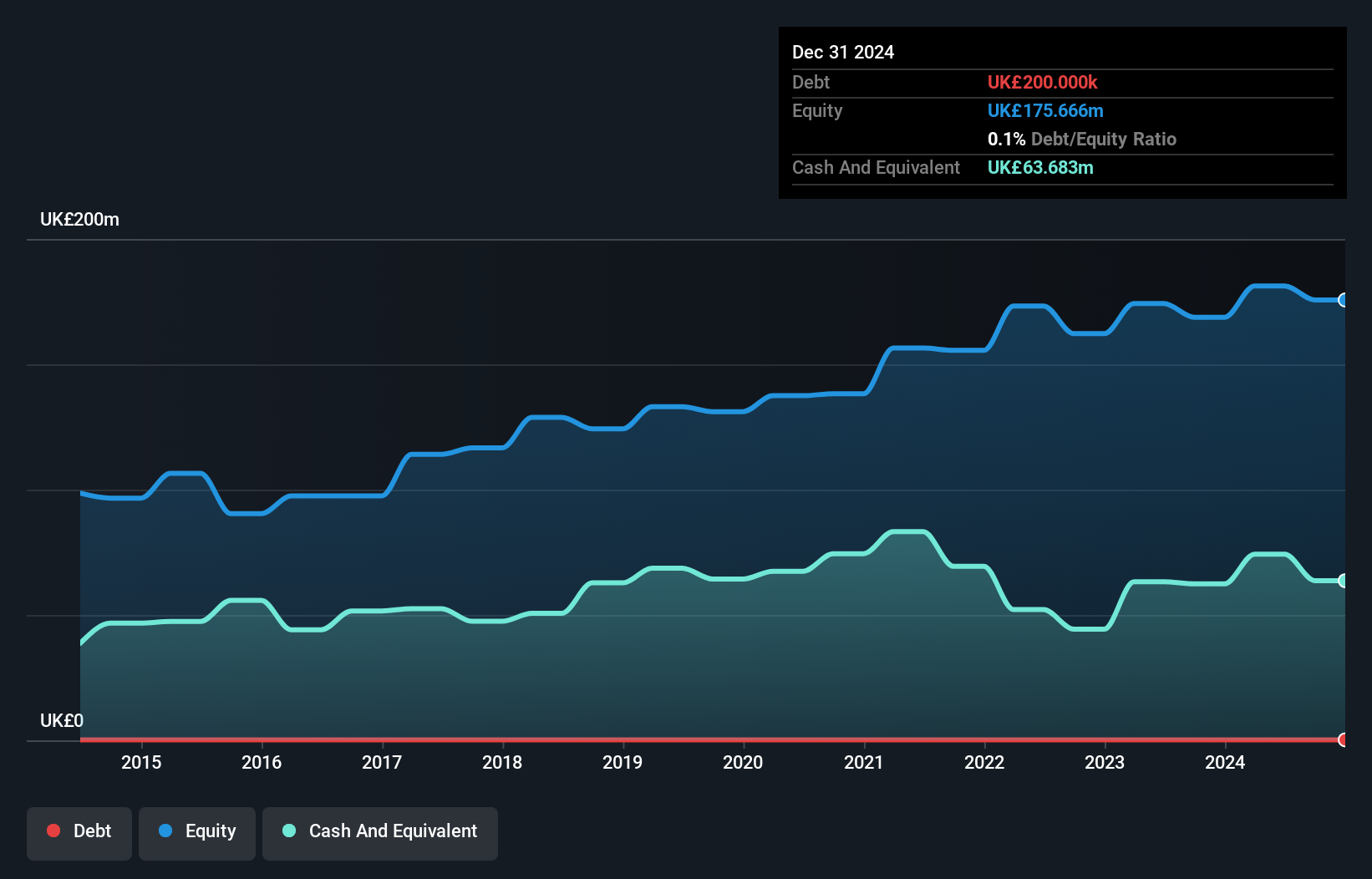

James Halstead plc, with a market cap of £737.71 million, has demonstrated financial stability and resilience in the penny stock category. Despite recent executive changes, the company maintains strong fundamentals: its debt is well covered by operating cash flow and it holds more cash than total debt. The firm offers reliable dividends at 4.8% and boasts high-quality earnings with improved net profit margins from last year. Although facing negative earnings growth recently, James Halstead's return on equity remains high at 22.9%, supported by seasoned management and board members ensuring strategic continuity amidst industry challenges.

- Navigate through the intricacies of James Halstead with our comprehensive balance sheet health report here.

- Examine James Halstead's earnings growth report to understand how analysts expect it to perform.

Synectics (AIM:SNX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Synectics plc designs, integrates, and supports security and surveillance systems in the UK and internationally, with a market cap of £60.80 million.

Operations: The company's revenue is derived from two main segments: Systems, contributing £35.55 million, and Security, generating £19.30 million.

Market Cap: £60.8M

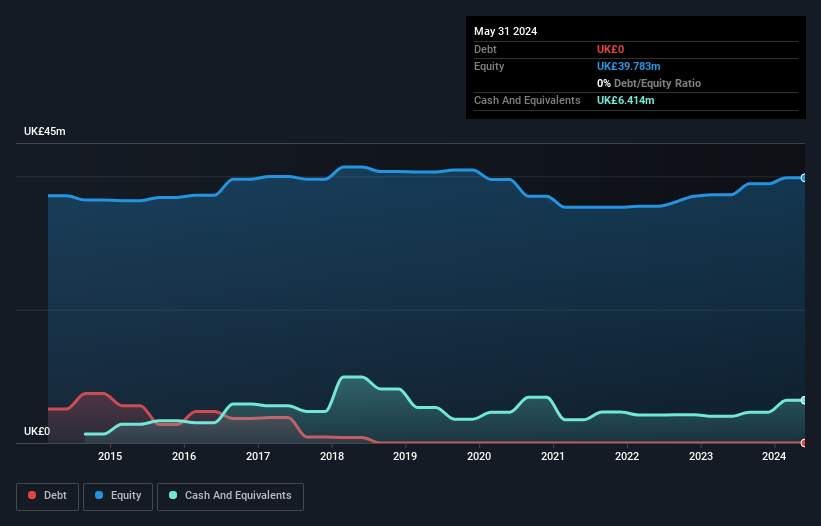

Synectics plc, with a market cap of £60.80 million, has shown robust performance in the penny stock arena through strategic contracts and financial health. Recent awards in the gaming and oil sectors, including $2.7 million for gaming resorts in the Philippines and £2.3 million for projects in Qatar and Brazil, highlight its expanding footprint. Despite a low return on equity at 7.6%, Synectics benefits from strong asset coverage over liabilities and no debt burden, enhancing financial stability. The company's earnings growth has been remarkable at 258% over the past year, outpacing industry averages significantly.

- Click to explore a detailed breakdown of our findings in Synectics' financial health report.

- Gain insights into Synectics' outlook and expected performance with our report on the company's earnings estimates.

Team17 Group (AIM:TM17)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Team17 Group plc, along with its subsidiaries, develops and publishes independent video games for both digital and physical markets in the United Kingdom and internationally, with a market cap of £328.32 million.

Operations: The company generates revenue of £167.42 million from its segment focused on developing and publishing games and apps.

Market Cap: £328.32M

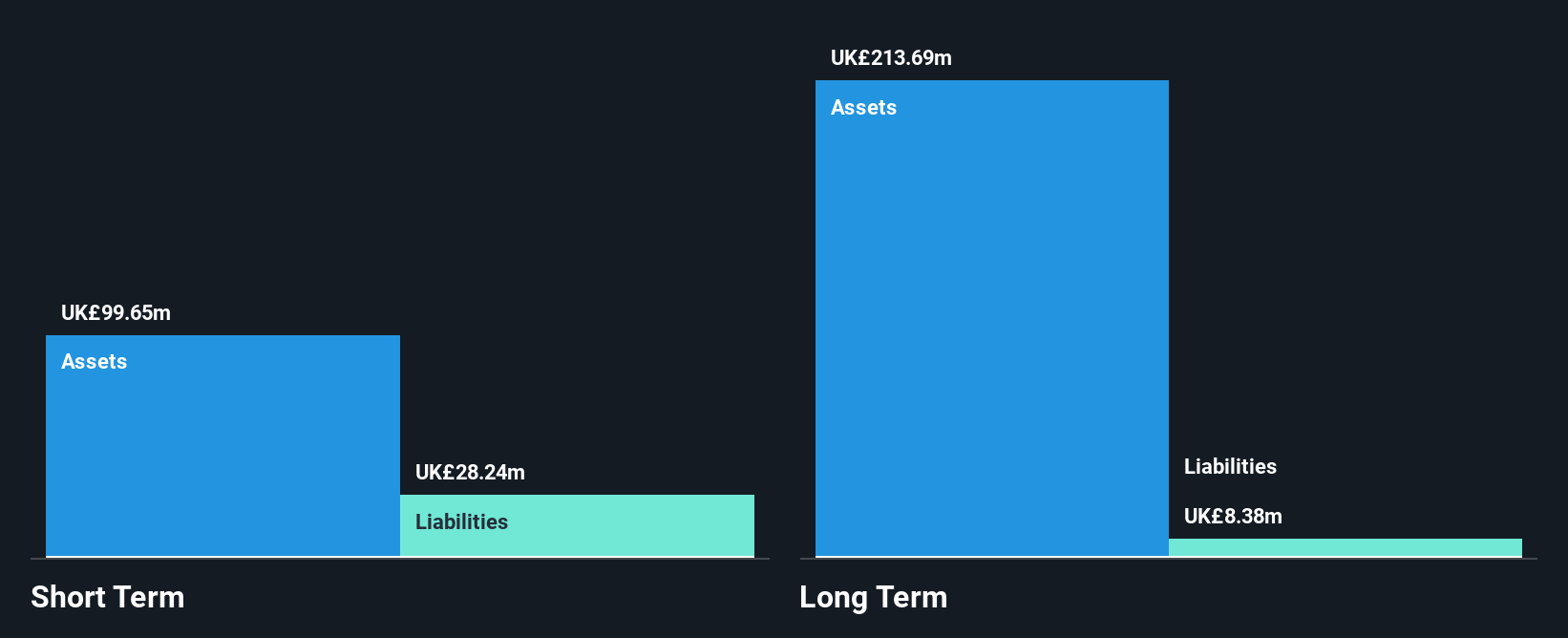

Team17 Group, with a market cap of £328.32 million, operates debt-free and maintains strong asset coverage over liabilities, with short-term assets of £90.9 million exceeding both short and long-term liabilities. Despite its unprofitability and increased losses over the past five years at 16.2% annually, the company is trading significantly below its estimated fair value by 65.4%. Recent executive changes include appointing Rashid Varachia as COO and CFO, bringing extensive industry experience which could influence future strategic directions positively amidst high share price volatility and significant insider selling in recent months.

- Click here and access our complete financial health analysis report to understand the dynamics of Team17 Group.

- Explore Team17 Group's analyst forecasts in our growth report.

Key Takeaways

- Gain an insight into the universe of 468 UK Penny Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:JHD

James Halstead

Manufactures and supplies flooring products for commercial and domestic uses in the United Kingdom, rest of Europe, Scandinavia, Australasia, Asia, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives